We expect the ECB to strengthen its forward guidance by linking the future path of policy rates to a new asset purchase programme.We estimate that a new QE2 programme worth at least EUR600bn would be needed for the ECB to close a 0.50% inflation gap. If anything, the decreasing marginal returns of QE and the risk of a de-anchoring of inflation expectations call for a more aggressive programme.How much does the ECB need to ease? QE size matters, but so do other parameters including the duration of the programme. Our initial expectation was for QE2 to be set at EUR50bn per month over 12 months. A compromise could take the form of a smaller quantum of purchases for longer — say EUR30bn over 18 months, EUR25bn over two years, or even open-ended asset purchases linked to a state-contingent

Read More »Articles by Frederik Ducrozet and Nadia Gharbi

The ECB is preparing for delivery

July 19, 2019After Draghi’s shift in Sintra, we still see the ECB rate cuts as a starter and a first step before the implementation of a broader policy package.We expect the European Central Bank (ECB) to prepare markets for the delivery of fresh monetary stimulus following Mario Draghi’s unequivocal signal in Sintra. An adjustment to forward guidance is the most natural path for the ECB to take, by signalling that policy rates will remain at present levels “or lower”, paving the way for a 10 bp deposit rate cut in September, to -0.50%.The ECB will likely note that so-called risk contingencies have been triggered in the sense that the data released over the past month have not been strong enough to qualify as an “improvement” in the outlook.However, this baseline scenario is now consensus and nearly

Read More »Euro area monetary policy – “Sintrapped”

June 21, 2019Although the final decision will depend on US-China trade negotiations, the Fed and economic data, the ECB is likely to deliver a comprehensive easing package in September.In Sintra, Mario Draghi signalled the ECB’s unequivocal readiness for further stimulus “in the absence of improvement”. Although the final decision will depend on US-China trade negotiations, the Fed and economic data, the ECB is likely to deliver a comprehensive easing package in September.We now expect the ECB to adjust its forward guidance in July to state that policy rates will remain at present levels – or lower – at least through the first half of 2020. We forecast a 10 basis point cut in the ECB’s deposit rate in September, to -0.50%.Draghi’s comments also suggest that a tiering deposit system will be

Read More »ECB preview – so close, yet so far away

June 4, 2019The European Central Bank’s meeting on 6 June is unlikely to result in major policy changes, but instead will focus on risk assessment and TLTRO-III. The press conference could set the stage for a policy response should downside risks materialise.Long story short, the ECB should continue to err on the side of caution, while preparing for dovish contingencies, which could range from the easy to the scary. The easy plan would follow if risks to the outlook remain firmly tilted to the downside. The tricky would involve TLTRO-III being priced at a negative rate with conditionality, possibly at -20 basis points as a compromise to the hawks. And finally, the scary, with inflation expectations are one shock away from dis-anchoring, forcing a bolder policy response (quantitative easing).While it

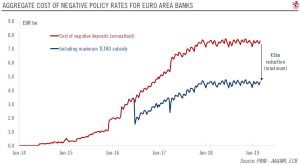

Read More »Getting ready for tiering

April 8, 2019ECB officials have hinted at policy measures aimed at reducing the cost of negative rates for the banking sector, including a tiered system of bank reserves.Although back in 2016 the European Central Bank (ECB) ruled out tiering of bank reserves to mitigate the side effects of negative rates, the situation has since changed, and it could be implemented eventually if policy rates were to remain negative into 2020.Despite nearly four years of asset purchases and five years of negative rates, the downside risks to growth and inflation still dominant. Mario Draghi himself ruled out a tiered reserve system in March 2016 “exactly for the purpose of not signalling that we can go as low as we want on this”. We cannot emphasise enough how important the recent shift in conditions is from that

