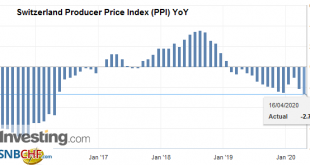

The Producer Price Index (PPI) or officially named “Producer and Import Price Index” describes the changes in prices for producers and importers. For us it is interesting because it is used in the formula for the Real Effective Exchange Rate. When producers and importers profit on lower price changes when compared to other countries, then the Swiss Franc reduces its overvaluation. The Swiss PPI values of -6% in 2015 (see below), compared to -3% in Europe or -1% in...

Read More »Covid-19 therapy could come by end of year, vaccine in 2021

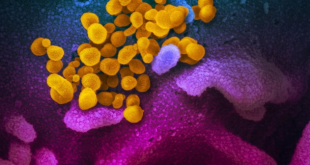

Electron microscope image of Covid-19 (yellow) emerging from the surface of cells (blue/pink) cultured in a US lab (Keystone / Niaid- Rml/national Institutes O) Swiss pharma and business insiders predict that an effective drug therapy against Covid-19 will be available by the end of this year, but a vaccine might take a year longer than that. “In the best-case scenario, a drug could be available before the end of 2020,” said on Monday Francesco De Rubertis, director...

Read More »All About The Repo Markets with Jeff Snider – April 15, 2020

Jeff Snider, Head of Global Research at Alhambra Investment Partners, takes the time with us to discuss what the Repo market is, how this market is used and why the Repo market can cause large moves in equities markets and across many assets. Join our list to be informed of future high-quality events such as this one: http://eepurl.com/drE6vH

Read More »The Best Internet Plans in Switzerland for 2020

These days, everybody needs an internet connection. And we can agree that we all want to pay as little as possible for our connection to the web. Although your internet plan may have been the cheapest when you started using it, it may not be the case anymore. New deals may have appeared. If you want to keep saving money on your internet plan, you need to compare offers and always keep up to date with the latest offerings. In Switzerland, there are many internet...

Read More »The Global Engine Is Still Leaking

An internal combustion engine that is leaking oil presents a difficult dilemma. In most cases, the leak itself is obscured if not completely hidden. You can only tell that there’s a problem because of secondary signs and observations. If you find dark stains underneath your car, for example, or if your engine smells of thick, bitter unpleasantness, you’d be wise to consider the possibility. There’s also the potential for the engine to overheat and maybe even...

Read More »In an Age of Pandemics We Need More Freedom to Trade, Not Less

There are many who use the coronavirus crisis to blame freedom to trade for the current epidemic. And, of course, there are those who are already arguing for autarky, closing our borders, and producing everything locally. But we have been living in a world that relies on trade between different populations since the birth of civilization. For example, eight thousand years ago, there was an intense trade in lapis lazuli, a semiprecious blue stone, between what is now...

Read More »Thanks to Lockdowns, State and Local Tax Revenues Are Plummeting

Unlike the federal government, state and local governments in America can’t just create money out of thin air. So when tax revenues go down, that money is simply not available to the state legislatures and city councils anymore. These governments either have to borrow the money or raise taxes and hope the tax hike itself doesn’t cause total revenue to fall. The tax revenues in these states, cities, and counties are heavily dependent on economy activity. That is,...

Read More »FX Daily, April 15: Dollar Rises as Equities Slump

Swiss Franc The Euro has fallen by 0.12% to 1.0528 EUR/CHF and USD/CHF, April 15(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The recovery in equities stalled, and the risk-off mood has helped lift the US dollar, which had been trending lower. Taiwan and Malaysia were notable exceptions in the Asia Pacific regions to the heavier equity tone. The Nikkei gave back almost 0.5% after surging more than 3% on...

Read More »Ranking finds Swiss cities less expensive

Bread in Geneva costs considerably more than bread in Zurich, but far less than a loaf in New York. (© Keystone / Martial Trezzini ) Zurich and Geneva are still among the world’s ten most expensive cities, but both have slid down the rankings since last year. The full effect of the coronavirus crisis remains to be seen. In the Economist Intelligence Unit’sexternal link annual report comparing the cost of living in cities around the world, Zurich is tied for 5th place...

Read More »Dollar Firm in Thin Holiday Trading

The virus news stream is mostly positive today; yet risk assets are starting the week under some modest pressure The dollar took a hit last week but we think it will recover; some US data releases from Good Friday are worth repeating With most of Europe closed today, the news stream from the region is very light; oil prices could not extend their gains today after OPEC+ finalized output cuts over the weekend India March CPI is expected to ease to 5.90% y/y from 6.58%...

Read More » SNB & CHF

SNB & CHF