The euro area Flash PMI index surged well above expectations in January. The ECB’s communication could turn more hawkish.The flash composite Purchasing Managers’ index for the euro area increased to 58.6 in January from 58.1 in December, above consensus expectations (57.9). The services sector index rose, offsetting the decline in the manufacturing index . Companies also expressed growing optimism about this year’s outlook, with business expectations up to an eight-month high.The modest drop in forward-leading indicators in the manufacturing sector is consistent with our forecast of a gradual slowdown in the pace of growth in the second half of 2018. Still, January PMIs confirm that growth is improving in terms of quantity as well as quality, with rising job creation and investment. We

Topics:

Frederik Ducrozet and Nadia Gharbi considers the following as important: Macroview

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

The euro area Flash PMI index surged well above expectations in January. The ECB’s communication could turn more hawkish.

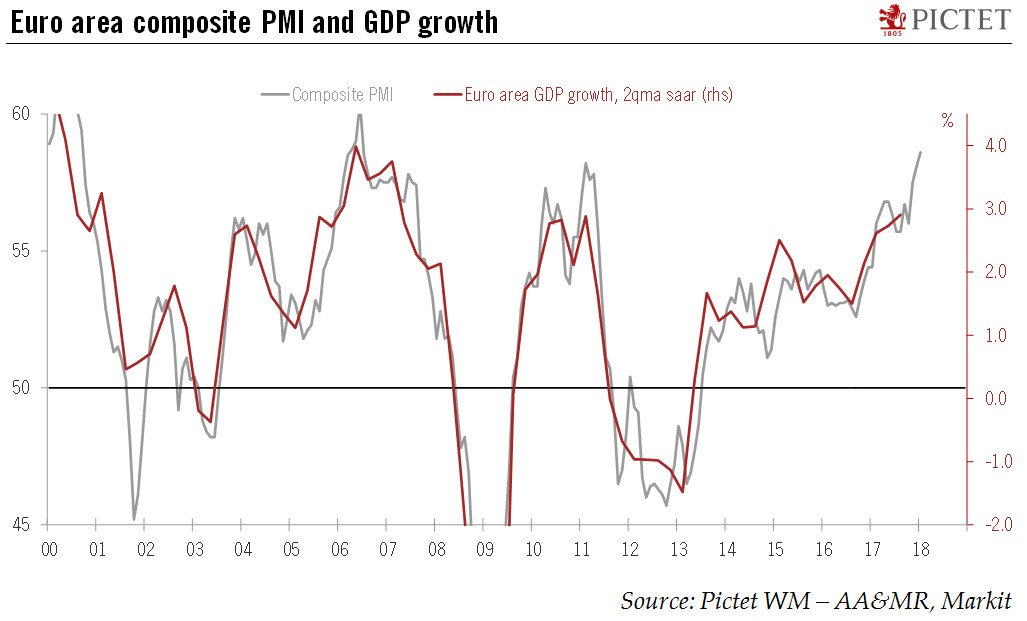

The flash composite Purchasing Managers’ index for the euro area increased to 58.6 in January from 58.1 in December, above consensus expectations (57.9). The services sector index rose, offsetting the decline in the manufacturing index . Companies also expressed growing optimism about this year’s outlook, with business expectations up to an eight-month high.

The modest drop in forward-leading indicators in the manufacturing sector is consistent with our forecast of a gradual slowdown in the pace of growth in the second half of 2018. Still, January PMIs confirm that growth is improving in terms of quantity as well as quality, with rising job creation and investment. We forecast euro area GDP growth of 2.3% both in 2017 and 2018, with near-term upside risks.

An important feature of recent PMI indices reports has been the emergence of capacity issues. Price pressures intensified further in January, according to the flash survey, and “capacity continued to show signs of being stretched” despite rising employment.

Rising price pressures along with above-potential GDP growth could force the ECB to adopt a more hawkish stance in its communication over the course of the year. Importantly, there has been little evidence so far that a stronger currency is having any meaningful impact on euro area growth or inflation.