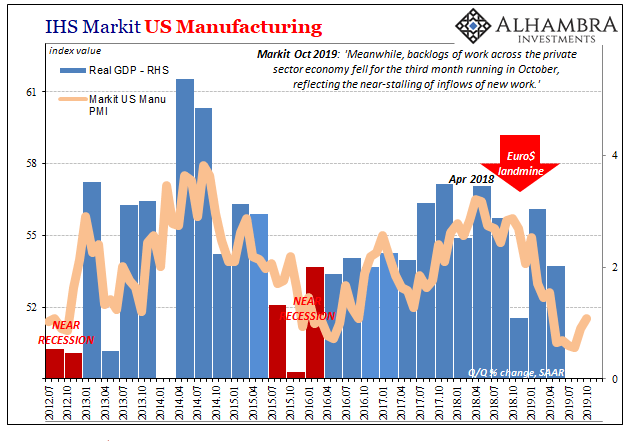

Flash PMI’s from IHS Markit for the US economy were split in October. According to the various sentiment indicators, there’s a little bit of a rebound on the manufacturing side as contrary to the ISM’s estimates for the same sector. Markit reports a sharp uptick in current manufacturing business volumes during this month. The manufacturing index came in at 51.5, up from a revised reading of 51.1 in September based almost entirely on the production subset. But at the same time, a decided drop in order backlogs remains the same cause for concern. In other words, activity ramped up for whatever reason in October, but there isn’t any new business behind it to likely keep it going. It’s not, therefore, a rebound so much as noise and regular high frequency volatility.

Topics:

Jeffrey P. Snider considers the following as important: 5.) Alhambra Investments, 5) Global Macro, baseline growth, capital goods, Composite PMI, currencies, durable goods, economy, Featured, Federal Reserve/Monetary Policy, IHS Markit, manufacturing, Markets, newsletter, PMI, Recession, services

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

| Flash PMI’s from IHS Markit for the US economy were split in October. According to the various sentiment indicators, there’s a little bit of a rebound on the manufacturing side as contrary to the ISM’s estimates for the same sector. Markit reports a sharp uptick in current manufacturing business volumes during this month.

The manufacturing index came in at 51.5, up from a revised reading of 51.1 in September based almost entirely on the production subset. But at the same time, a decided drop in order backlogs remains the same cause for concern. In other words, activity ramped up for whatever reason in October, but there isn’t any new business behind it to likely keep it going. It’s not, therefore, a rebound so much as noise and regular high frequency volatility. |

IHS Markit US Manufacturing, 2012-2019 |

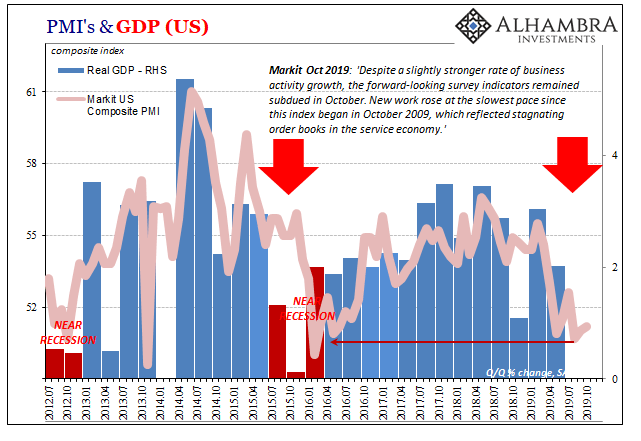

| The news in the more important services sector was much worse. In fact, Markit’s services PMI is now significantly below the manufacturing one which many had come to believe was the part of the economy where all the trouble has been limited. The former’s index was calculated to be 51.0 in October’s flash update.

The big concern across the data continues to be the lack of new order inflow as inventory keeps piling up for lack of overall buying. For both manufacturing and services combined, Markit says it was the slowest rate of growth since the composite index had been put together in October 2009. And because of that, the series is beginning to more persistently pick up trouble where it comes to employment.

It is the last thing Jay Powell wants to see, as, again, unlike the increase in current manufacturing production, weakness in new orders leading to cuts in employment are almost certainly going to further erode economic standing not too far down the line. |

PMI's & GDP, 2012-2019 |

| October’s small uptick is therefore a timing issue, an illusion. Unless, of course, the Fed’s rate cuts actually do begin to work and change the nature of business and consumer psychology. It doesn’t sound like Markit’s survey panel is counting on it, though, more along the lines of a wait and see approach – in both directions.