Read More »ECB rates and TLTRO-III: the devil in the details

March 13, 2019Following the changes to its forward guidance, we have revised our forecast for ECB policy rates.Last week, the European Central Bank (ECB) announced a new long-term refinancing package for banks (called TLTRO-III) and made clear that interest rates would not be raised this year. While these measures were expected, they have come earlier than we thought. We were also taken aback by the extent of the downside revisions to the ECB’s inflation and growth projections and ECB President Draghi‘s overall dovishness.We have revised our scenario accordingly and now expect a 15bp deposit rate hike in March 2020, followed by a 25bp hike in the deposit and refi rates in September 2020. The former would be a technical rate hike rather than the start of a full-blown normalisation cycle.As for

Read More »PMIs point to downside risk to near term euro area growth

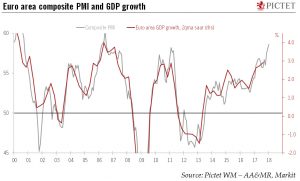

May 24, 2018Euro area flash PMI indices failed to stabilise in May. Details were somewhat less worrying than headline numbers and overall still consistent with a broad-based economic expansion, if only at a slower pace than last year. Our forecast of 2.3% GDP growth in 2018 still holds, but the balance of risks is now clearly tilted to the downside in sharp contrast with the situation prevailing a few months ago.

The deterioration in business sentiment in France and Germany was likely amplified by transitory factors once again. Outside the two largest euro area countries, activity rebounded to a three-month high.

The euro area composite PMI remains consistent with 0.4-0.5% q-o-q growth in Q2, only marginally lower than ECB staff

PMIs point to downside risk to near term euro area growth

May 23, 2018Following another disappointing set of business sentiment indicators, speculation over a longer extension of QE is rising.Euro area flash PMI indices failed to stabilise in May. Details were somewhat less worrying than headline numbers and overall still consistent with a broad-based economic expansion, if only at a slower pace than last year. Our forecast of 2.3% GDP growth in 2018 still holds, but the balance of risks is now clearly tilted to the downside in sharp contrast with the situation prevailing a few months ago.The deterioration in business sentiment in France and Germany was likely amplified by transitory factors once again. Outside the two largest euro area countries, activity rebounded to a three-month high.The euro area composite PMI remains consistent with 0.4-0.5% q-o-q

Read More »Euro area growth: somewhere between hard and soft data

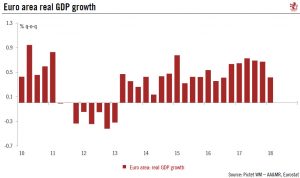

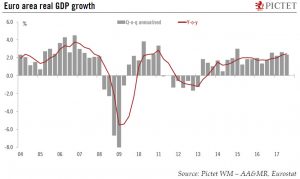

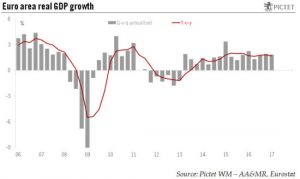

May 2, 2018The euro area economy’s loss of momentum in Q1 derived largely from temporary factors. We remain construction on the cyclical outlook.Euro area real GDP expanded by 0.4% q-o-q in Q1, or 1.7% in annualised terms, according to Eurostat’s flash estimate. This comes after an upwardly revised figure of 0.7% q-o-q in Q4 2017. Although this first estimate could be subject to statistical revisions, it confirms that the euro area economy lost some momentum in Q1.This Q1 flash estimate confirms that most business confidence surveys overestimated growth at the beginning of the year, with the ‘true pace’ of economic expansion lying somewhere in between estimates based on available soft and hard data.Looking ahead, the latest data suggest that the slowdown of recent months has likely halted: soft

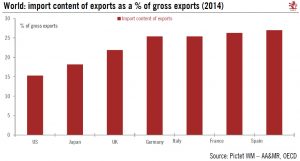

Read More »Europe has a lot to lose from trade wars

April 6, 2018Highly integrated into global value chains, the euro area is vulnerable to their disruption.Any estimate of the economic costs of protectionist measures, let alone trade wars, is subject to uncertainty given the complexity of global supply chains. A common assumption is that new tariffs on exports will produce small direct effects on GDP growth but more significant indirect effects in the event of escalating trade conflicts, including on domestic investment. Europe looks particularly vulnerable to such indirect effects given its relatively high degree of openness to trade. For all the talk about ‘Euroboom’, about one quarter of euro area GDP growth in 2017 was driven by net trade.Euro area exports amounted to 47% of GDP in 2017 compared with 12% in the US. Importantly, the euro area is

