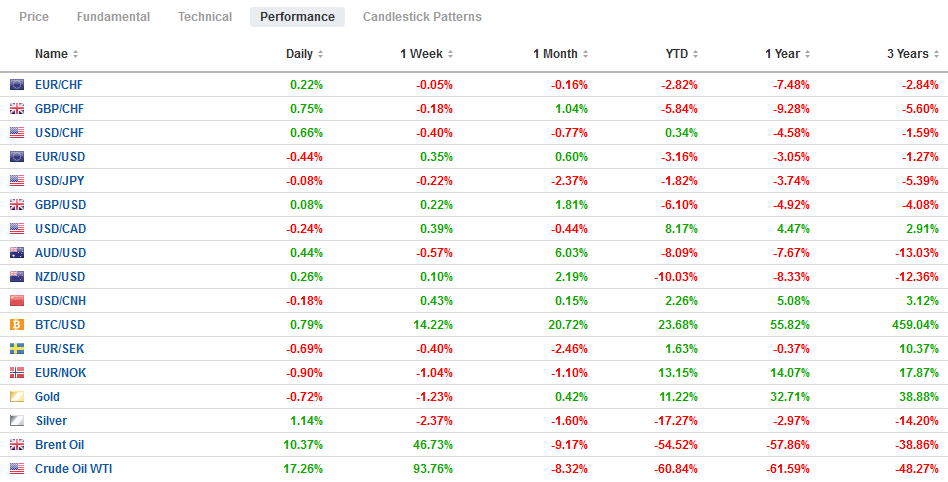

Swiss Franc The Euro has risen by 0.11% to 1.0535 EUR/CHF and USD/CHF, May 05(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The S&P 500 recovered yesterday after dipping trading below the 20-day moving average for the first time in a month. The key area is the gap between the April 30 low (~2892.5) and the May 1 high (~2869). Oil reversed higher as well. June crude was off nearly 9% in the US morning and closed 7% higher on the day and above for the first time since April 21, the day of negative oil prices. Equities are advancing further today, and oil is extending its gain. Japan, China, and South Korea markets were closed, but other bourses in the region advanced. Thailand was a notable exception.

Topics:

Marc Chandler considers the following as important: 4.) Marc to Market, 4) FX Trends, Currency Movement, Featured, Germany, Mexico, newsletter, RBA, USD

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Swiss FrancThe Euro has risen by 0.11% to 1.0535 |

EUR/CHF and USD/CHF, May 05(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

FX RatesOverview: The S&P 500 recovered yesterday after dipping trading below the 20-day moving average for the first time in a month. The key area is the gap between the April 30 low (~2892.5) and the May 1 high (~2869). Oil reversed higher as well. June crude was off nearly 9% in the US morning and closed 7% higher on the day and above $21 for the first time since April 21, the day of negative oil prices. Equities are advancing further today, and oil is extending its gain. Japan, China, and South Korea markets were closed, but other bourses in the region advanced. Thailand was a notable exception. Europe’s Dow Jones Stoxx 600 is snapping a three-day decline, and US stocks are also firmer and poised to extend yesterday’s gain. With oil and equities moving higher, bonds have lost some appeal. The German high court ruling raised questions over the ECB’s asset purchases program, and this weighed on peripheral yields, especially Italy, and triggered sales of the euro, which fell to around $1.0825 after poking above $1.10 at the end of last week. The dollar is mixed, but with the euro and Swiss franc underperforming. while the JP Morgan Emerging Market Currency Index was steady to higher after rising yesterday. The dollar-bloc currencies and Norwegian krone caught a bid in the European morning. Gold continues to straddle the $1700 level, while June WTI is higher for a fifth session and above its 20-day moving average (~$21.10) for the first time since mid-April. |

FX Performance, May 5 |

Asia Pacific

As widely expected, the Reserve Bank of Australia left its cash rate at 25 bp and indicated it was prepared to boost its bond-buying program is necessary. As markets have calmed, it has reduced its purchases. The RBA will update its quarterly forecasts at the end of the week. Broadly, the RBA expects the economy to contract by 10% in H1 and begin recovering and contract 6% for the year before rebounding 6% next year. Operationally, the RBA announced it was broadening the pool of securities that can be used as collateral for its operations. It plans on including investment-grade non-bank paper, and this may help reduce some money market spreads. Australia reported that it lost 7.5% of its jobs in mid-March to mid-April and that total wages paid fell by 8.2%. Meanwhile, the services and composite PMI readings were shaved from the preliminary April estimates.

