Finanz und Wirtschaft, August 2, 2017. PDF. Macroeconomists are neither forecasters nor economic policy makers. They devise models. Economic policy makers are in charge of applying them.

Read More »Switzerland’s Changing International Linkages

In a CEPR discussion paper, Cedric Tille argues that Switzerland’s international linkages have been transformed over the last decade. Abstract: Over the last decade, the economic linkages between Switzerland and the rest of the world have been transformed. First, merchanting and the chemical industry account for an increasing share of international trade, with chemicals exports expanding robustly in recent years despite the European crisis and the strong Swiss franc. Second, the nature of...

Read More »Dictionary Money

On his blog, JP Koning discusses “dictionary money” and the ancient practice of simply redefining what “pound,” say, means. People have historically advertised prices for wares using a word, or unit of account, the LSD unit being the most prevalent. … from the Latin librae/solidi/denarii. The monarch was responsible for declaring what these words meant. … something to the effect that a pound, or £, was worth, say … silver coin[s]. This definition was subject to change. … Dictionary...

Read More »Limits of Arbitrage and Covered Interest Parity

In a BIS working paper, Dagfinn Rime, Andreas Schrimpf, and Olav Syrstad analyze the apparent breakdown of covered interest parity (CIP). They argue that CIP holds remarkably well for most potential arbitrageurs when applying their marginal funding rates. With severe funding liquidity differences, however, it becomes impossible for dealers to quote prices such that CIP holds across the full rate spectrum. A narrow set of global top-tier banks enjoys risk-less arbitrage opportunities as...

Read More »RTGS Open To Non-Bank Payment Service Providers

The Bank of England has announced plans to open its central-bank-money settlement system (RTGS) to non-bank payment service providers. This, it hopes, will promote competition, innovation, and financial stability by creating more diverse payment arrangements.

Read More »The IMF “In Principle” Approves Funding For Greece

In the FT, Mehreen Khan reports about the IMF’s conditional acceptance to lend to Greece. The IMF’s “agreement in principle” (AIP) tool draws on a practice where the fund is able to greenlight its involvement in a debtor country, conditional on the government and its creditors agreeing to future debt relief measures. Of course, the dispute about the merits of debt relief is unresolved. The IMF thinks Greek debt is ‘unsustainable’ and the European creditors should bear more losses, earlier...

Read More »Gerzensee (The Lake)

In the Berner Zeitung, Johannes Reichen reports about planned maintenance work on Lake Gerzensee’s overflow. The Study Center (which owns the lake located on the territory of three communities) is portrayed as an institution that could have given more money … Interested parties are welcome to inquire if they wish to know more.

Read More »The Reformation, Education, and Secularization

In a paper, Davide Cantoni, Jeremiah Dittmar, and Noam Yuchtman argue that the Protestant reformation after the year 1517 triggered major reallocation, due to religious competition and political economy. [T]he Reformation produced rapid economic secularization. … shift in investments in human and fixed capital away from the religious sector. Large numbers of monasteries were expropriated … particularly in Protestant regions. This transfer of resources shifted the demand for labor...

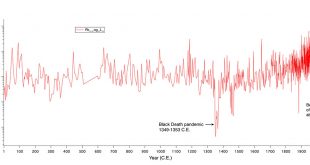

Read More »The Black Death and Atmospheric Lead Concentration

During the black death epidemic (1349–1353), atmospheric lead concentration collapsed as mining ceased. This is the result of a study by Alexander More, Nicole Spaulding, Pascal Bohleber, Michael Handley, Helene Hoffman, Elena Korotkikh, Andrei Kurbatov, Christopher Loveluck, Sharon Sneed, Michael McCormick, and Paul A. Mayevski on lead levels in an Alpine glacier. They write that [c]ontrary to widespread assumptions, … resolution analyses of an Alpine glacier reveal that true historical...

Read More »Trust and Money

In the Trustlines Network every user is acting as a bank by granting credit lines to friends they trust. This allows to issue people powered money between friends and facilitate secure payments between strangers, by sending payments along a chain of trusting friends. Think of IOUs or cheques and netting in the blockchain.

Read More » Dirk Niepelt

Dirk Niepelt