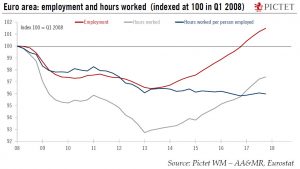

Read More »Europe chart of the week – Employment

March 16, 2018Average number of hours worked per employee suggests there is still slack in the euro area job market.Euro area employment grew for the 18th consecutive quarter in Q4 2017 (+0.3% q-o-q), and is now 1.5% above its pre-crisis (2008) level. By contrast, hours worked per person employed decreased during the same period, remaining 4% below their pre-crisis level.The two data series have followed divergent trends since the start of the economic recovery. Between Q1 2008 and Q2 2013, the total amount of labour input used by firms decreased massively. The fall was more significant in terms of total hours worked than in terms of headcount. Underlying these developments was a fall in average hours worked per person, which then remained broadly stable during the recovery (see chart below). To a

Read More »Euro area: Flash PMI surveys pass their peak

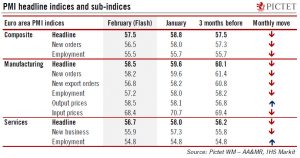

February 21, 2018In spite of some cooling in forward indicators, euro area growth should remain robust this year.Flash PMI indices eased in February, but remain consistent with continuing solid growth in the euro area.The flash composite purchasing managers’ index (PMI) for the euro area fell to 57.5 in February from 58.8 in January, below consensus expectations. Activity in both services and manufacturing cooled in February.While the average composite PMI is pointing to an acceleration in growth in Q1, the fall in some forward-looking components is consistent with our forecast of a gradual slowdown in the pace of growth in the second half of 2018. Still, February PMIs confirm that growth is improving in terms of quantity as well as quality, with rising job creation and investment. We forecast euro area

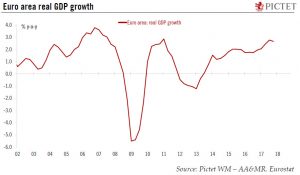

Read More »Euro area Q4 GDP growth: Strong, but not stronger

January 30, 2018Euro area real GDP expanded in Q4, in line with expectations but marginally less than in Q3. We forecast GDP growth of 2.3% in 2018, with near-term upside risks.According to Eurostat’s preliminary estimate, euro area real GDP rose by 0.6% q-o-q in Q4 (2.3% q-o-q annualised; 2.7% y-o-y), in line with consensus expectations but slightly less than its upwardly-revised 0.7% q-o-q increase in Q3.The euro area economy expanded by 2.5% in 2017 overall, its fastest annual growth since 2007. The flash Q4 estimate is based on figures published by six countries (including Spain and France), as well as some confidential inputs from five others. German and Italian flash GDP readings are due on 14 February, while the euro area breakdown by expenditure components will be published on 7 March.The French

Read More »Euro area business activity expanding at its fastest pace in nearly 12 years

January 24, 2018The euro area Flash PMI index surged well above expectations in January. The ECB’s communication could turn more hawkish.The flash composite Purchasing Managers’ index for the euro area increased to 58.6 in January from 58.1 in December, above consensus expectations (57.9). The services sector index rose, offsetting the decline in the manufacturing index . Companies also expressed growing optimism about this year’s outlook, with business expectations up to an eight-month high.The modest drop in forward-leading indicators in the manufacturing sector is consistent with our forecast of a gradual slowdown in the pace of growth in the second half of 2018. Still, January PMIs confirm that growth is improving in terms of quantity as well as quality, with rising job creation and investment. We

