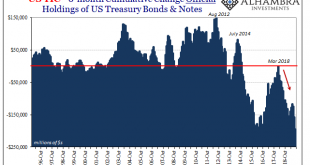

Scarcely a week will go by without some grand prediction of the dollar being dethroned. Set aside how if anything is to be deposed it would have to be the eurodollar, these stories typically follow the same formulaic approach: Country X is moving away from dollar reserves, “diversifying” its holdings because of the geopolitics of Y. Usually, it is the Chinese who are set to play the role of upstart. It makes sense. As the world’s second largest national economy...

Read More »There Is No End to History, No Perfect Existence

All doctrines that have sought to discover in the course of human history some definite trend in the sequence of changes have disagreed, in reference to the past, with the historically established facts and where they tried to predict the future have been spectacularly proved wrong by later events. Most of these doctrines were characterized by reference to a state of perfection in human affairs. They placed this perfect state either at the beginning of history or at...

Read More »Swiss president continues on his ‘autocrat world tour 2019’

Ueli Maurer reviews guards during a welcome ceremony at the Great Hall of the People in Beijing on April 29 (Keystone / Madoka Ikegami / Pool) Ueli Maurer, who holds the rotating Swiss presidency this year, was set to meet Russian President Vladimir Putin in Moscow on Thursday. It is Maurer’s fourth foreign visit this year that has raised eyebrows in Switzerland. Most controversial was his trip in October to Saudi Arabia, which had already been postponed after the...

Read More »20 years of the Vereina tunnel

[embedded content] On November 19, 1999, after eight years of construction, the Vereina Tunnel opened in eastern Switzerland. Connecting the Landquart – Davos Platz and the Bever – Scuol-Tarasp lines, the tunnel is 19 kilometres long and the journey through takes 18 minutes. In 20 years, it has brought various improvements to locals, tourists, and businesses. However, its construction had initially been opposed by some as it was feared that the tunnel would lead to...

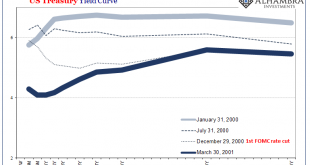

Read More »More (Badly Needed) Curve Comparisons

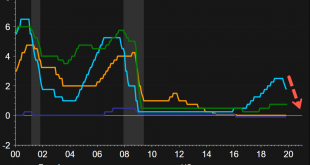

Even though it was a stunning turn of events, the move was widely celebrated. The Federal Reserve’s Open Market Committee, the FOMC, hadn’t been scheduled to meet until the end of that month. And yet, Alan Greenspan didn’t want to wait. The “maestro”, still at the height of his reputation, was being pressured to live up to it. The Fed had begun to cut rates. In Austin, Texas, where President-elect Bush and many prominent business leaders were gathered, the news...

Read More »What’s Been Normalized? Nothing Good or Positive

What’s been normalized are policies and cultural norms that seek to enrich and protect the few at the expense of the many. When the initially extraordinary fades into the unremarkable background of everyday life, we say it’s been normalized. Put another way, we quickly habituate to new conditions, and rationalize our ready acceptance of what was previously unacceptable. Technology offers many examples of extraordinary advances quickly becoming normalized as we...

Read More »Global Gold Buyers Are ‘Confident’ in Gold

‘Retail Gold Insights 2019’ has just been published by the World Gold Council. It is a thematic analysis of their new consumer research survey. With a base of 18,000 participants across India, China, Russia, Germany, the US and Canada, we believe it is the largest ever consumer survey on the global gold market. 5 main themes of the report People are confident in – and loyal to – gold. Gold already has strong foundations and it’s important to know where that...

Read More »The Financial System Is Broken (w/ Jeff Snider)

Jeff Snider, head of global research at Alhambra Investment Partners, has been covering the repo market breakdown since May 2018. With the recent spike in repo rates, it seems like the rest of the market has finally started to take notice. Snider explains why this problem is not coming up out of the blue and breaks down why he views recent market moves as a sign that the banks are telegraphing their knowledge of major threats to the monetary system. Filmed on September 27, 2019 in New York....

Read More »FX Daily, November 22: Europe’s Flash PMI Disappoints and Hong Kong Shares Advance Ahead of Sunday’s Election

Swiss Franc The Euro has risen by 0.18% to 1.0997 EUR/CHF and USD/CHF, November 22(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Equities in the Asia Pacific managed to mostly shrug off the drag of the losses in US equities yesterday. China and India could not escape the pull, but most other bourses were higher, led by Singapore and Hong Kong. It was the second consecutive week that the MSCI Asia Pacific Index...

Read More »UBS Has No Choice In Passing Negative Rate Pain To Customers

There’s been talk that the Federal Reserve will slam interest rates to zero or even negative when the next recession strikes. President Trump’s support for negative interest rates has quickly increased in the last several months as the latest tracking estimates for Q4 GDP have tumbled to sub 0.4%. It seems that policy rates in the US are too high — and will likely conform to the rest of the world, which is near zero to negative territory. This has undoubtedly...

Read More » SNB & CHF

SNB & CHF