Hong Kong reported a 5.3% contraction in Q1 20 from the end of last year. It was the fourth consecutive quarterly contraction. From a year ago, it contracted 8.9%. The median forecast in the Bloomberg survey was for 6.5% contraction. The relative strength of the Hong Kong dollar, which has triggered intervention last month, is a function of interest rate arbitrage rather than a vote of confidence in the local economy. With high confidence that the currency peg holds, the short-term interest rate differential is near the widest in 20-years.

Coming into today, the US dollar has risen against the yen in one of the past nine sessions. The dollar is slightly firmer in the European morning but in a narrow range between JPY106.50 and JPY106.85. The greenback continues to build a base in the JPY106.40-JPY106.60 area, while the top end of the range is around JPY107.50-JPY107.60. The Australian dollar bounced off its 20-day moving average (~$0.6375) yesterday and extended its recovery to about $0.6460 today before running out of steam. Initial support is seen near $0.6415. With the onshore market closed, the offshore yuan is retracing some of the pre-weekend losses ostensibly fueled by US threats to retaliate over the virus. The dollar is trading near CNH7.1230 after hitting a high yesterday near CNH7.1560.

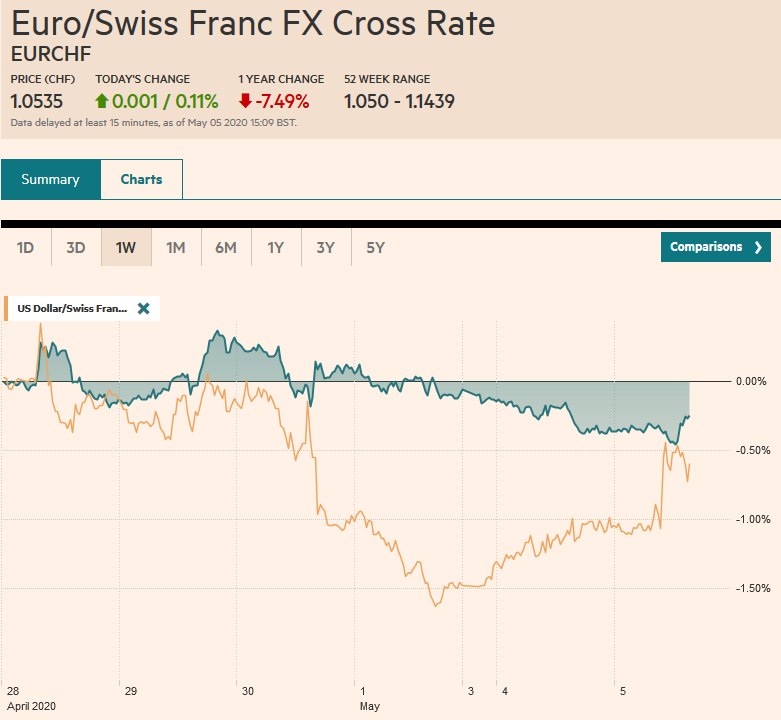

EuropeGermany’s Constitutional Court gave the ECB three months to demonstrate that its bond purchases were necessary, or the Bundesbank would no longer be able to participate in the asset purchase program. At issue was the purchases program before the Pandemic Emergency Purchase Program (750 bln euros). The 7-1 ruling appears to require the ECB to justify that is purchases are a “proportionate” response. |

Eurozone Producer Price Index (PPI) YoY, March 2020(see more posts on Eurozone Producer Price Index, ) Source: investing.com - Click to enlarge |

| It also said that the Bundesbank must ensure that the bonds it already purchased can be sold as part of the Eurosystem strategy. It was explicit about two other controversial issues. First, the ruling does not concern the emergency purchases since the virus. Second, the purchases themselves do not violate the prohibition against monetary financing deficits. It does not seem like an insurmountable hurdle but will require a response by the ECB. |