Read More »Light at the end of the Greek tunnel

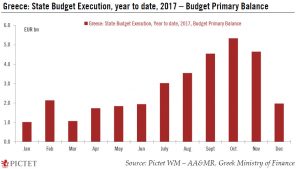

January 19, 2018The Eurogroup is set to conclude its third review of Greece’s bailout programme. The country could exit the programme this summer.Eight years after it first requested financial assistance from its European and international partners in April 2010, Greece has never been so close to a ‘clean exit’ from its bailout programme(s). The economy has shown more convincing signs of improvement, with real GDP recovering since mid-2016 and fall in unemployment accelerating in 2017. Macro imbalances have started to correct and the primary budget surplus that Greece has managed to generate is expected to be sustained in the coming years.True, the preliminary State Budget figures of primary surplus for 2017 were slightly weaker than expected (EUR1.97bn in 2017 after EUR 2.78bn in 2016), but fiscal

Read More »Euro area forecast to grow 2.3% in 2018

December 12, 2017We have upgraded our growth projection for this year and next. There are upside risks to our forecast that the ECB will start hiking rates in Q3 2019.

Taking account of stronger growth momentum, the carryover effect and upward revisions to past data, we have upgraded our euro area annual GDP growth forecasts to 2.3% both in 2017 and 2018. Our forecasts remain consistent with a very gradual slowdown in the quarterly pace of GDP growth, to 2% by end-2018. We view the likelihood of a domestically-generated recession as very low.

The main downside risks are exogenous, including a disorderly Brexit or a sharper-than-expected slowdown in emerging-market growth. Some volatility is likely to return around the Italian elections early next year. A moderate

Euro area: solid growth, but inflation still under par

October 31, 2017GDP figures confirming a strong and steady expansion have yet to turn up in core inflation data.According to preliminary Eurostat estimates, euro area real GDP increased by 0.6% q-o-q in Q3, slowing marginally from an upwardly-revised 0.7% in Q2. A breakdown by expenditure components will not be released until 14 November, but domestic demand was likely the key driver in the euro area’s solid momentum.At a country level, France and Spain are the first of the big four euro area economies to have published Q3 GDP figures. In France, real GDP increased by 0.5% q-o-q in Q3, while it rose by 0.8% in Spain.The French number implies that 2017 annual GDP growth is likely to be in line with the government’s new forecast of 1.8% , providing a welcome boost to fiscal revenues at a critical juncture.

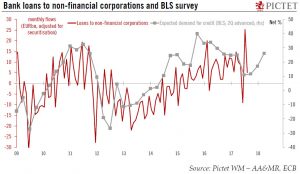

Read More »Broad-based rebound in euro area credit demand

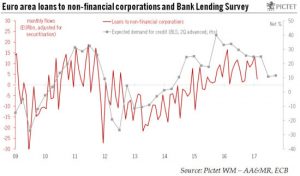

October 24, 2017The latest ECB’s lending survey shows credit conditions remain loose for the private sector, paving the way for cautious ECB policy normalisation.The ECB’s October Bank Lending Survey (BLS) indicated that credit standards were broadly unchanged in Q3, while some modest easing was expected in Q4. The brightest spot is loan demand, which is expected to rebound for all types of loans moving forward.Net demand for bank loans to enterprises increased further in Q3, in line with banks’ expectations. The low level of interest rates was the key factor behind the rise in corporate loan demand. M&A activity as well as inventories and working capital continued to have a positive impact on demand, albeit less than in the previous quarter. Looking ahead, banks expect credit demand to rise further in

Read More »Euroscepticism is making less of a splash

October 13, 2017Renewed political risks are leading to very limited repricing of the sovereign risk premiums.A Catalan crisis, a Dutch eurosceptic-leaning government coalition, the return of Austrian populists, difficult German coalition talks… Eurosceptics have had plenty of opportunities to make a comeback, and yet the market continues to trade each event as largely idiosyncratic in nature.Explanations abound for the resilience of peripheral markets to political risks, including a stronger and broad-based economic recovery, the ECB’s “prudent and persistent” approach to rescaling QE, prospects of further euro area governance reforms, etc. We believe that the Brexit vote and the current difficult state of negotiations are also playing an important role, as populist parties have reviewed their positions,

