Overview: The late sell-off in US stocks yesterday has not prevented gains in Asia and Europe. Most of the equity markets, including the re-opening of China, gain more than 1%. Australia was a notable exception, falling about 0.4%, and Taiwan was virtually flat. European bourses opened higher but made little headway before some profit-taking set in, while US shares are trading higher. Benchmark 10-year yields are firmer, and the US Treasury yield is near 67 bp...

Read More »Students’ finances affected by coronavirus lockdown

Shut for business: a restaurant in Bern. (Keystone / Peter Klaunzer) Most Swiss students rely on part-time jobs during their studies, but the shutting of restaurants, bars, cinemas and gyms during the coronavirus pandemic has led to many of them losing a source of income. Around three quarters of students have a part-time job during their studies, with around half of them working on average two days a week, according to the Federal Statistical...

Read More »How Swiss cobalt traders are trying to prevent child labour

Children walk along the road from Kolwezi to Musonoi where there are numerous copper mines with huge tailings piles. (Courtesy of Meinrad Schade – Brot für alle/Fastenopfer) Swiss cobalt traders Glencore and Trafigura deal very differently with small-scale miners in the Democratic Republic of Congo (DRC), many of whom are children. Eight kilograms of cobalt are needed for every electric car battery. More than 70% of the increasingly sought-after metal is mined in...

Read More »Restricted Market Trading Comments

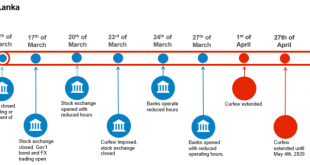

By Dara O’Sullivan, Derrick Leonard, and Ilan Solot Covid-19 related measures for restricted markets remain largely unchanged from last week. Sri Lanka and India have extended their lockdown periods, while Kenya and Nigeria continue to face limited liquidity. Please see trading comments below Sri Lanka: The government announced on May 1 that the current lockdown will remain in place until May 11, when it will be reviewed. The Colombo Stock Exchange (CSE) remains...

Read More »The Art of Survival, Taoism and the Warring States

Longtime correspondent Paul B. suggested I re-publish three essays that have renewed relevance. This is the first essay, from June 2008. Thank you, Paul, for the suggestion. I’m not trying to be difficult, but I can’t help cutting against the grain on topics like surviving the coming bad times when my experience runs counter to the standard received wisdom. A common thread within most discussions of surviving bad times–especially really bad times–runs more or less...

Read More »Politicians Have Destroyed Markets and Ignored Human Rights with Alarming Enthusiasm

An economic cataclysm has been unleashed upon the world by Western politicians and bureaucrats. Unbelievably, economic activity in the West has slowed to a creep, as entire populations have been confined to their homes for weeks, if not months. As a result, millions have had their lives turned upside down. Most entrepreneurs and self-employed persons have had their livelihoods jeopardized. The EU economy may shrink by 5 percent according to the European Central Bank...

Read More »FX Daily, April 5: German Court Adds to the Euro’s Woes

Swiss Franc The Euro has risen by 0.11% to 1.0535 EUR/CHF and USD/CHF, May 05(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The S&P 500 recovered yesterday after dipping trading below the 20-day moving average for the first time in a month. The key area is the gap between the April 30 low (~2892.5) and the May 1 high (~2869). Oil reversed higher as well. June crude was off nearly 9% in the US morning and...

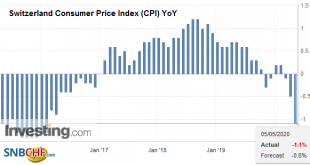

Read More »Swiss Consumer Price Index in April 2020: -1.1 percent YoY, -0.4 percent MoM

05.05.2020 – The consumer price index (CPI) fell by 0.4% in April 2020 compared with the previous month, reaching 101.3 points (December 2015 = 100). Inflation was –1.1% compared with the same month of the previous year. These are the results of the Federal Statistical Office (FSO). The 0.4% decrease compared with the previous month can be explained by several factors including falling prices for air transport. Hotel accommodation also recorded a price decrease, as...

Read More »Mark O’Byrne: Silver to Go to $150 and Beyond!

To subscribe to our newsletter and get notified of new shows, please visit http://palisaderadio.com Tom welcomes a new guest to the show Mark O'Byrne who is Research Director and founder of GoldCore, a Bullion dealer based out of Ireland. They provide services and bullion sales around the world, with vaults in Singapore and Switzerland. Mark discusses his outlook for the precious metals markets and what lead him to start a bullion business. He outlines the differences between bail-outs and...

Read More »FINMA eröffnet Anhörung zur Teilrevision des Rundschreibens “Liquiditätsrisiken Banken”

Der Bundesrat hat im November 2019 die Einführung der Finanzierungsquote für Banken (Net Stable Funding Ratio, NSFR) beschlossen. Dies macht kleine Anpassungen des FINMA-Rundschreibens „Liquiditätsrisiken – Banken“ notwendig. Dazu eröffnet die FINMA eine Anhörung, die bis am 13. Juli 2020 läuft. Der Bundesrat hat im November 2019 beschlossen, die Finanzierungsquote für Banken (Net Stable Funding Ratio, NSFR) auf Mitte 2021 einzuführen und die Liquiditätsverordnung...

Read More » SNB & CHF

SNB & CHF