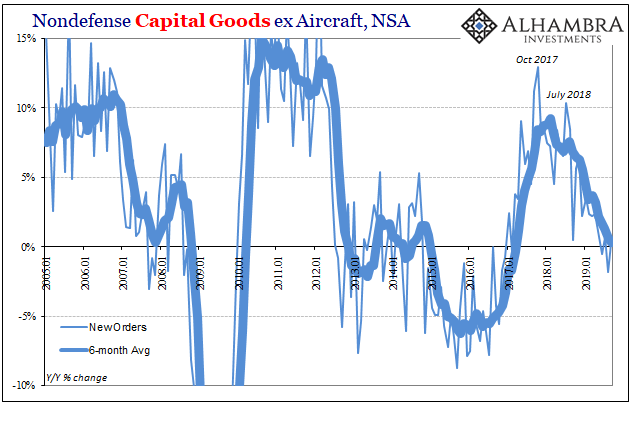

These numbers aren’t atrocious, though they aren’t good, either. They indicate a serious stumble in the US as global economy, though not yet a truly big one like what you might see in a full-scale recession. The risks continue to be there, however. Businesses appear to be waiting for this limbo-like condition to shift either way. If things materially pick up, then a rebound. If they don’t, it sounds like heightened negative pressures could materialize relatively quickly. Businesses already appear to be on edge and just waiting for confirmation to go further with negative adjustments (from a hiring freeze to actually cutting headcounts). Preservation over growth at that point. That’s the same thing we see all around the economic data at least in the US. Over in the manufacturing sector, the Census Bureau reported new orders and shipments on durable and capital goods today. Like the PMI figures, they aren’t atrocious but they also aren’t good. Orders for durable goods (excluding transportation industries) are straddling the line between slightly positive and slightly negative (therefore neither atrocious nor good) while orders for cap goods are heading more clearly toward the minus side. |

Nondefense Capital Goods ex Aircraft, NSA 2005-2019 |

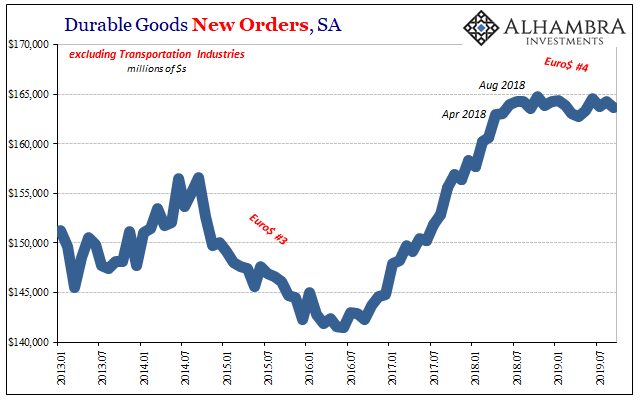

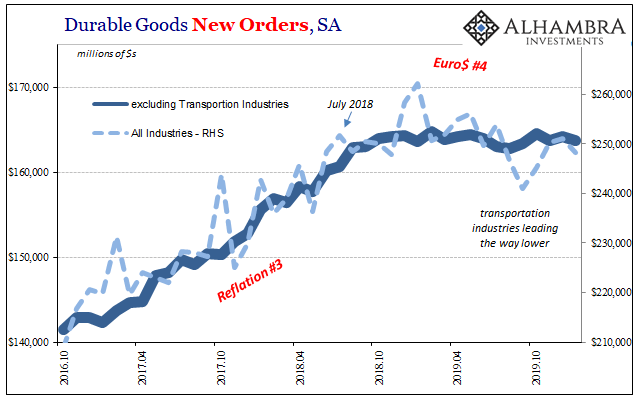

| It has left the series at least as far as the seasonally-adjusted data is concerned to look like a highly unusual straight line sideways. I still believe that it will be revised at future benchmark revisits to something more conventional, but for now this is just plain weird.

Again, complete lack of growth while simultaneously no visible recession. An indicated wait and see attitude, even though the economy has been waiting and seeing very little for longer than a full year already. |

Durable Goods New Orders, SA 2013-2019 |

Durable Goods New Orders, SA 2016-2019 |

|

| But in a lot of important ways even the strange sideways track is worse than it appears at first glance. Realizing the non-linear nature of the world, that’s how we reconcile what doesn’t appear to be too much negative in durable goods, therefore manufacturing, with PMI’s that suggest conditions more and more like 2009 (Markit’s PMI, like the ISM, a few months ago fell to the lowest level since the Great “Recession”).