Read More »In spite of broadening growth, ECB will remain prudent

August 4, 2017A growth spurt may push us to raise our euro area GDP forecast for this year and next, although we expect some slowdown in the pace of expansion and the ECB to continue to act cautiously.While the latest euro area GDP numbers were broadly in line with expectations, at 0.6% quarter-on-quarter in Q2, net revisions to past data pushed the GDP profile higher again.Once detailed estimates are published by Eurostat—and assuming there are no significant revisions to past data—we might revise our 2017 annual growth forecast for the euro area to 2.0-2.1% from 1.9% currently. Our 2018 growth forecasts are likely to be affected as well, if only mechanically, with modest upside risks relative to our current projection of 1.6%.Almost ten years after the financial crisis, the euro area continues to

Read More »ECB: see you in autumn

July 20, 2017The ECB made no change in its forward guidance at its July meeting. Our baseline scenario remains unchanged.At its July meeting, the ECB made no change in its monetary policy statement, as we expected. Importantly, the bias for QE extension “in terms of size and/or duration” was kept in the statement. ECB president Mario Draghi mentioned that the Governing Council (GC) was unanimous in communicating no change to forward guidance.Draghi reiterated that a very substantial degree of accommodation is still needed for underlying inflation pressures to build up. During the Q&A session, he mentioned that the GC had not discussed an exit strategy. He also tried to reassure financial markets after his Sintra speech in June.Following today’s press conference, our baseline scenario remains

Read More »Rise in our growth forecast for the euro area

June 9, 2017We are upgrading our GDP growth forecast for the euro area to 1.9% this year, although we expect a modest decline in momentum in the second half.Euro area Q1 GDP growth was today revised up to 0.6% quarter on quarter, from 0.5% in the previous estimate. This revision reflects large adjustments in several countries, and mechanically pushes our annual growth forecasts higher. We now expect euro area real GDP to grow by 1.9% on average this year, after 1.7% in 2016 and 1.9% in 2015. We had previously forecast that GDP growth this year would be 1.5%.More than a half of the upgrade to our forecasts is due to statistical revisions to past data while the rest is due to sentiment and activity data being more robust than expectations.We have made no change to our quarterly growth profile for H2

Read More »Euro area growth on track to reach at least 1.5% in 2017

May 3, 2017GDP shows economic performance is somewhere between what hard and soft data are suggesting.According to Eurostat’s preliminary flash estimate released today, euro area real GDP expanded by 0.5% q-o-q in Q1 2017 (+0.455% q-o-q; 1.8% q-o-q annualised; 1.7% y-o-y), slightly above consensus expectations (0.4%). This flash estimate confirms that most business confidence surveys overestimated growth at the beginning of the year, with the ‘true pace’ of economic expansion lying somewhere in between estimates based on available soft and hard data.As a result, we have maintained our GDP forecast for 2017 at 1.5%, with risks modestly tilted to the upside. Once detailed estimates are published, assuming no revision to past GDP figures, we might indeed revise our 2017 annual growth forecast to 1.6-1.7%. Speaking of revisions, Q4 GDP growth was revised up from 0.40% to 0.48% q-o-q in the final estimate. It is worth mentioning that the Q4 flash estimate, published on 31 January, was 0.5%.Euro area real GDP now stands 3% above its pre-crisis level. The carryover effect for 2017 reached 1.1%, meaning that even with zero growth in the remaining three quarters of 2017, euro area GDP would grow by 1.1% on average this year. Today’s Q1 estimate is based on published figures from six countries (including for Spain and France) as well as some confidential inputs from five other countries.

