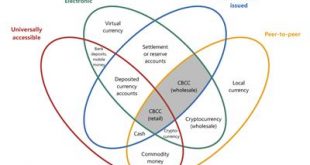

In a BIS Quarterly Review article, Morten Bech and Rodney Garratt offer a taxonomy of money, with special emphasis given to central bank issued digital and crypto currency. They stress four dimensions: issuer (central bank or other); form (electronic or physical); accessibility (universal or limited); and transfer mechanism (centralised or decentralised). The taxonomy defines a CBCC as an electronic form of central bank money that can be exchanged in a decentralised manner known as...

Read More »Should a Central Bank Issue Cryptocurrency?

On Alphaville, Izabella Kaminska asks why a central bank would want to issue cryptocurrency rather than conventional digital currency. … if anonymity is not the objective of issuing a centrally supervised cryptocurrency, what really is the point of using blockchain or crypto technology? Just issue a conventional digital currency and be done with it. If, on the other hand, anonymity is the objective of issuing a centrally supervised cryptocurrency, how can this be justified by a central...

Read More »The Midlife Crisis

On VoxEU, David Blanchflower and Andrew Oswald argue that it exists. Overall, we think there is a great deal of evidence – though we have critics, especially among a small group of social psychologists – that humans experience a midlife psychological ‘low’. The midlife decline in wellbeing is apparently substantial and not minor … It should perhaps be emphasised that the midlife low is not affected by regression-equation controls for having young children, nor by changing the exact nature...

Read More »“View of a Steep, Rocky Coast and a Rough Sea at Sunset”

Ivan K. Aivazovsky, 1883

Read More »The Cost of Identity Theft

The Economist reports that according to estimates, undoing identity fraud can take an average of six months and 100 to 200 hours of a person’s time. In addition there is the risk of substantial financial losses due to identity fraud. Suppose a data breach exposes personal information of 1 million people. As a consequence, 0.1% of the affected persons suffer financial costs of $100 each, and all affected persons spend 100 hours to undo the damage. Suppose the average wage of the affected...

Read More »ICOs and Frequent Flyer Miles

The Economist on “initial coin offerings:” Many ICOs are designed to finance applications that will make use of the blockchain … In some cases, the “coins” can be exchanged for services on the site. In a way, this is like selling air miles in a startup airline; investors can either use the miles for flights or hope they can trade them at a profit. For the business, it is also a way of creating demand for the product they are selling. But in plenty of cases, an ICO is just a way of raising...

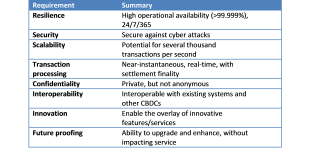

Read More »Desirable Features of Central Bank Issued Digital Currency

On bankunderground, Simon Scorer reminds us that a central bank issued digital currency (CBDC) need not operate on a distributed ledger platform. The two do not have much to do with each other. Scorer suggests a series of technical requirements for a CBDC: And he concludes that a distributed ledger does not meet all requirements. It’s unlikely that all of the above attributes could be perfectly met with today’s technology; you may need to make compromises between features – e.g. the...

Read More »US Top Income Shares Rose Less Dramatically

That’s what Gerald Auten and David Splinter argue in a paper from last year. … new estimates of top income shares using two consistent measures of income. Our measure of consistent market income includes full corporate profits and adjusts for changes from TRA86, including changes to the tax base and increased filing by dependent filers. In addition, we include employer paid payroll taxes and health insurance and adjust for falling marriage rates. The effect of these adjustments on...

Read More »The Lifespan of Constitutions

The comparative constitution’s project shows timelines of the world’s constitutions. Japan’s constitution appears as one of the most stable ones, Switzerland’s doesn’t.

Read More »Distributed-Ledger Based Payment Systems Could Work

The ECB has published a first report on Stella, a joint research project with the Bank of Japan. The two banks are interested in potential roles that distributed ledger technology could play to support the financial market infrastructure. The report assesses whether existing payments systems could be safely and efficiently run on a distributed ledger. It concludes that a distributed-ledger-based system could meet the performance needs of real-time gross settlement systems, up to some...

Read More » Dirk Niepelt

Dirk Niepelt