Durable goods, an important part of manufacturing, doesn’t look nearly as bad now when compared with, say, three years ago let alone 2009. The difference is the lack of recovery in between. Despite all the noise and hysteria surrounding globally synchronized growth, there never was nearly enough of it to get the US (or global) economy back on track toward what really would’ve been a true, meaningful recovery. |

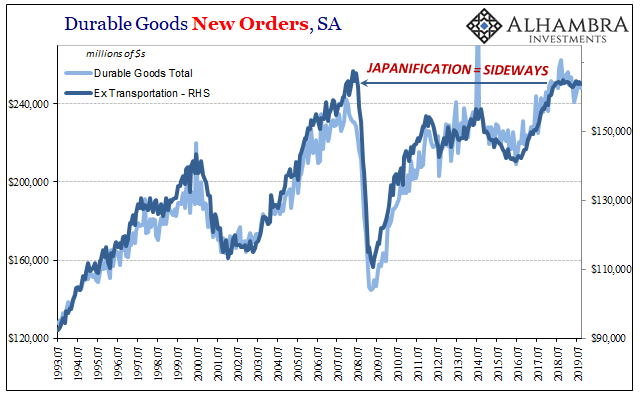

Durable Goods New Orders, SA 1993-2019 |

| You see it better in the longer-term comparisons, the more appropriate context. If globally synchronized growth had actually been real growth, the manufacturing sector would’ve been advancing at far better than double digit rates. The relevant and meaningful comparison, therefore interpretation, isn’t how far above zero the rate of change became, but how far below the better than double-digit growth it would’ve taken for real recovery.

Even at its highest point in 2018, the level of new orders here was still less than it had been at the peak in 2007 more than a decade ago. That would’ve meant a whole decade of growth that had been absent to catch up on. And that’s what makes even sideways in 2019 worse than it appears (if real recovery would’ve meant, say, +15% between 2016 and now, then even at +7% that’s actually -8%; shift from even that level of growth to 0%, as has been the case since the middle of 2018, and the relevant reading isn’t zero it’s -15%). The longer we go without even a plus sign, the farther behind we fall. In non-linear terms, sideways is a bigger contraction the longer the time period stretches forward. |

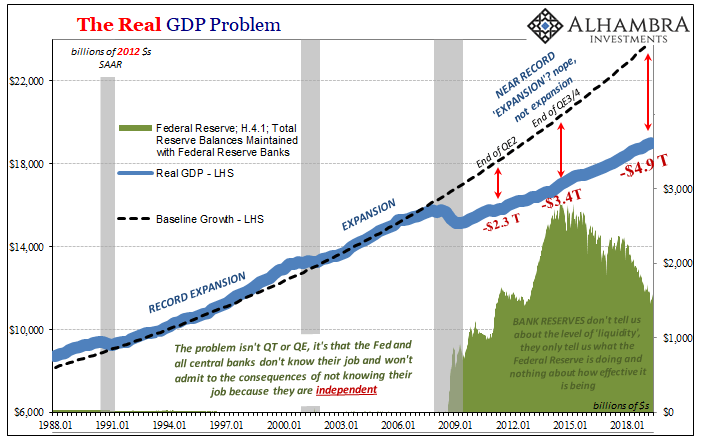

The Real GDP Problem, 1988-2018 |

The gap between where we are and where we “should” be, no matter what the Fed does, is that much more – and more significant.

Even a one or zero percent growth rate after a decade of falling behind is a much bigger minus than it seems. That’s why the PMI’s are all down around their decade lows even though in absolute terms on some of these other economic accounts it doesn’t “feel” like it.

That’s really the biggest immediate problem over what is now a confirmed downturn at the very least – services as well as manufacturing. What that means in the big picture is for however the downside works out, it will already be a prolonged period of further missed opportunity and compounding. The gap will only get bigger no matter if it ends up in recession. The damage is already being done. Again.

Tags: baseline growth,capital goods,Composite PMI,currencies,durable goods,economy,Featured,Federal Reserve/Monetary Policy,IHS Markit,manufacturing,Markets,newsletter,PMI,recession,services