Read More »Bank lending gives no ground for ECB to change stance

April 25, 2017The April Bank Lending Survey remains consistent with the ECB leaving its stance unchanged on credit conditions, negative rates and QE.Credit standards on loans to euro area enterprises eased in Q1, according to the ECB’s Bank Lending Survey (BLS), released today. Although banks expect a small net tightening of credit standards across all loan categories in Q2, credit conditions remain broadly favourable in the euro area.Demand for credit continued to rise in Q1, albeit at a slower pace than in the previous quarter, indicating there has been no material rebound in credit growth. Increased use of alternative sources of finance by corporates as well as elevated cash balances likely go a long way to explaining subdued demand for bank loans.The BLS looks consistent with an unchanged ECB stance on credit conditions, negative rates and quantitative easing. An eventual decision to hike the deposit rate will likely be based on the ECB’s fundamental assessment of economic conditions rather than motivated by growing side effects of such policy on the banking sector.

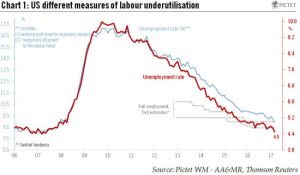

Read More »U.S. job creation slows but unemployment drops to a new record low

April 7, 2017Job growth was strong in the first quarter as a whole, however, and latest numbers may not lead Fed to change its overall assessment of the economic outlook.Non-farm payrolls increased by 98,000 m-o-m in March, well below consensus expectations (180,000). Adverse weather conditions likely weighed on the aggregate numbers. Moreover, job creation averaged 177,000 in Q1 2017, above the Q4 average of 147,000.Importantly, the US unemployment rate fell to a new cycle low of 4.5% in March, from 4.7% in February. The U6 measure of underemployment dropped to 8.9%, from 9.2%. Wage growth was in line with expectations, up 0.2% m-o-m and 2.7% y-o-y in March.Overall, we suspect that today’s jobs report will not lead to a material reassessment of the economic outlook by the Fed. Barring a sharper slowdown in job creation or the economy, the main driver for monetary policy in the next few months is likely to be the prospects of fiscal stimulus, or lack thereof.

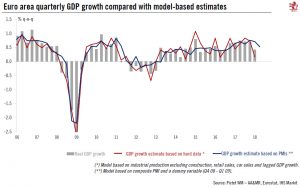

Read More »Euro area: reconciling soft and hard data

April 5, 2017The latest confidence surveys in the euro area have been remarkably strong, adding upside risks to our GDP forecasts, but meaning that the ECB will have to tread carefully.Recent composite purchasing manager surveys for the euro area are consistent with a growth rate of about 0.7% q-o-q in Q1, above our projection of 0.4%, and are pointing to similar levels of growth in Q2. More generally, ‘soft’ survey data and ‘hard’ activity data have been diverging significantly of late, with large differences across countries. The mixed signals from hard data in Q1 support our more cautious assessment of the pace of economic expansion. Although we expect hard data to catch up to some extent with the soft variety, PMI indices have already tended to overstate GDP growth in the present recovery. As a result, we are maintaining our GDP growth forecast for the euro area unchanged, although with upside risks. In essence, we expect both hard data to pick up and soft data to moderate in the next few months, leaving euro area real GDP growth at around 2% in annualised terms in H1, and around 1.5% in H2. If we are right, upside risks to our GDP forecast (1.5% in 2017 as a whole) will prove more limited than soft indicators are signalling.The global context and the hope of a more supportive fiscal policy, in particular, might help explain part of the discrepancy between hard and soft data.

Read More »Another spectacular rise in euro area PMIs

March 24, 2017PMI surveys surprised to the upside in March. The euro area composite PMI surged to 56.7, its highest level since April 2011.The average composite PMI is now consistent with a GDP growth rate of about 0.6% q-o-q in Q1, above our forecast. At the same time, hard data came in slightly weaker than expected, suggesting that business surveys might be overstating the pace of growth to some extent. As a result, we are keeping our growth forecast unchanged at 1.5% for 2017Both the euro area composite PMI and the price pressure gauges are now firmly in ‘ECB tightening’ territory. Today’s PMI indices confirm our expectations that a change in the ECB’s forward guidance is likely at the 8 June meeting as a formal discussion on an “exit package” could start. We forecast a first deposit rate hike in Q2 2018 and a very gradual tapering in asset purchases between Q1 and Q4 2018.In Germany, the flash composite PMI index increased from 56.1 in February to 57.0 in March, against expectations of a stable print. The increase is the fastest rate of growth in private sector in six years and was broad based across sectors. Meanwhile, increasing demand pushed firm to step up recruitment in both sectors. The rate of job creation strengthened again, to the highest since March 2011 and was the second-strongest since the series began in January 1998.In the meantime, France has an even stronger rebound.

