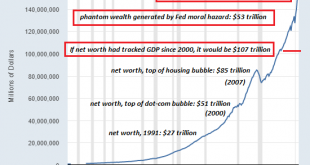

If the Fed set out to destroy the financial system, they’re very close to finishing the job. If you set out to destroy markets and the financial system, your most important weapon is moral hazard, the disconnection of risk and consequence. You disconnect risk from consequence by rewarding those making the riskiest bets and bailing out gamblers whose bets went bad. You reward those making the riskiest bets by pushing markets higher regardless of any other factors....

Read More »The Long Rehabilitation of Frank Fetter

Abstract: Economics has long history of “rehabilitations,” including W.H. Hutt’s rehabilitation of Say’s law, and Alfred Marshall’s attempt to rehabilitate David Ricardo. The rehabilitation of Frank A. Fetter should be as important as either of these, especially for economists working in the contemporary Austrian tradition. The historical records reveal that for the last century there has been underway a nearly unbroken series of efforts, especially by Austrian...

Read More »Bitcoin Lightning Tips auf Twitter jetzt auch für Android verfügbar

Die Social Media Plattform Twitter hat ihr Bitcoin Projekt ausgeweitet. Bisher war das sogenannte Bitcoin Lightning Tips Feature nur über iOS verfügbar – es wurde vor wenigen Monaten gelaunched. Doch nun wurde es auch für Android freigeschaltet. Bitcoin News: Bitcoin Lightning Tips auf Twitter jetzt auch für Android verfügbar Das Feature nutzt Jack Maller’s Strike Lightning Wallet auf der Social Media Plattform seit September 2021. Doch Twitter CEO Jack Dorsey gilt...

Read More »How the bubble house movement took hold in Switzerland

Futuristic architecture sketches from Pascal Häusermann, 1970. Competition in Cannes, private urban atmosphere. Collection Frac Centre-Val de Loire / Donation Pascal Häusermann Swiss architects were swept up in the movement to build bubble houses out of concrete and plastic in the 1960s. While the bubble movement burst decades ago, many of the original structures are still standing to this day. Need more space? Why not just build an extra room on the side of your...

Read More »Swiss franc highest against Euro since July 2015

© Skovalsky | Dreamstime.com On 19 November 2021, the Euro went below 1.05 Swiss francs, the lowest it has been since July 2015. The Swiss franc is viewed as a safe haven currency and tends to rise when markets are bearish. However, this week the shift in exchange rate may have had more to do with the situation in Euro zone than a shift to safety. The Euro has recently weakened against a number of currencies including the Yen, US dollar and Pound. Currency traders...

Read More »Inflation Or Deflation??? I Agree With Jeff Snider

With everyone screaming inflation, the U.S. Treasuries are telling us inflation is not happening Macrovoices https://youtu.be/DfjDzlD5HQE Karissa Jolene Taylor https://youtu.be/tK9RB-_t1ys uneducatedeconomist.com [email protected] real mail P.O. 731 Astoria , OR 97103 Instagram uneducated.economist patreon https://www.patreon.com/UneducatedEconomist Want to buy me a coffee https://www.paypal.me/meatbingo where the money goes...

Read More »Jeff Snider: Inflation Vs Deflation. Part 2

?? Please Support the Channel & Subscribe here for more: http://www.youtube.com/channel/UCZIFOCfVxLJexAKnSb2TWXg?sub_confirmation=1 Jeff Snider: Inflation Vs Deflation. Part 2 As the reflation trades cools down and the economic data begins to roll over, Jeff Snider, head of global research at Alhambra Investments, anticipates an ugly, near-term outcome for growth. In this conversation he explains how bonds and financial conditions have been signaling a return to the environment of...

Read More »Covid Surge Compounds Monetary Divergence to give the Euro its Biggest Weekly Loss in Five Months

Strong US consumption and production figures kept the greenback well supported last week on the heels of the jump in CPI to 6.2%. Meanwhile, the surge of Covid cases in Europe underscores the divergences with the US, sending the euro to new lows for the year. At the same time, oil prices headed south for the fourth consecutive week, matching the longest decline in more than two years. It did not favor the Norwegian krone, the weakest of the majors, with a 2.15%...

Read More »How the pandemic has widened inequalities in Swiss watchmaking

Audemars Piguet is one of four independent brands that dominate the global luxury watch market. Thomas Kern Driven by strong Chinese demand, Swiss watchmaking is recovering after suffering one of its biggest economic shocks in 2020. But the crisis has further widened the gap between the few brands that take the lion’s share of the profits and the rest of the industry. My specialty is telling stories, and decoding what happens in Switzerland and the world from...

Read More »Is Price Stability Really a Good Thing?

One of the mandates of the Federal Reserve System is to attain price stability. It is held that price stability is the key as far as economic stability is concerned. What is it all about? The idea of price stability originates from the view that volatile changes in the price level prevent individuals from seeing market signals as conveyed by changes in the relative prices of goods and services. For instance, because of an increase in the demand for apples, the prices...

Read More » SNB & CHF

SNB & CHF