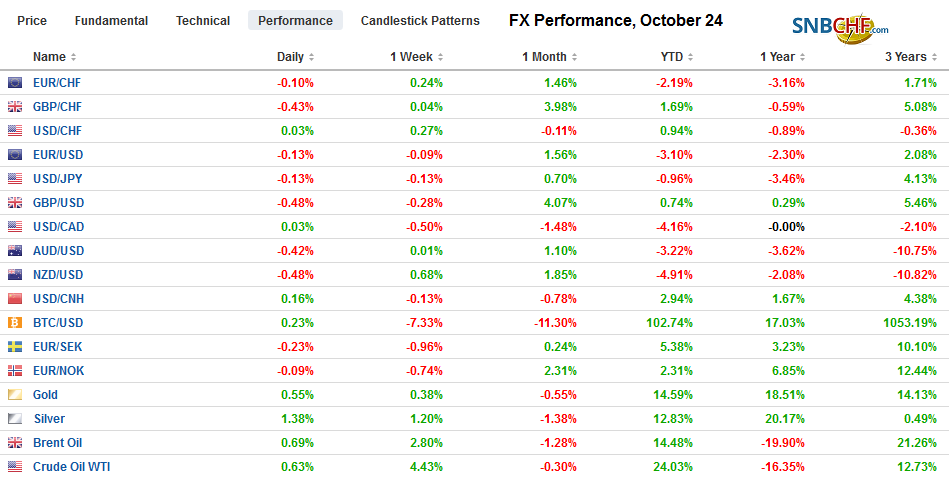

Swiss Franc The Euro has fallen by 0.08% to 1.1014 EUR/CHF and USD/CHF, October 24(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: As the UK awaits the EU’s decision on its request, disappointing flash PMI readings Japan, Australia, and Germany have filled the news vacuum. Sweden’s Riksbank retained a hawkish tone while keeping rates on hold, and Norway’s Norges Bank also stood pat. The market expects Turkey to deliver a rate cut, while the ECB meeting is Draghi’s last at the helm. Encouraged by US equity gains, the Nikkei rose to new highs for the year. India and China were notable exceptions to firmer equities in Asia Pacific. Japan and South Korea have agreed to a rapprochement after a political dispute

Topics:

Marc Chandler considers the following as important: 4.) Marc to Market, 4) FX Trends, Brexit, Currency Movement, Eurozone Markit Composite PMI, Eurozone Services PMI, Featured, Federal Reserve, Japan Manufacturing PMI, newsletter, Sweden, USD

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Swiss FrancThe Euro has fallen by 0.08% to 1.1014 |

EUR/CHF and USD/CHF, October 24(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

FX RatesOverview: As the UK awaits the EU’s decision on its request, disappointing flash PMI readings Japan, Australia, and Germany have filled the news vacuum. Sweden’s Riksbank retained a hawkish tone while keeping rates on hold, and Norway’s Norges Bank also stood pat. The market expects Turkey to deliver a rate cut, while the ECB meeting is Draghi’s last at the helm. Encouraged by US equity gains, the Nikkei rose to new highs for the year. India and China were notable exceptions to firmer equities in Asia Pacific. Japan and South Korea have agreed to a rapprochement after a political dispute was expressed in trade relations. Europe’s Dow Jones Stoxx 600 also recorded new highs for the year. US shares are little changed, with the S&P 500 hovering around 3000. Benchmark 10-year bond yields are narrowly mixed, with the US yield near 1.75%. The dollar is sporting a firmer profile, gaining against the major currencies but the Swedish krona and Japanese yen. Most emerging market currencies are softer. December WTI is paring yesterday’s 2.7% surge on the back of an unexpected drawdown of US inventory. For more than two weeks, gold closed the North American session between $1480 and $1495. |