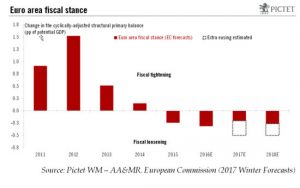

Read More »Euro area fiscal stimulus prospects

February 28, 2017As the emphasis moves away from monetary initiatives, euro area GDP should benefit from a shift in fiscal policy going back to before the US elections.There has been growing evidence of a shift in the policy mix of various developed economies, from monetary to fiscal. In the euro area, we have likely entered a new cycle where the combination of austerity fatigue and greater flexibility on spending rules leads to more sustained fiscal support, however sub-optimal and uneven across countriesIn theory, only Germany and the Netherlands have fiscal space within EU rules. In practice, one-off factors may contribute to further fiscal slippage, including public spending related to the refugee crisis, the election cycle, or the Juncker Plan. There is room for additional fiscal easing within existing European rules, depending on political will and incentives. The quasi-fiscal effects of ECB QE should play a major role from that perspective.As for the euro area as a whole, we expect this year’s fiscal easing to amount to 0.5% of GDP – unevenly spread across countries. This is larger than what is forecasted by the European Commission (0.2% of the GDP, 2017 winter forecast, revised down from the previous forecast of 0.3%). ECB’s supportive policies have led to low interest rates on government debt. Therefore, even countries without fiscal space face no pressures in the short run.

Read More »PMI survey signals sustained euro area expansion in Q1

February 21, 2017Although business surveys outpaced expectations and there are signs of rising price pressures, we continue to believe the ECB will not shift its monetary stance in the near term.The euro area composite flash PMI surged to 56.0 in February, the highest reading since April 2011. The main boost came from a surge in the services index due to strong data in Germany and France.The euro area average composite PMI is now consistent with a GDP growth rate of about 0.6% q-o-q in Q1, above our forecast. At the same time, hard data came in slightly weaker than expected at the end of last year, suggesting that business surveys might be overstating the pace of growth to some extent. As a result, we are keeping our growth forecast unchanged at 1.5% for 2017.In France, the composite PMI rose by more than two points, to 56.2 in February, against expectations of a small decline. Other national business surveys have been more mixed recently, but overall momentum in the French economy appears to be fairly strong and certainly not consistent with weaker growth ahead of the elections. In Germany, the flash composite PMI index also rose, contrary to expectations. Overall, the German PMI composite index is consistent with a GDP growth of 0.6% q-o-q in Q1, marking an acceleration from 0.4% in Q4 2016.A key takeaway from PMI report was “a further intensification of inflationary pressures”.

Read More »Systemic risks remain low ahead of euro area elections

February 14, 2017While we believe upcoming elections are unlikely to shake the European edifice, investors are turning cautious, if only because opinion poll accuracy has proved questionable over the past year.There are good reasons for investors to worry about political risks in Europe. The most legitimate concerns, in our view, come from the timing of elections this year in the largest euro area countries. They are coming against the backdrop of a broad shift towards protectionism, and at a time when ECB support is being reduced before, potentially, being unwound in 2018.At the same time, we see little evidence of political uncertainty weighing on growth. If anything, economic momentum in Europe has improved since the US elections of November, partly due to global fiscal stimulus and reflation hopes, and partly due to domestic improvements. Better-than-expected data have pushed our forecast for euro area growth mechanically higher, to 1.5% in 2017 (from 1.3%). The biggest risk, in our view, is that corporate investment spending – the single most important driver for a sustained and sustainable recovery – weakens ahead of the elections.Our baseline scenario remains constructive and we expect pro-European, pro-business governments to be elected in all.

Read More »