Our main text for the Rothbard Graduate Seminar this week is Murray Rothbard’s Power and Market: Government and the Economy, which contains a systematic treatment of one area of economic theory, interventionism. This represents a departure from past seminars in an important respect. Earlier seminars focused on texts by Mises or Rothbard that addressed a much broader scope of their thought. Previous seminar texts such as Man, Economy and State and Human Action over...

Read More »Respect the Fed? No, End the Fed

President Joe Biden has unveiled a three-part plan to fight inflation — or at least make people think he is fighting inflation. One part of the plan involves having government agencies “fix” the supply chain problems that have led to shortages of numerous products. Of course, any attempt by the government to solve the supply chain problems (which were caused by prior government interventions such as shutting down the economy for over a year) will not just fail to...

Read More »Switzerland wants to play key role in rebuilding Ukraine

Swiss President Ignazio Cassis at the 51st annual meeting of the World Economic Forum, WEF, in Davos, Switzerland, on May 24, 2022. © Keystone / Laurent Gillieron The Swiss are hosting a major international conference on reconstruction in Ukraine at the beginning of July. The agenda and a participants’ list are currently taking shape. However, it’s unclear how much international enthusiasm this event – and its aims – will garner in the end. International support for...

Read More »Degradation and Nationalization: The Inevitable Ways of Russian Autocratic Economic Policy

As Russian political scientist Gleb Pavlovsky has quite rightly said, one should not consider the five-thousand-plus sanctions imposed against the Russian Federation as of this writing as sanctions in the normal diplomatic and economic sense. They are a conditional “second front,” a blow aimed at dismantling the Russian economy, the Russian social structure, and the institutional framework in response to the corresponding actions of the Russian authorities, with the...

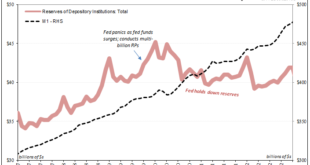

Read More »A Volcker Pan Recession

The Volcker Myth is simple because there isn’t math for it just voodoo economics (to borrow George HW Bush’s phrase). In theory, the FOMC finally realized after more than a decade of currency devastation and its economic, financial, and social consequences, hey, inflation and money. Once Paul Volcker took over in ’79, he acted on the belated realization, seeking to get the Great Inflation under control by restricting, well, something that seems like money. All the...

Read More »The Heat Death of the Economic Universe – Keith Weiner

In physics, the heat death of the universe occurs if all matter is moving apart. If it happens, it will be long after we're gone. But there's a troubling move towards the heat death of the economy. There is a diminishing return on debt. Keith Weiner is the founder and CEO of Monetary Metals, an investment firm that is unlocking the productivity of gold. Become an Ayn Rand Centre UK Member Here! https://AynRandCentre.co.uk/become-a- Check Out Our Playlists!...

Read More »Vol. 5 The Bellringer – The Post-Election Economy – Stacey Mankoff & Marc Chandler

Vol. 5 The Bellringer - Conversations with Thought Leaders - The Post-Election Economy - Stacey Mankoff & Marc Chandler

Read More »Auch Luna-Neustart gescheitert

Ob das Luna (Terra)-Projekt noch gerettet werden kann, steht in den Sternen. Nachdem der ursprüngliche Cryptocoin bereits abstürzte, ist jetzt auch der Relaunch gescheitert – zumindest vorerst. Crypto News: Auch Luna-Neustart gescheitertDer Kopf von Terra, Do Kwon, ist vielen dadurch bekannt geworden, dass sein Projekt einen historischen Absturz erlebte. Im Mai dieses Jahres verlor Terra innerhalb von ungefähr 5 Tagen seinen Wert vollständig. Von fast 100 US-Dollar...

Read More »Sustainable investments boom in Switzerland

The most important sustainable themes in 2021 were energy, social concerns and environmental issues. Keystone / Laurent Gillieron The volume of sustainable investments in Switzerland increased by almost a third last year, reaching an all-time high of CHF1.98 trillion ($2 trillion). This continuing growth – the rate is almost the same as last year – is mainly due to the increased use of sustainable investment approaches and the overall positive market development in...

Read More »Joe Biden’s Economic Plan Editorial in the WSJ [Eurodollar University, Ep. 244]

US President Joe Biden has a three-step plan to address the vulnerable US economy. We agree the economy is vulnerable but note that it is not for the reasons the president believes. Also, we note similarities between President Xi Jingping's 2017 messaging and Biden's 2022 narrative. ----EP. 244 REFERENCES---- Joe Biden: My Plan for Fighting Inflation: https://on.wsj.com/3MpUAcT President Phillips Emerges To Reassure On Growing Slowdown: https://bit.ly/3Nuslej Alhambra Investments Blog:...

Read More » SNB & CHF

SNB & CHF