It’s gotten to the point that pretty much everyone is now aware of the risks. Public surveys, market behavior, on and on, hardly anyone outside politics thinks the economy is in a good place. Gasoline, sentiment, whatever, Euro$ #5 in total is much more than what’s shaping up inside the American boundary. Globally synchronized of which the US is proving to be a close part. The destination, or depth, really, is what’s left to argue. As noted yesterday, even President...

Read More »Does an Increase in Demand Cause Economic Growth? How Keynesians Reverse the Roles of Demand and Supply

According to John Maynard Keynes: The ideas of economists and political philosophers, both when they are right and when they are wrong, are more powerful than is commonly understood. Indeed, the world is ruled by little else. Practical men, who believe themselves to be quite exempt from any intellectual influence, are usually the slaves of some defunct economist. Madmen in authority, who hear voices in the air, are distilling their frenzy from some academic scribbler...

Read More »Who’s Going to Fix What’s Broken?

When nobody cares that systems have broken down and there is no will or interest in fixing essential systems, there is no happy ending. Who fixes systems when they break down? The answer appears to be: nobody. Here are three everyday examples from my own life, breakdowns which may be random and rare but which the odds suggest are systemic. Let’s assume I’m not an unlucky one in a million but just another recipient of systemic breakdown. 1. U.S. Mail forwarding six...

Read More »Inflation outlook – A battle lost before it started

After months of consumer price increases and after countless working households found themselves in dire financial straits struggling to make ends meet, in the late May, President Biden finally revealed his grand plan to fight inflation in an op-ed for the Wall Street Journal. The much-anticipated response to the cost of living crisis that has been ravaging the nation sadly did not contain the silver bullet that so many Americans were hoping for. Instead, it...

Read More »Moderating Labor Market is what the Fed Wants

Overview: For the large rally in US stocks yesterday and the sell-off in the dollar, US rates were surprisingly little changed. This set the tone for today’s action, ahead of the US employment data. Asia Pacific equities moved higher and Europe’s Stoxx 600 has edged up to extend yesterday’s rise. The 10-year US Treasury yield is little changed, hovering around 2.91%. European benchmark yields are 1-3 bp higher. The greenback has stabilized after yesterday’s fall. The...

Read More »Swiss set aside CHF100 million in Ukraine development funding

The Ukrainian funds available to the Swiss Agency for Development and Cooperation (SDC) for 2022 will not affect projects elsewhere, an official said on Thursday. Before the Russian invasion in February, the SDC had earmarked CHF25 million ($26 million) for development and cooperation projects in Ukraine; parliament has since boosted this by CHF61 million, SDC director Patricia Danzi said on Thursday. On top of this, various other ministries have sent development...

Read More »Monetary Metals CEO Keith Weiner Interviewed on RealVision

CEO of Monetary Metals Keith Weiner sat down with Michael Green of RealVision to discuss how Monetary Metals increases gold’s value proposition by paying interest on gold and silver holdings and the inevitable debasement of fiat currencies. Keith and Mike discuss the inherent volatility of Bitcoin, Costco’s ability to maintain its price point, and the colossal meltdown of the Terra stablecoin. In addition to exploring all things gold, Keith and Mike get into the...

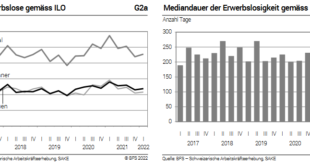

Read More »Switzerland Unemployment in 1st quarter 2022: number of employed persons rises by 1.7 percent, unemployment rate based on ILO definition falls to 4.6%

02.06.2022 – In the first quarter of 2022, the number of employed persons in Switzerland increased by 1.7% compared with the same quarter of 2021 and the number of actual hours worked per week, per employed person, rose by 2.8%. During the same period, the unemployment rate as defined by the International Labour Organisation (ILO) fell from 5.8% to 4.6% in Switzerland and from 7.8% to 6.5% in the EU. These are some of the results of the Swiss Labour Force Survey...

Read More »The German Rejection of Classical Economics

1. The German Rejection of Classical Economics The hostility that the teachings of Classical economic theory encountered on the European continent was primarily caused by political prepossessions. Political economy as developed by several generations of English thinkers, brilliantly expounded by Hume and Adam Smith and perfected by Ricardo, was the most exquisite outcome of the philosophy of the Enlightenment. It was the gist of the liberal doctrine that aimed at the...

Read More »Can’t Blame COVID For This One

Late in March 2021, then-German Chancellor Angela Merkel announced a reverse. Several weeks before that time, Merkel’s federal government had reached an agreement with the various states to begin opening the country back up, easing more modest restrictions to move daily life closer to normal. But with case counts sharply rising once more, the whole thing was going to get shutdown instead. The government declared a holiday starting April 1 (no fooling) last year,...

Read More » SNB & CHF

SNB & CHF