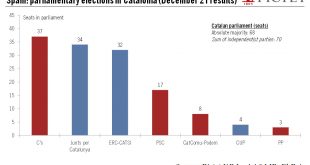

Spain, like Europe, continues to take political tensions in the region in its stride, but prolonged uncertainty could have an impact on the economy.Following the December regional elections, in which pro-independence parties won a majority of parliamentary seats, the main challenge in Catalonia will be the formation of a new coalition government. Catalan parties have until end March/early April to reach an agreement on the next regional president, failing which repeat elections may need to...

Read More »China: FX reserves rise again

The decline in capital outflows may suggest that investors’ sentiment towards China is improving.According to the Chinese State Administration of Foreign Exchange, China’s FX reserves amounted to USD3.14 trillion at end-December 2017, up USD20.7 billion from the previous month. This marks the 11th consecutive monthly increase in Chinese FX reserves since February 2017. In full-year 2017, Chinese FX reserves increased by USD129.4 billion, in contrast with a drop of USD512.7 billion in 2015...

Read More »VIDEO0026

VIDEO0025

VIDEO0024

VIDEO0023

Switzerland: Inflation at a seven-year high

Swiss inflation remained at its highest rate in almost seven years in December. We expect average headline inflation to continue to move higher in 2018.According to the Swiss Federal Statistical Office (FSO), consumer prices in Switzerland remained broadly stable at 0.8% year on year (y-o-y) in December, in line with consensus expectations. Core inflation (headline CPI excluding food, beverages, tobacco, seasonal products, energy and fuels) increased slightly to 0.7% y-o-y in December.In...

Read More »VIDEO0027

成果影片

币安 Profittrailer 介紹(国语) 一天赚 0.01个btc

我是 profittrailer幣安自動交易機器人官方認證reseller link購買連接PT: https://profittrailer.com/pt/paul/ https://profittrailer.com/pt/chinese/ 使用我的链接購買PT註冊幣安我可以送上私人買賣策略: https://www.binance.com/?ref=13722855 購買安裝介紹: https://www.youtube.com/watch?v=0H8bO_KMSEQ 國內的朋友需要用VPS點這裡: https://www.vultr.com/?ref=7313058 有什么问题可以问我电报: https://t.me/joinchat/G7rMWUg6Tj_70JaDNIu8_Q ... https://t.me/PAULADSIC or @PAULADSIC QQ 群 585103 EMAIL : [email protected] 跑交易机器人要一个电脑24小时运作才能保证交易 如果您想支援一下我...

Read More » Perspectives Pictet

Perspectives Pictet