If the Fed set out to destroy the financial system, they’re very close to finishing the job. If you set out to destroy markets and the financial system, your most important weapon is moral hazard, the disconnection of risk and consequence. You disconnect risk from consequence by rewarding those making the riskiest bets and bailing out gamblers whose bets went bad. You reward those making the riskiest bets by pushing markets higher regardless of any other factors. Nothing matters except your support of ever higher markets. This implicit guarantee that any bet on markets lofting higher will be a winning gamble rewards those making the riskiest bets. The punters who played small with cash made a few bucks, but the punters who borrowed heavily and then leveraged

Topics:

Charles Hugh Smith considers the following as important: 5.) Charles Hugh Smith, 5) Global Macro, Featured, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

|

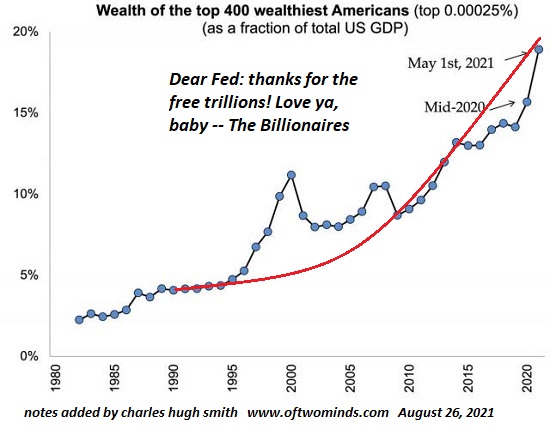

If the Fed set out to destroy the financial system, they’re very close to finishing the job. If you set out to destroy markets and the financial system, your most important weapon is moral hazard, the disconnection of risk and consequence. You disconnect risk from consequence by rewarding those making the riskiest bets and bailing out gamblers whose bets went bad. You reward those making the riskiest bets by pushing markets higher regardless of any other factors. Nothing matters except your support of ever higher markets. This implicit guarantee that any bet on markets lofting higher will be a winning gamble rewards those making the riskiest bets. The punters who played small with cash made a few bucks, but the punters who borrowed heavily and then leveraged those bets to the hilt made a killing. In other words, moral hazard incentivizes maximizing debt and leverage to increase the risk and size of bets because every bet is a can’t-lose proposition. The hesitant, the cautious, the prudent, those who hedge their riskiest bets, are all left in the dust. Anyone who doesn’t max out borrowing and leverage is a loser. |

|

| By pushing markets ever higher, you bail out every participant. To make up any losses, all the punters have to do is increase the size and risk of their next bet.

To make sure everyone is properly incentivized and assured, you bail out the biggest gamblers should they somehow lose. You do this by offering them unlimited lines of credit (so they can leverage up their next bet and and win back their losses), you eliminate transparency in market pricing to mask their losses (eliminate mark-to-market requirements, etc.) and you overlook fraud, racketeering, price-fixing, collusion and embezzlement because all these activities serve to increase risk-taking and delegitimize markets. The biggest gamblers know they can literally do anything and get away with it, and so they do literally everything that undermines markets and trust: there’s no limits on fraud, racketeering, price-fixing, collusion and embezzlement, those conjuring up the most creative frauds and scams are the most richly rewarded. The Moral Hazard Monster will now completely destroy markets and the financial system, just as you intended. Every participant will continue pyramiding debt, leverage and risk because they know you’ll keep markets lofting higher regardless of any other condition: they will follow “flows” (i.e., what other punters are buying at the moment) and ride those flows higher, fully confident that you will never ever let markets decline by more than signal-noise dips that offer punters a fresh opportunity to leverage up another bet on higher markets next week and next month. |

|

| Your plan is clever because the punters are all so focused on maximizing their own gains they don’t notice that the debt, leverage and risk now dwarf everything else. Having guaranteed that the riskiest, most leveraged bets will be the biggest winners, debt and leverage have exploded higher. The entire financial system is now dependent on the riskiest, most leveraged bets continuing to pay out even as they dwarf the rest of the financial system.

