One of the biggest reasons for people deciding to buy gold bars or to own silver coins is because of the folly of central banks and government. It seems bizarre to most people that we are all aware that money doesn’t grow on trees and yet those responsible for financial stability have forgotten this basic life-lesson. But, what has felt even more bizarre (and maddening) is for how long this foolishness has been allowed to continue. Well, it seems this won’t be the...

Read More »This Is Why the Yield Curve Just Inverted, Signaling a Coming Recession

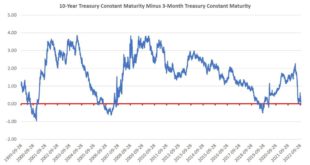

In recent decades, every instance in which the economy contracted two quarters in a row has coincided with a recession. Nonetheless, the Biden Administration and the leadership at the Federal Reserve insist there is no recession now, nor is one even in the works. On the other hand, declining GDP growth, rising credit card debt, disappearing savings, and falling disposable income all point to recession. And now one of the most closely watched recession indicators is...

Read More »Has the world avoided what looked to be a dollar/recession disaster? Not at all by these accounts.

For three weeks, even the mainstream media had to report on Switzerland and its US$ auctions. Then, abruptly, all that fuss just disappeared when the bidders did. Does this mean crisis averted? Not if history is any guide. The similarities between now and May 2010 are eerie - right down to the dollar swap issue, the financial instability, a foiled recovery, and eventually the QE restart. Eurodollar University's Money & Macro Analysis Twitter: https://twitter.com/JeffSnider_AIP...

Read More »Bill Bonner’s “4th and Final Prediction”

Get Bill Bonner's research here: https://secure.sjuggerudtruewealth.com/?cid=MKT650099&eid=MKT686796 Bill Bonner built one of the largest financial research firms in the world. Along with that he has made 3 major financial predictions in his 50+ year career that all came true, and he expects his 4th and final predication will too. The same old stock market investments and stock recommendations won't cut it anymore. That's why Bill Bonner is coming forward with his detailed analysis...

Read More »Fatal Conceits – Bill Bonner on the End of the Age of Abundance

In Ep #74 of the Fatal Conceits Podcast, Agora Founder Bill Bonner shared with us his thoughts on the end of the Age of Abundance, the reason our current financial predicament differs greatly from what Volcker faced in the ‘70s (Hint: It begins with D and rhymes with “regret”) and why those born after 1980 cannot know, first hand, what a return to the “Old Normal” will entail… Full Transcript at BonnerPrivateResearch.Substack.com...

Read More »Honest Money in Dishonest Hands

For those who would find relief knowing the Bible sanctions a market-derived medium of exchange, Gary North’s Honest Money will come as a godsend (no pun intended). Even for those reprobates who forswear a religious worldview, his book will provide a solid grounding in monetary theory and history. North’s vast understanding of money and banking coupled with his lean, no-jargon writing style takes the labor out of reading. His narrative carries us on a journey from...

Read More »Credit Suisse cuts thousands of jobs to restore fortunes

Credit Suisse is attempting to recover from a catastrophic sequence of business reversals and scandals. © Keystone / Walter Bieri Swiss bank Credit Suisse is shedding thousands of jobs, selling off parts of its business and raising billions in extra capital in a bid to reverse a downward spiral in fortunes. The bank announced on Thursday that it will slim down from a current headcount of 52,000 to 43,000 by the end of 2025. The job cuts will start this year with...

Read More »Turnover in foreign exchange and derivatives markets in Switzerland

BIS Triennial Survey: April 2022 survey The SNB has today published the results of the survey on turnover in foreign exchange and over-the-counter (OTC) derivatives markets in Switzerland. The data reflect the turnover in April 2022 of the banks surveyed. The survey is part of a global survey coordinated by the Bank for International Settlements (BIS) on foreign exchange and OTC derivatives trading. It is conducted every three years and in over 50 countries. This is...

Read More »The Cleanest Dirty Shirt

The Cleanest Dirty Shirt It’s easy to overestimate the problems the United States faces while underestimating its strengths. The challenges are certainly significant. Politics have seldom been so divisive. The government is running an annual deficit of over a trillion dollars, with a total debt many times that. Inflation has spiked. The Fed has been hiking interest rates at a pace that could imperil the economy. There is enormous wealth disparity. Economic growth has...

Read More »Ep 45 – Danielle Lacalle: The Case for the People’s Zombification

In this latest installment of our Zombie Month series, we welcome Daniel Lacalle onto the Gold Exchange Podcast. Daniel is an economist, fund manager and professor of Global Economics. Daniel discusses the recent fallout in the UK, the pressures building up in the global economy, and the central banks’ creation of zombie firms. Listen to Ben, Keith and Daniel get into everything from quantitative easing to zombie slaying. Connect with Daniel on twitter @dlacalle and...

Read More » SNB & CHF

SNB & CHF