In Die Volkswirtschaft, Ernst Baltensperger and Peter Kugler summarize the history of the Swiss Franc since the mid 19th century: After 1973, the Swiss Franc has been strong. Swiss Franc yields have been lower than what uncovered interest parity would suggest. Before 1914, the Swiss Franc was weak in the sense that it enjoyed only limited credibility. In periods with fixed exchange rates, Swiss Franc yields typically exceeded yields in French Franc or Sterling. Throughout the 20th...

Read More »Pet Health Care

In an NBER working paper, Liran Einav, Amy Finkelstein, and Atul Gupta document similarities between healthcare for humans and pets in the US: (i) rapid growth in spending as a share of GDP over the last two decades; (ii) strong income-spending gradient; (iii) rapid growth in the employment of healthcare providers; and (iv) similar propensity for high spending at the end of life.

Read More »The Trouble with Macroeconomics

The “Trouble with Macroeconomics,” according to a working paper by Paul Romer that is posted on his website, relates to dishonest identification assumptions, in particular in DSGE models used for policy analysis. Romer singles out calibration, assumptions about distribution functions and strong priors as culprits. Romer argues that [b]eing a Bayesian means that your software never barfs and I agree with the harsh judgment by Lucas and Sargent (1979) that the large Keynesian macro models...

Read More »Karl Brunner

The SNB commemorated Karl Brunner’s 100th birthday with a Centenary Event and the first of a new lecture series, the Karl Brunner Distinguished Lecture Series. Allan Meltzer, Benjamin Friedman, Charlie Plosser, and Ernst Baltensperger reviewed Karl Brunner’s life and work at the event; Kenneth Rogoff delivered the lecture. In the NZZ, Allan Meltzer writes about Karl Brunner. Ditto Kurt Schilknecht.

Read More »Favors?

In the FAZ, Patrick Bernau und Manfred Schäfers report that the German Federal Ministry for Economic Affairs invited five research institutes to produce economic forecasts although the call for bids had stated that the Ministry would contract with at most four institutions. Legal experts agree that this procedure is illegal. The report suggests that the institution that just made it (DIW) is led by Marcel Fratzscher who is politically close to the Minister.

Read More »Secular Stagnation Skepticism

I was asked to play devil’s advocate in a debate about “secular stagnation.” Here we go: Alvin Hansen, the “American Keynes” predicted the end of US growth in the late 1930s—just before the economy started to boom because of America’s entry into WWII. Soon, nobody talked about “secular stagnation” any more. 75 years later, Larry Summers has revived the argument. Many academics have reacted skeptically; at the 2015 ASSA meetings, Greg Mankiw predicted that nobody would talk about secular...

Read More »“Macroeconomics II,” Bern, Fall 2016

MA course at the University of Bern. Lectures follow chapters 1–4 in this text. Time: Wed 10-12. KSL course site. Course assistant: Christian Myohl.

Read More »Tens of Thousands of Deaths from Forest Fires in Indonesia

In the FT, Jeevan Vasagar reports about a study according to which the haze spreading from Indonesian forest fires in Fall 2015 killed about 100 000 people in Southeast Asia.

Read More »Young Men in the US Work Fewer Hours

More discussion about falling employment of young men in the US: John Rust publicizes the facts in a speech: Unskilled young men spend more time playing video games and less time in the labor market. “In 2015, 22 percent of lower-skilled men aged 21–30 had not worked at all during the prior 12 months.” They live in the basement of their parents’ houses and are not married. (And on his 12-year old son: “If we didn’t ration video games, I am not sure he would ever eat. I am positive he...

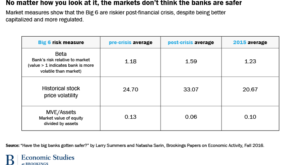

Read More »Have Banks Become Less Risky?

In BPEA, Natasha Sarin and Larry Summers argue that bank stock has not: … we find that financial market information provides little support for the view that major institutions are significantly safer than they were before the crisis and some support for the notion that risks have actually increased. … … financial markets may have underestimated risk prior to the crisis … Yet we believe that the main reason for our findings is that regulatory measures that have increased safety have been...

Read More » Dirk Niepelt

Dirk Niepelt