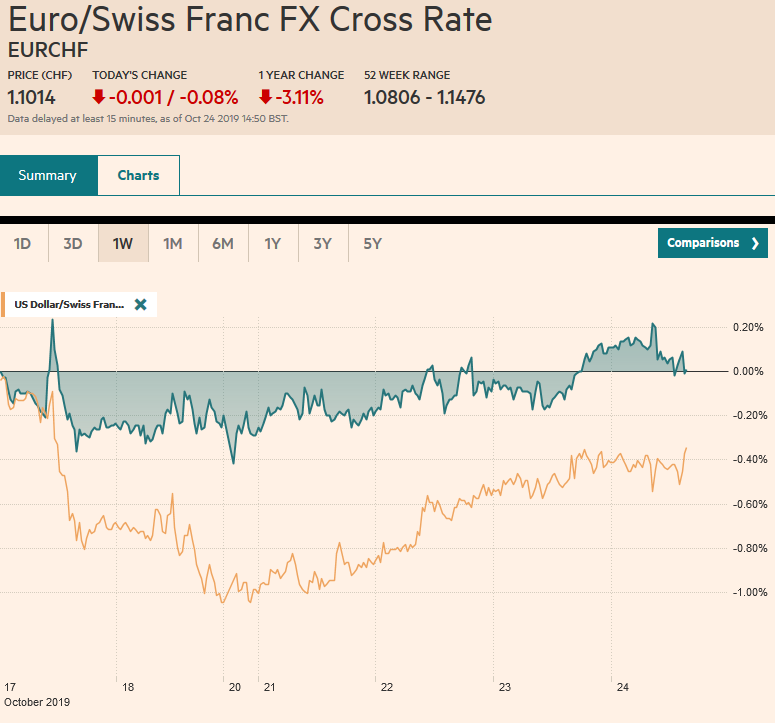

FX Performance, October 24 |

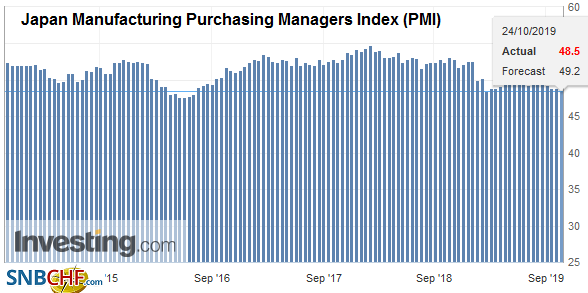

Asia PacificJapan’s flash PMI was poor, and this confirms the broad misgivings of the wisdom of the retail sales increase that was implemented at the start of the month. The damage by the typhoon adds to the poor optics. The manufacturing PMI slipped to 48.5 from 48.9. It is the sixth month below the 50 boom/bust level. The service PMI fell to 50.3 from 52.8. The composite PMI slide below 50 to 49.8 (from 51.5). The weak readings are indicative of the pressure on the Abe government to offer a supplemental budget and for the BOJ, which meets next week, to revise down its economic assessment and ease policy. |

Japan Manufacturing Purchasing Managers Index (PMI), October 2019(see more posts on Japan Manufacturing PMI, ) Source: investing.com - Click to enlarge |

Australia’s flash PMI fell but remains above 50. The manufacturing PMI barely held above 50 at 50.1 down from 50.3. It is not just about manufacturing as the services slumped to 50.8 from 52.4. The composite eased to 50.7 from 52.0. Adding to today’s disappointment, Australia held a T-bill auction that was under-subscribed. The three-month bill auction saw bids for A$936 mln for an A$1 bln offering. It is the first failed bill auction in nearly two decades. On the other hand, the six-month bill auction was five-times oversubscribed. The failure seems to be a bit of a fluke having to do with technical factors rather than a capital strike and is not expected to be repeated.

The dollar is little changed against the yen. It continues to trade in a narrow range, and today’s range is less than a quarter of a yen below JPY108.75. There are options for $920 mln between JPY108.75 and JPY108.80 that expire today. Ahead of yesterday’s low (~JPY108.25), there is an option for about $425 mln at JPY108.30 that will also roll-off. We think the risk-reward favors the dollar’s downside. The Australian dollar is trading at new lows for the week around $0.6825. We continue to look for a test on the $0.6785-$0.6800 area.