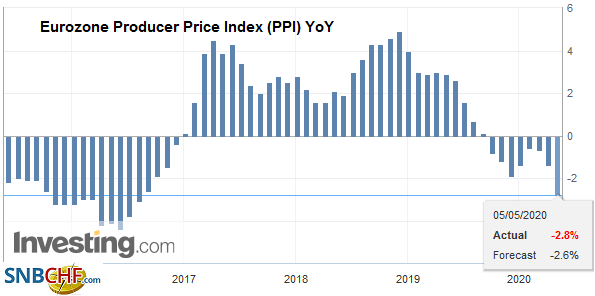

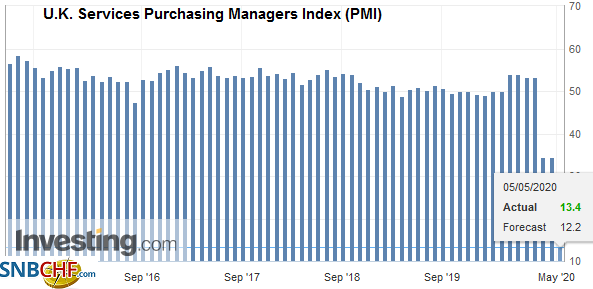

U.K. Services Purchasing Managers Index (PMI), April 2020(see more posts on U.K. Services PMI, ) Source: investing.com - Click to enlarge |

Sweden has responded to the virus differently than most other countries and did not have a nationwide lockdown, though other forms of social distancing were practiced. The economic consequences were clear. The economy has fared better than most. Sweden reported Q1 GDP contracted by 0.3%. The median forecast was for a 1% decline. Nevertheless, Q2 GDP is expected to fare considerably worse. Sweden’s National Institute of Economic Research expects output to decline by 7% this year.

The euro fell from around $1.09 to about $1.0825 on the German court decision. There is an expiring option for a little more than 600 mln euros struck at $1.08. Initial resistance is now pegged in the $1.0850-$1.0870 area. Sterling is trading inside yesterday’s range. It has been confined to about a 30 pip range on either side of $1.2450. There is an option for almost GBP275 mln at $1.2470. Separately, Switzerland reported a deepening of deflationary pressure (April CPI -1.0% year-over-year, on an EU harmonized basis from -0.4% in March). The euro is has been sold back toward CHF1.05, where it based last month with the help of large SNB intervention.

America

The US Treasury is looking to borrow around $3 trillion in the current quarter. It borrowed $1.28 bln for the entire last year and $477 bln in Q1. The massive borrowing is expected to be followed by another $677 bln in Q3. Tomorrow’s refunding announcement is expected to reflect the increased needs by incremental increases of each note and bond auction coupled with the reintroduction of a 20-year issue.

US data today includes the March trade balance, which could impact expectations for Q1 GDP revisions, and the final April PMI for services and the composite reading, and the non-manufacturing ISM. The main focus this week is on the jobs report. Tomorrow’s ADP private-sector estimate will give a sense of what to expect with the national report at the end of the week. Fed officials Bostic, Bullard, and Evans speak today. Canada will also report March trade figures, and a larger deficit is expected.

Contrary to expectations that loss of jobs in the US would disrupt the worker remittances into Mexico, which are one of the three top sources of hard currency (the other two being oil and tourism), remittances jumped 36% in March to a record high of a little more than $4 bln. Consider that the average remittance is about $378, according to the central bank, up from $320 a year ago. At the end of March, the dollar bought almost 22% more pesos than at the end of Q1 2019.

The US dollar traded at a week and a half high against the Canadian dollar yesterday near CAD1.4150 before settling near CAD1.4080 as the recovery in equities took the bid from the greenback. The US dollar eased to CAD1.4030 before bouncing back to almost CAD1.4100 in the European morning. Still, there is potential toward CAD1.4000 today.The US dollar posted an outside down day against the Mexican peso by trading on both sides of the pre-weekend range and settling below the previous day’s low. There has been follow-through dollar selling today that has pushed the greenback toward MXN23.89. Last week’s low was set near MXN23.6450, and that is the next target. Below there is the April low near MXN23.2460.

Tags: #USD,Currency Movement,Featured,Germany,Mexico,newsletter,RBA