The BoJ remains the last major central bank still firmly committed to large-scale monetary easing.After its Monetary Policy Meeting of December 21, the Bank of Japan (BoJ) announced its intention to keep its current monetary easing programme intact. The BOJ will continue with its “Quantitative and Qualitative Monetary Easing with Yield Curve Control ”, aiming to achieve and overshoot the core inflation target of 2%.The reason for the BoJ deciding to stay put is the stubbornly low inflation...

Read More »Global macro: 10 surprises for 2018

Having set out our expectations for the global economy in 2018, we add here a number of potential surprises. None of them are included in our baseline projections.In the US, we include first a ‘Texas boom’ due to rising oil prices. US oil investment could see a major uptick and Texas could accelerate, in turn lifting US growth.Secondly, we include a hawkish shift at the Fed. While Trump has preferred continuity in the Fed’s leadership with his nominee as Fed Chair, Jerome Powell, he could...

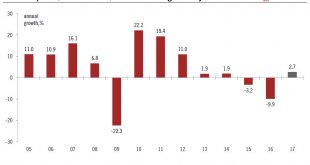

Read More »Chinese demand leads the Swiss watch industry’s recovery

The most important driver of the Swiss watch industry’s recovery has been the revival of the mainland China market.After years of impressive growth, the Swiss watch industry faced difficult conditions in 2015 and 2016, when exports declined by 3.2% and 9.9% respectively in value terms. The last time that there were two consecutive years of decline was in 1995-96. The appreciation of the Swiss franc, the collapse of the top market Hong Kong due to the sudden disappearance of Chinese tourists...

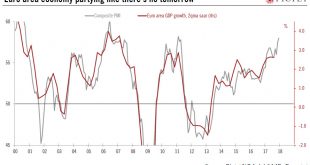

Read More »2018 ECB outlook – Mission: possible

We expect the ECB to announce a tapering of its asset purchase programme in the summer, but not to overreact to strong economic data.Our first choice as the title for our 2018 ECB outlook was “The courage not to act”, but regular readers will know that we used this hommage to Ben Bernanke earlier this year. Yet our faith in ECB’s courage knows no bounds and this still feels relevant today, with the caveat that the ECB will act in 2018, announcing a tapering of its asset purchase programme in...

Read More »US to overtake Switzerland in WEF competitiveness survey?

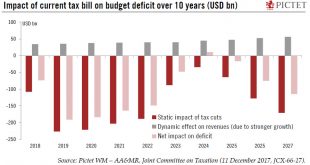

The US is about to enact significant corporate tax cuts, and could therefore edge closer to the number 1 spot in the World Economic Forum’s ranking – currently held by Switzerland.The US is about to enact significant corporate tax cuts, that will see the federal statutory corporate tax rate drop to 21%, from 35%, starting in January (see our latest note ‘US tax cuts update – 19 December 2017’).This will significantly increase the global competitiveness of the US economy, especially as high...

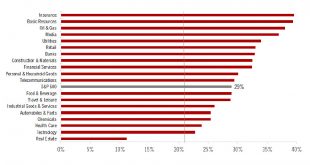

Read More »The US tax bill will boost 2018 earnings forecasts

The 21% corporate tax rate could cause 2018 expected earnings growth for US stocks to more than double. We see some upside risk to our US equity scenario.Last night, the US Senate approved the tax bill. It has since returned to the House of Representatives for administrative reasons, but, in line with an earlier vote, a green light looks now highly likely. Shortly thereafter, President Trump should sign it formally into law. If the tax reform is adopted, the statutory tax rate is expected to...

Read More »US tax bill looks set to pass

The tax bill continues to make its way through Congress at a swift pace, and now looks increasingly likely to be enacted into law this week.The Republican leadership seems to have corralled enough support to pass the tax bill approved in conference committee. The bill could be signed into law as soon as this week.The tax bill cuts the corporate tax rate to 21% from 35%, from January 2018. Global corporate taxation will move to a territorial regime, with a one-off tax on foreign investments...

Read More »Multi-Generational Wealth, Singapore

[embedded content] The fourth edition of the Asian Family Office Master Class took place in Singapore in November 2017, with about 70 guests attending. The focus was around the three pillars of Pictet’s Family Office offer: family governance, investment governance and operational governance. Among the speakers, we had the pleasure of welcoming José Leyte, Chief Executive Officer of one of the biggest European Family Office in terms of asset under management; Kelly Poon, Partner at Atomico,...

Read More »Pictet Multi-Generational Wealth, Singapore (Full version)

The fourth edition of the Asian Family Office Master Class took place in Singapore in November 2017, with about 70 guests attending. The focus was around the three pillars of Pictet’s Family Office offer: family governance, investment governance and operational governance. Among the speakers, we had the pleasure of welcoming José Leyte, Chief Executive Officer of one of the biggest European Family Office in terms of asset under management; Kelly Poon, Partner at Atomico, an innovative...

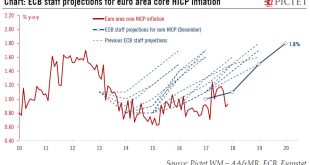

Read More »ECB closer to the 2% inflation target than meets the eye

Euro area GDP growth and inflation forecasts have been revised up, reflecting growing confidence over the macro outlook.During an uneventful ECB press conference on Thursday, attention centred on the new staff projections. The headline projections were in line with expectations, albeit slightly higher on GDP growth and lower on inflation.The key word was “confidence”- in a strong expansion leading to a “significant” reduction in economic slack, as well as in the ECB’s capacity to meet its...

Read More » Perspectives Pictet

Perspectives Pictet