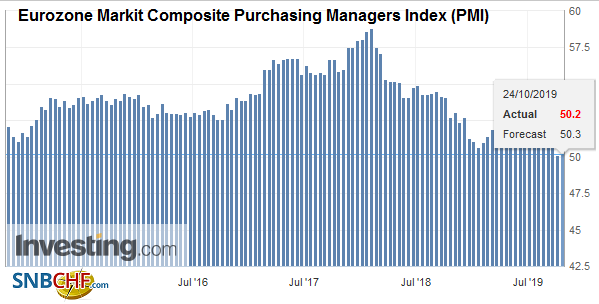

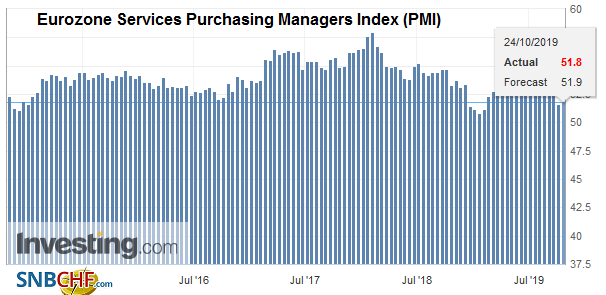

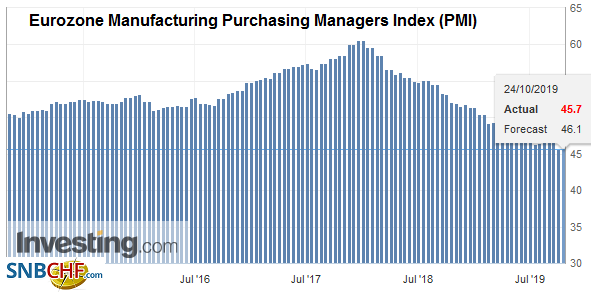

EuropeThe eurozone flash PMI ticked up but unimpressively so and offers a poor backdrop for the ECB meeting. Germany disappointed and was only partly blunted by better French data. The EMU composite PMI stands at 50.2, up from 50.1 in September. |

Eurozone Markit Composite Purchasing Managers Index (PMI), October 2019(see more posts on Eurozone Markit Composite PMI, ) Source: investing.com - Click to enlarge |

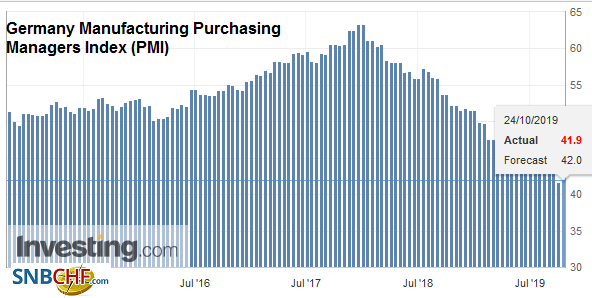

| Germany’s manufacturing PMI rose to 41.9 from 41.7, while the services PMI slipped to 51.2 from 51.4. The composite rose to 48.6 from 48.5. |

Germany Manufacturing Purchasing Managers Index (PMI), October 2019(see more posts on Germany Manufacturing PMI, ) Source: investing.com - Click to enlarge |

| France saw its manufacturing PMI increase to 50.5 from 50.1, and the services PMI improved to 52.9 from 51.1. The composite rose to 52,6 from 50.8 |

Eurozone Services Purchasing Managers Index (PMI), October 2019(see more posts on Eurozone Services PMI, ) Source: investing.com - Click to enlarge |

| Today Draghi will hold his last press conference as ECB president. We suspect he will be known for expanding the central bank’s mandate and its tools. The broader interpretation of the mandate allowed him to famously declare to do “whatever it takes” to ensure the survival of EMU. The range of tools was on display last month: negative interest rates, tiering, asset purchases, new targeted long-term loans (TLTRO), and forward guidance. Some are critical of Draghi because he employed the tools, which is to say, that the ECB failed to lift inflation to its self-defined target of near 2%. Nor is it expected to be reached any time soon. It is a fair observation, but it is not clear what else the ECB could do to lift inflation. Remember, negative policy rates first appeared in Europe, not Japan, despite the media references to “Japanification” of the US and Europe. However, as a criticism, it is weak unless one can say what the ECB could do to reach its inflation target. Instead, Draghi may have found the limits of monetary policy and monetarism itself. It appears that inflation is not “once and always a monetary phenomenon.” Lastly, we note that Germany has nominated Isabel Schnabel to replace Lautenschlager, who unexpectedly resigned last month, on the ECB Board of Directors. While she was also critical of the ECB’s decision to resume asset purchases, she has defended the ECB from the kind of criticism seen in Germany and cautioned against “scapegoating” the central bank, drawing parallels with the UK demonizing the EU ahead of the 2016 referendum, |

Eurozone Manufacturing Purchasing Managers Index (PMI), October 2019(see more posts on Eurozone Manufacturing PMI, ) Source: investing.com - Click to enlarge |

UK Prime Minister Johnson continues to insist that the October 31 timeframe can still be respected, and he reportedly is urging European leaders not to extend. EU President Tusk has indicated that it would never push the UK out without a deal and has endorsed a three-month delay. Yes, France, which blocked the UK’s initial efforts to join the EU, is playing hard to get, but Macron said the same thing before the previous extension. He reportedly wants to grant a short delay to November 15 but has an uphill struggle to convince others that the short delay won’t have to be re-visited. The European response is expected ahead of the weekend. Will Europe’s officials think less or more of Johnson that he is purposely seeking to undermine his own parliament? This is important because, after the divorce (withdrawal) agreement, a new trade agreement will be negotiated. That is next year’s Brexit meme. Separately, a vote is expected today on Johnson’s legislative agenda outlined in the Queen’s Speech. A defeat here would weigh on sterling, and the opposition may try to link it to a second referendum.

