In the FT, Claire Jones reports about the German Federal Constitutional Court’s decision to refer a case against the European Central Bank’s PSPP program to the European Court of Justice. “In the view of the [court] significant reasons indicate that the ECB decisions governing the asset purchase programme violate the prohibition of monetary financing and exceed the monetary policy mandate of the European Central Bank.” … While Germany’s constitutional court said the OMT programme was...

Read More »Liechtenstein: Role Model or Worse?

In the NZZ, Simon Gemperli argues that Liechtenstein is doing better than Switzerland. Swiss tabloid Blick criticizes Liechtenstein. Previous, more positive NZZ articles about Liechtenstein: May 2014; March 2016; November 2016; April 2017.

Read More »Air Berlin’s Insolvency

In the FT, Mark Odell, Nick Megaw, and Stefan Wagstyl report about Air Berlin’s (ABX:GER) insolvency. This outcome will barely surprise Air Berlin passengers.

Read More »Economics Journals’ Response Times

In a blog post, Douglas Campbell offers a ranking of economics journals by response times (based on non-representative data). The ranking (with # indicating the rank according to citations): # Journal Name Accept % Desk Reject % Avg. Time Median Time 25th Percent. (Months) 75th Percent. (Months) N = 1 Quarterly Journal of Economics 1% 62% 0.6 0 0 1 71 12 Journal of the European Economic Association 4% 56% 1.2 0.5 0 2 ...

Read More »Say’s Law

From The Economist’s economics brief on Say’s Law: Supply gives people the ability to buy the economy’s output. But what ensures their willingness to do so? According to the logic of Say and his allies, people would not bother to produce anything unless they intended to do something with the proceeds. … Even if people chose to save not consume the proceeds, Say was sure this saving would translate faithfully into investment in new capital … But what if the sought-after thing was [money] …...

Read More »Federalism Trends in Switzerland

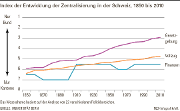

In the NZZ, Sean Müller und Paolo Dardanelli report about long-term trends in the Swiss federalist structure. Legislation has become more centralized. Implementation less so. Cantons increasingly implement federal legislation. But decentralized authority to collect taxes has remained largely in place. Figure from the NZZ:

Read More »Berlin, or Berlin Tegel, or Air Berlin?

Berlin Tegel airport (TXL). Air Berlin flight to Zurich. Passengers have been waiting in the cabin for about half an hour. Apparently, some disagreement or confusion among ground staff on how to deal with delayed passengers. Enter the Maître de Cabine: Ja, meine Damen und Herren. Sie haben es sicher schon bemerkt: Hier wieder mal völliges Chaos in Berlin Tegel … (Well, Ladies and Gentlemen: As you surely realize, we have once again complete chaos here in Berlin Tegel …) While Berlin (and...

Read More »Theory of the Firm

The Economist’s economics brief on theories of the firm. For a nice exposition, see the 1998 JEP article by Partrick Bolton and David Scharfstein.

Read More »Corporate Governance of Crypto Currencies

The Economist reports about conflicting strategies among important Bitcoin players; the struggle aligns pragmatists against libertarian ideologists. It also reports about attempts by competing crypto currencies to strengthen corporate governance: Tezos, another blockchain, will … not only have regular votes on competing proposals for how to change the system, but a more scientific approach to evaluating them and a way to compensate the developers for coming up with ideas. If their...

Read More »Bitcoin, Arbitrage, and the Human Side of the Blockchain

On Bloomberg view, Matt Levine discusses the recent bitcoin fork. The handling of long and short positions on Bitfinex, a bitcoin exchange, created an arbitrage opportunity, until Bitfinex changed its mind. Bitfinex announced a policy to deal with the fork, people took advantage of the policy, and Bitfinex changed its mind after the fact. Each of its decisions was rational, and quite plausibly the fairest option available to it. None of those decisions were required by, like, the nature...

Read More » Dirk Niepelt

Dirk Niepelt