I. Introduction Remember the quaint old days of 2019? We were told the US economy was in great shape. Inflation was low, jobs were plentiful, GDP was growing. And frankly, if covid had not come along, there is a pretty good chance Donald Trump would have been reelected. At an event in 2019, my friend and economist Dr. Bob Murphy said something very interesting about the political schism in this country. He said: If you think America is divided now, what would things...

Read More »More from SNB’s Jordan: No comment on currency invention. We don’t rule anything out

Looks at series of models to gauge Swiss francs value; market has to live with some volatility no comment on currency intervention. We don’t rule anything out monetary policy cannot influence explosion and prices in case of a severe shortage the longer inflation last, the greater the risk of a 2nd round of facts having a negative impact central banks need to watch out that fiscal policy does not dictate monetary policy Meanwhile SNB’s Maechler is now joining in...

Read More »SNB’s Jordan: We must ensure price stability over medium-term

SNB’s Jordan is on the wires after the ECB hike rates by 75 basis points today: ECB 75 basis point rate hike not fully surprising We must ensure price stability over medium-term Gas or power stoppages would have devastating impact on economy’s Exchange rates play a role in inflation , when big central banks act this helps us You should not be surprised that SNB acts independently It is positive for SNB of major central banks normalize It would not create difficulty...

Read More »Social security

© Keystone / Gaetan Bally Switzerland has a social security network that covers risks in many areas – work, health, family and old age. The Swiss social security system cannot be easily compared with that found in other countries, as it comprises a variety of insurance schemes with very different mechanisms. Its funding is characterised by a relatively low use of tax revenues, a focus on individual pension plans, and the influence of private institutions....

Read More »Does Reducing Unemployment through Government Spending Boost the Economy?

Some experts hold that the key to economic growth is to strengthen the labor market, which is based on the view that because of the reduction in the number of unemployed workers, more individuals can afford to increase spending. As a result, economic growth follows suit. The Expanding Pool of Savings—Not Declining Unemployment—Is the Key for Economic Growth However, the key driver of economic growth is an expanding pool of savings, not the state of the labor market....

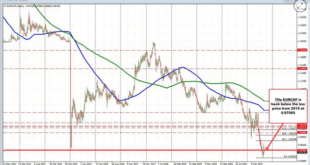

Read More »FX intervention watch – Swiss National Bank edition – too early for the CHF

This via the folks at eFX. Credit Agricole CIB Research argues that it would be premature for the SNB to resume its intervention against CHF strength around current levels. “We note that the wild fluctuations of global bonds, stocks and exchange rates may make it more difficult for market participants to find a “concrete indication” of FX intervention from the data,” CACIB notes. “We further think that following the hawkish shift of its policy outlook in June, it...

Read More »Twitter Spaces: Gold, Silver, and Energy with Vince Lanci, Tom Luongo, Keith Weiner, Bob & Jim

This is a recording of a live Twitter Spaces event from September 7, 2022. This first part features Vince Lanci and Tom Luongo discussing politics, energy, and the metals markets. Keith Weiner explains how gold could be successfully remonetized and his thesis regarding metals manipulation. In Part Two coming out soon we take listener questions and Bob Coleman goes indepth into silver and the metals manipulation. Vincent Lanci Twitter: https://twitter.com/VlanciPictures Website:...

Read More »Energiekrise bremst Crypto Mining aus

In Deutschland ist das Crypto Mining ohnehin wenig profitabel. Doch durch den explosionsartigen Anstieg der Energiekosten in den letzten Wochen kam es weltweit zu großen Verschiebungen des Mining-Marktes. Crypto News: Energiekrise bremst Crypto Mining ausErst im letzten Jahr erlebten Crypto Miner mit dem Verbot des Minings in China eine intensive Herausforderung. In vielen chinesischen Provinzen wurde das Crypto Mining komplett verboten, so dass China als der...

Read More »The World Don’t Care If US Is Broke Jeff Snider | US Dollar Stronger Than Ever

The World Don't Care If US Is Broke Jeff Snider | US Dollar Stronger Than Ever. #jeffsnider #treasurybills#economy#useconomy credit: Emil Kalinowski https://www.youtube.com/watch?v=yV4zI2IXC-A Jeff: https://twitter.com/JeffSnider_AIP Jeff: https://www.eurodollar.university/ Emil: https://twitter.com/EmilKalinowski Emil: https://www.EuroDollarEnterprises.com David: https://DavidParkins.com/ Terence: https://www.VisualFocusMedia.com ELFL: https://www.epidemicsound.com/artists......

Read More »Throwing the Fed’s Machinery in Reverse: Fed Interest Rate Policies Continue to Damage the Economy

According to Federal Reserve minutes from last month, Fed officials expressed a willingness to push ahead with a tight interest rate stance to eradicate the inflationary menace. For most commentators, inflation is seen as a general increase in the prices of goods and services, so raising interest rates will soften the increase in prices. The logic here is that a tighter interest rate stance will weaken the demand for goods and services and bring the overall demand in...

Read More » SNB & CHF

SNB & CHF