The electricity prices reflect the supply and demand conditions in Europe and interfering with the price formation mechanism would have dangerous consequences. Since the end of 2021, we have witnessed unprecedented price levels in the European electricity markets, with an increase in electricity prices by 200% within less than a year. This tense market situation was further perpetuated by geopolitical events, namely the Russian invasion of Ukraine, impacting gas flows to Europe. Energy prices, especially retail prices, are an extremely sensitive political issue. High energy prices affect countries differently, leading to disagreements between EU Member States on how to respond to the price crisis. While the EU Commission, along with some Member States, defend

Topics:

Arnold Weiss considers the following as important: 6b.) Austrian center, 6b) Austrian Economics, economy, Energy, Featured, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

The electricity prices reflect the supply and demand conditions in Europe and interfering with the price formation mechanism would have dangerous consequences.

Since the end of 2021, we have witnessed unprecedented price levels in the European electricity markets, with an increase in electricity prices by 200% within less than a year. This tense market situation was further perpetuated by geopolitical events, namely the Russian invasion of Ukraine, impacting gas flows to Europe. Energy prices, especially retail prices, are an extremely sensitive political issue. High energy prices affect countries differently, leading to disagreements between EU Member States on how to respond to the price crisis.

While the EU Commission, along with some Member States, defend the EU Internal Energy Market, others blame the power market design. Recently, market interventions such as electricity price caps have been discussed as a potential way out of the energy price crisis. But is the power market design really to blame?

The market principles of supply and demand – at the centre of the electricity system

Electricity is not a commodity like any other, as it has the particular characteristic that it cannot be stored efficiently. Moreover, the frequency on the electricity grid needs to remain stable at all times, meaning transmission grids must be balanced in real-time between feed-in of produced electricity and consumption. Therefore, the balance of supply and demand is essential for the stability of the electricity system.

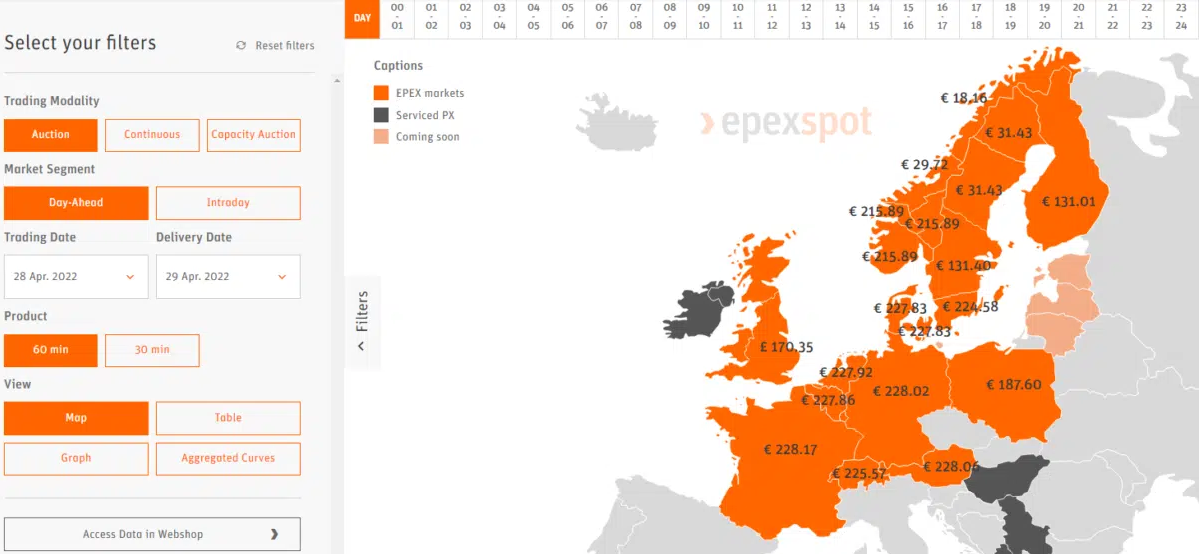

This makes the short-term market an essential tool to balance the system: Unlike the futures market, which is a purely financial market, the short-term market, also referred to as the power spot market, triggers a physical delivery of the electricity traded. Electricity can be traded through an auction for delivery on the next day (Day-Ahead) and last-minute adjustments can be made through continuous trading for delivery on the same day (Intraday). The European Power Exchange EPEX SPOT operates such power spot markets in 13 countries.