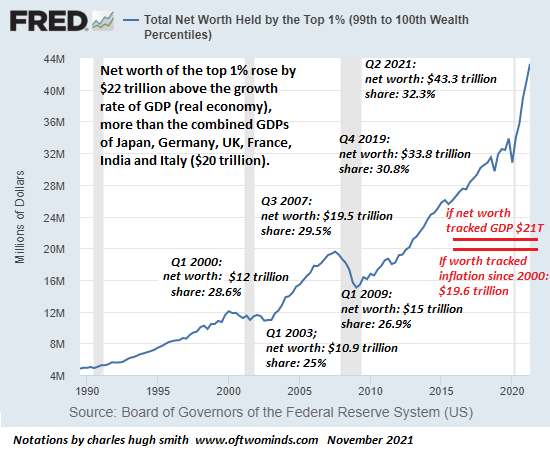

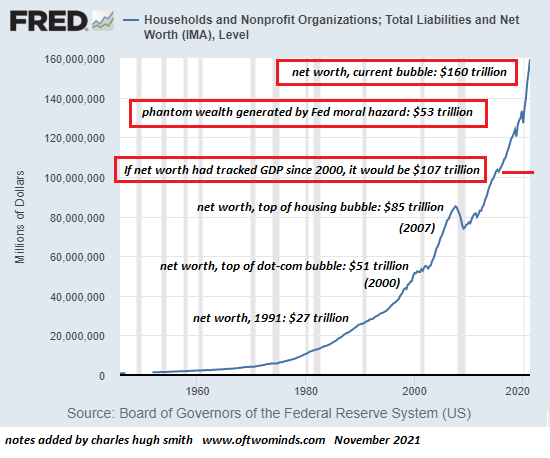

Your plan depends on the mispricing of risk: by implicitly guaranteeing every punter betting on a higher market next week or month will be a winner, you’ve reduced apparent risk to near-zero. What’s the risk if everyone knows markets will loft higher regardless? There is no risk, so forget about it; hedging risk just reduces your net profits. But since risk isn’t extinguished, it’s only transferred, the question becomes: where did all the risk end up? Answer: in the financial system itself. All the risks piling up as trillions of dollars are leveraged into ever larger can’t-lose bets have not evaporated, they’ve been transferred to the financial system. So when risk exceeds the carrying capacity of the system, it will be the system which implodes, not just punters’ riskiest, most highly leveraged bets. Here is a chart of household net worth over the past 70+ years. (Yes, it included nonprofit organizations, which make up a modest percentage of the total.) Note the three bubbles inflated by Federal Reserve policies: the dot-com bubble in 2000, the housing bubble in 2007 and now the Everything Bubble in 2021. If net worth had tracked GDP growth since the peak of the dot-com bubble in 2000, it would be about $107 trillion–$53 trillion below current bubblicious levels. This can be understood as $53 trillion in phantom wealth generated by leveraging up the Federal Reserve’s $8 trillion expansion of its balance sheet since 2008 seven-fold. This highly leveraged phantom wealth will evaporate once the system can no longer contain all the risk that’s been piled up by the Fed’s Moral Hazard Monster. |

|

| Once $50+ trillion of phantom collateral evaporates, the entire pyramid of debt and leverage will collapse, destroying the entire financial system.

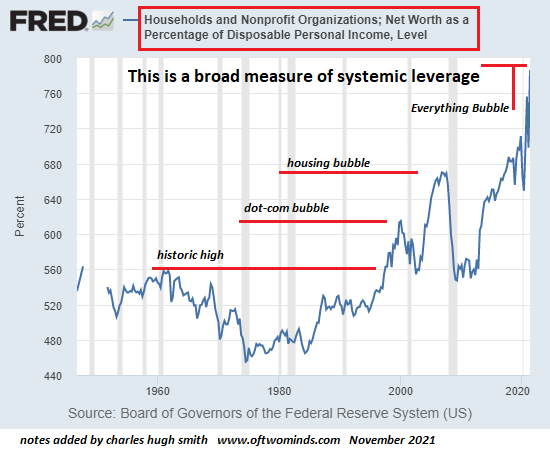

One broad measure of the leverage that’s been piled up in the Fed’s moral hazard free-for-all is net worth relative to disposable personal income which is the ultimate collateral for the financial system, as all debt service and consumption is paid out of income. Note the vast expansion of leverage in each bubble. Leverage in the Everything Bubble has blown past every previous extreme. If the Fed set out to destroy the financial system, they’re very close to finishing the job. Their Moral Hazard Monster is about to lay waste to phantom collateral and everything that’s been borrowed and leveraged against that phantom collateral. Thanks to the Fed’s Moral Hazard Monster, debt, leverage and risk now far exceed what the system can support. Predicting the bottom is difficult when the system collapses. Historically, a return to 400% of disposable personal income would be a reasonable guess. If disposable income craters, net worth will adjust accordingly. |

|

Tags: Featured,newsletter