Further loosening of broad monetary and financial conditions likely, adding to upside risks to the outlook for growth. We were looking for a rebound in euro area bank credit flows in October following a large and unexpected decline in September, largely due to a collapse in lending to non-financial corporations in the Netherlands. In the end, bank lending to the non-financial private sector did recover quite strongly in October and we continue to believe that the credit cycle has legs, in line with other indicators such as the ECB’s Bank Lending Survey. October figures speak for themselves. M3 annual growth rate rose to 5.3% y-o-y in October, from in 4.9% y-o-y in October, close to its cycle highs. The narrower monetary aggregate M1 accelerated slightly, to 11.8% y-o-y, and to over 14% y-o-y in real terms, pointing to growing upside risks to GDP growth if the relationship with domestic output is to even remotely hold. Meanwhile, on the asset side of the Monetary and Financial Institutions balance sheet (MFI), the strong and relatively broad-based rebound in net credit flows to the private sector in October has translated into a new cycle high for the overall credit impulse – the second derivative of credit to the private sector – to above 3% y-o-y in October. These developments are consistent with a stronger pace of GDP growth in Q4 (around 0.

Topics:

Perspectives Pictet considers the following as important: Macroview

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

Further loosening of broad monetary and financial conditions likely, adding to upside risks to the outlook for growth.

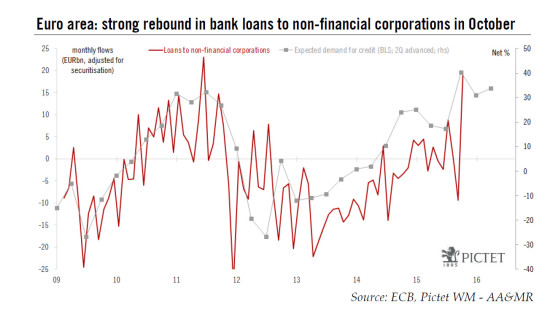

We were looking for a rebound in euro area bank credit flows in October following a large and unexpected decline in September, largely due to a collapse in lending to non-financial corporations in the Netherlands. In the end, bank lending to the non-financial private sector did recover quite strongly in October and we continue to believe that the credit cycle has legs, in line with other indicators such as the ECB’s Bank Lending Survey.

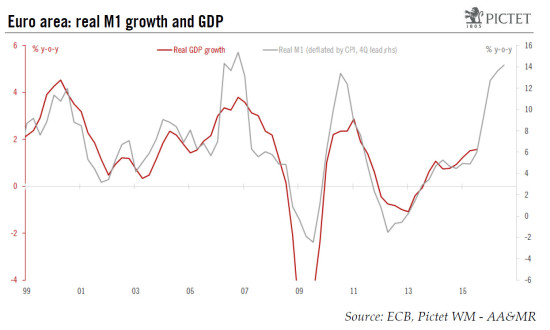

October figures speak for themselves. M3 annual growth rate rose to 5.3% y-o-y in October, from in 4.9% y-o-y in October, close to its cycle highs. The narrower monetary aggregate M1 accelerated slightly, to 11.8% y-o-y, and to over 14% y-o-y in real terms, pointing to growing upside risks to GDP growth if the relationship with domestic output is to even remotely hold.

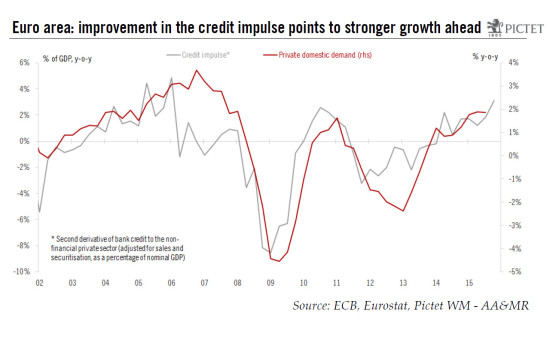

Meanwhile, on the asset side of the Monetary and Financial Institutions balance sheet (MFI), the strong and relatively broad-based rebound in net credit flows to the private sector in October has translated into a new cycle high for the overall credit impulse – the second derivative of credit to the private sector – to above 3% y-o-y in October. These developments are consistent with a stronger pace of GDP growth in Q4 (around 0.5% q-o-q) and beyond, in line with recent business surveys (services PMIs and German IFO, among others).

We therefore maintain our forecast for euro area GDP to expand by 1.8% in 2016, with upside risks building up into year-end as the ECB is very likely to announce a new ambitious easing package at its 3 December meeting.

Details of the October M3 report were at least as encouraging as the headline numbers. The rebound in bank credit to the non-financial private sector was indeed broad-based across sectors with loans to households rising by €9bn in October (slightly stronger than in recent months) and loans to non-financial corporations up by €19bn (following an upwardly-revised €9bn decline in September), using adjusted measures for sales and securitisation in both cases. This €19bn increase marked a new cycle high since the adjusted series began, second only to a €23bn rise in June 2011. The rebound was consistent with forward-leading indicators including the ECB’s Bank Lending Survey (see chart below).

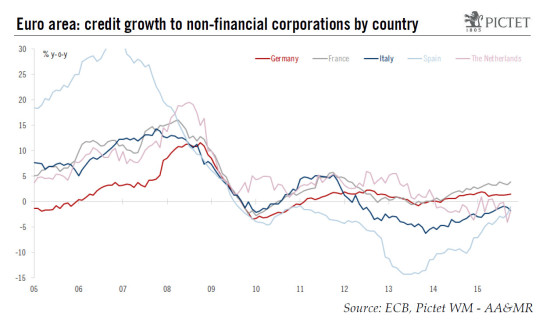

Breaking down credit flows to non-financial corporations (NFC) by countries, the strongest figures were recorded in the Netherlands (+9.8bn), France (+9.1bn), Spain (+3.2bn) and Germany (+1.9bn). In the Netherlands, the rebound followed a (unrevised) €14.6bn collapse in the previous month, although excluding those volatile Dutch numbers the trend remains one of convincing improvements in the euro area credit cycle. On the more negative side, bank loans to NFC fell by €6.2bn in Italy, following a €2.5bn increase in September, perhaps reflecting those structural weaknesses in the Italian banking sector that have only recently started to be addressed by the government.

Putting those numbers into our euro area credit impulse which estimates the second derivative of credit to the non-financial private sector, a series well correlated to domestic demand and GDP growth, the results point to growing upside risks to our current forecasts – we are looking for euro area GDP to expand by 1.8% in 2016, after 1.5% this year. Indeed, assuming a similar pace of credit flows in the last two months of the year, the credit impulse would reach a new cycle high of 3.1% y-o-y in Q4, consistent with domestic demand growth in the region of 2.5 to 3.0%.

Moreover, real M1 growth, another useful leading indicator, also reached a new high at above 14% y-o-y in October (see chart below), only confirming the upbeat signal from the asset side of banks’ balance sheets.

While the ECB is likely to take comfort from today’s money and credit data, the central bank’s main focus remains on subdued inflation prospects. Having de facto pre-committed to new measures since October, we continue to expect the ECB to announce a comprehensive easing package at its 3 December policy meeting, including a 10bp deposit rate cut, a 6-month extension of its QE programme, and possibly more. The result should be a further loosening of broad monetary and financial conditions, adding to those upside risks to the outlook for growth.