Den vollständigen Tagesdosis-Text (inkl. ggf. Quellenhinweisen und Links) finden Sie hier: https://apolut.net/die-titanic-analogie-die-sie-noch-nicht-gehoert-haben-von-charles-hugh-smith

Read More »Die “Titanic”-Analogie, die Sie noch nicht gehört haben | Von Charles Hugh Smith

Den vollständigen Tagesdosis-Text (inkl. ggf. Quellenhinweisen und Links) finden Sie hier: https://apolut.net/die-titanic-analogie-die-sie-noch-nicht-gehoert-haben-von-charles-hugh-smith Ein Kommentar von Charles Hugh Smith. Passive Akzeptanz des Verleugnens Ob wir uns dessen bewusst sind oder nicht, wir reagieren mit passiver Akzeptanz des Verleugnens. Sie haben zweifellos gehört, dass die Neuanordnung der Liegestühle auf der Titanic eine Analogie für die...

Read More »Yesterday’s Dollar Recovery Questioned Today

Overview: The 11 bp jump in the 10-year US yield yesterday after dropping nearly 26 bp in the previous three sessions, helped the greenback recover and took a toll on stocks. Still, the S&P 500 is above the low set on November 30 (~3939) before Fed Chair Powell’s talk that day. Global equities were dragged lower today. Most large bourses in the Asia Pacific region fell, including Hong Kong’s Hang Seng and the index of mainland companies that trade in Hong Kong....

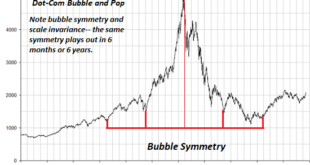

Read More »The Bubble Economy’s Credit-Asset Death Spiral

Who believed that central banks’ financial perpetual motion machine was anything more than trickery designed to generate phantom wealth? Central banks seem to have perfected the ideal financial perpetual motion machine: as credit expands, money pours into risk assets, which shoot higher under the pressure of expanding demand for assets that yield either hefty returns (junk bonds) or hefty capital gains as the soaring assets suck in more capital chasing returns. As...

Read More »“Classical Liberalism” Will Never Satisfy the Left

“Today the tenets of this nineteenth-century philosophy of liberalism are almost forgotten. In the United States “liberal” means today a set of ideas and political postulates that in every regard are the opposite of all that liberalism meant to the preceding generations.” —Ludwig von Mises, 1962 (emphasis added) F.A. Hayek is back in the public eye, thanks to a promising and weighty new biography from Professors Bruce Caldwell and Hansjörg Klausinger. Predictably,...

Read More »Ep 50 – Brent Johnson: Has the Dollar Milkshake Spilled or Just Begun?

Is the dollar heading to new heights or new lows? Brent Johnson of Santiago Capital joins the Gold Exchange Podcast LIVE in New Orleans! Listen to Brent discuss the historic rise of the DXY, the effects on (d)emerging markets, and how he sees a currency and sovereign debt crisis playing out. Will Powell be able to solve Triffin’s Dilemma? Can foreign central banks escape the zugzwang position? Will the financial justice warriors finally be vindicated? Watch the full...

Read More »Reflections upon the Centennial of Mises’s Socialism

Ludwig von Mises published Die Gemeinwirtschaft: Untersuchungen über den Sozialismus in 1922 (translated into English as Socialism: An Economic and Sociological Analysis, 1951). In more than five hundred pages, the most prominent representative of the Austrian school offers a comprehensive and deep analysis of the “socialist phenomenon.” Despite the catastrophes associated with the attempt to install a socialist system, this ideology has lost little of its appeal....

Read More »Now that we’re finally here, what does it mean?

A consensus is being reached even among the official classes: "inflation" has peaked and with that consumer price pressures are going to reverse. That means decelerating price changes and eventually, in some places, falling prices. While this seems like it would be a very positive development, only in a world where all else remains equal. We don't live in that world. Eurodollar University's Money & Macro Analysis Twitter: https://twitter.com/JeffSnider_AIP...

Read More »“It begins”: The rise of the digital dollar

In mid-November, while the whole world was focused on the Ukraine crisis, the US midterms or whatever other “big story” the media decided was more important, a truly momentous shift took place in the global financial system. It might seem like a small step on the surface, but it has the potential to bring about a real and possibly irreversible sea change in the way we use money; or better said, the way it uses us. As Reuters reported on the 15th of...

Read More »Chinese Yuan Jumps While the Dollar recovers After Losses were Extended Against the Euro and Sterling

Overview: The markets remain hopeful about a re-opening in China and continue to pour into Chinese stocks on the mainland and in Hong Kong. The index of Chinese companies that trade in the US rose nearly 22.4% last week. Large bourses in the Asia Pacific region were mixed, but China and Hong Kong stand out. Europe’s Stoxx 600 is nursing a small loss for the second consecutive session. US equity futures have a slightly heavier bias. European 10-year yields are 2-5...

Read More » SNB & CHF

SNB & CHF