Flows follow prices – for the benefit of all EuropeansBy matching the anonymous orders, submitted by its Exchange Members, for selling and buying electricity, EPEX SPOT establishes reference prices for electricity for every hour of every day. These reference prices determine the generation and consumption decisions – what unit is activated, which one is taken off the grid and who consumes when – of the entire sector. Especially the results of the Day-Ahead auction are crucial here, as they are pivotal in determining the electricity flows across the continent. This happens through a mechanism called Market Coupling: All Power Exchanges of the 27 countries involved in the Single Day-Ahead Coupling simultaneously run the calculation through a shared algorithm. This algorithm calculates the supply and demand curves for every country, based on the order-books, and determines the market price at their intersection. During this calculation, the algorithm takes into account all available cross-border capacity between countries and ensures the optimal use of these interconnections. Electricity flows from a lower-priced area to a higher-priced area, as long as cross-border capacities are available. This is called flow-based Market Coupling, which creates annual welfare of EUR 1bn. |

|

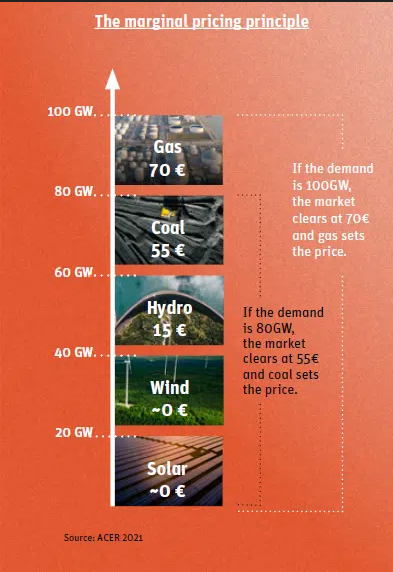

Merit order – the cheapest units are dispatched firstThe underlying principle of the Day-Ahead auction, the merit order, has recently been blamed to cause the electricity price crisis. The production of power plants is put on the market by the order of their marginal production cost, from the least expensive one (i.e. renewables) to the most expensive ones (coal and gas). The marginal cost indicates how much it costs a producer to generate one additional MWh of electricity. According to this principle, the cheapest generation units are activated first to meet the demand, and only when they are fully exploited, the more expensive unit is called upon. At the end of the results calculation of the Day-Ahead auction, all producers are paid the same price. The marginal cost pricing enables all generators to cover their costs at all times while securing supply. In addition, demand is met at the lowest possible price. If renewable production is insufficient, nuclear availability is low, and demand is high, then the gas units will set the price. This is what has been happening over the past months. |

An apparent quick fix could put at risk the energy transition and security of supply

The electricity prices over the past months have been reflecting the supply and demand conditions in Europe. The market design is not to blame for this, it merely renders the situation transparent. Amid pressure to address the energy price crisis, calls to interfere with the price formation mechanism have grown. They might seem like a quick fix, but have dangerous consequences:

A price cap would artificially limit the market price in a country. Since, however, as previously explained, these prices determine the import and export flows, a country that relies on a price cap could continue to export, even though electricity is already scarce, putting at risk the security of supply.

Since all power producers are paid the same price on the power market, others argue that cheap generation units currently make “excessive” profits and that these profits should be redistributed through taxes. Nonetheless, the definition of ‘excessive profits’ does not find a reference in reality. In fact, fixed costs covering the initial investment – typically high for decarbonized generation technologies – have to be recovered. Taxation measures should not disincentivize the investment in renewable energy and flexibility, as this would endanger the energy transition. Redistributions measures can be effective to shield consumers when they are applied ex-post and do not cause distortion in the market – such as targeted lump-sum payments. The so-called EU toolbox, proposed by the Commission to Member States, lists several such measures.

What the electricity prices are telling us today, is that Europeans need to move away from fossil fuels to meet electricity demand. It is the strongest signal for investment into clean technologies and flexibility that we have seen in over a decade. Instead of suppressing this call for a transition through hasty measures that hamper with the market design, policymakers, industrials and citizens should put all their efforts into decarbonizing the energy sector.

Tags: economy,Energy,Featured,newsletter