Is Johnson’s plan good or bad for the UK economy? It may be difficult to know because the government has not performed an economic assessment, which seems absurd on the face of it. The government can’t and won’t conduct an impact study. It can’t because it wants to leave at the end of the month and there is not enough time. It won’t because such a study would likely show that it is not good for the UK economy., though the Chancellor of the Exchequer said that it was “self-evidently in our economic interest.” There are only a few things that are self-evident, and this is not one of them. Indeed, a BBC report cited a range of economic forecasts, ranging from 2.3% to a 7% decline in per capita GDP over the next ten years.

For the fifth session, the euro is trading on the $1.11-handle. The $1.110 level held yesterday and an option for one billion euros struck there expires today. It had spiked a little above $1.1160 on the flash French PMI but quickly came off to session lows (~$1.1125) on the German disappointment. While Draghi may call for a review of fiscal policy, and we expect the new European Commission to be more supportive, presently, there seems to be little appetite, and earlier this week, the EC sent proposed 2020 budgets back to five countries that put the EC fiscal targets at risk. Sterling recovered from yesterday’s low near $1.2840 to reach $1.2950 today. A large GBP1.1 bln option is struck at $1.28 that expires today. Although it does not seem to be in place, volatility around the ECB meeting keeps on it our radar screen. The hawkish comments by the Riksbank (is a December hike really likely?) helped drive the US dollar to its lowest level since mid-August (a little below SEK9.56). Against the euro, the krona fell to one-month lows near SEK10.65.

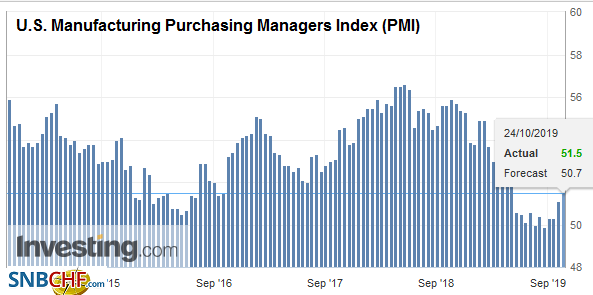

AmericaThe Federal Reserve announced it was increasing the size of its repo operation in what seems to be a preemptive move ahead of the $42.6 operation from October 10 rolling off today and the month-end pressures that already seem to be building. Beginning today, the overnight operation will increase to $120 bln from $75 bln and the term repo today, and next week’s will be at least $45 bln. The size of the operation is not the key to whether it is a plumbing issue or a monetary policy issue. We continue to accept the distinction. Remember that the Fed regularly conducted repo operations before the Great Financial Crisis, and no one confused it with QE. Monetary policy will be addressed next week, and a rate cut is widely expected. |

U.S. Manufacturing Purchasing Managers Index (PMI), October 2019(see more posts on U.S. Manufacturing PMI, ) Source: investing.com - Click to enlarge |

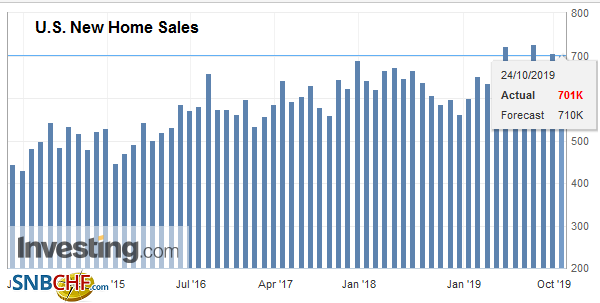

| Today’s US economic reports include September durable goods orders (expect a soft report) and October flash PMI (Q3 ended on a soft note and don’t look for improvement at the start of Q4). September’s new home sales were expected to pare the 7.1% surge in August, and after the larger than expected pullback in existing home sales reported earlier this week, the risk appears on the downside. Canada and Mexico have a light schedule. |

U.S. New Home Sales, September 2019(see more posts on U.S. New Home Sales, ) Source: investing.com - Click to enlarge |

The US dollar has fallen about 1.2% against the Canadian dollar since the middle of the month, and the momentum appears to be stalling. A move now above CAD1.3110, and ideally CAD1.3125, would likely confirm that a near-term low is indeed in place. The greenback is also trading sideways against the Mexican peso. Resistance at MXN19.20 held yesterday. A nearly three-month low was set earlier this week near 19.0740. Here too, we think risk-reward considerations favor a dollar recovery.

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #USD,Brexit,Currency Movement,Eurozone Markit Composite PMI,Eurozone Services PMI,Featured,federal-reserve,Japan Manufacturing PMI,newsletter,Sweden