Swiss Franc The Euro has fallen by 0.41% to 1.14 CHF. EUR/CHF and USD/CHF, August 01(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates After taking a step lower in the North American session yesterday, the dollar is consolidating today. The euro is holding above .18, and the dollar held JPY110.00. Global equities are mostly higher, while bonds are mixed. Asia-Pacific yields were mostly higher, while European rates are a little lower. The US 10-year yield is flat just below 2.30%. FX Daily Rates, August 01 - Click to enlarge The RBA did meet earlier, and as widely anticipated, the cash rate was not touched (1.5%). New forecasts will be published at the end of the

Topics:

Marc Chandler considers the following as important: AUD, China Caixin Manufacturing PMI, EUR, EUR/CHF, Eurozone Gross Domestic Product, Eurozone Manufacturing PMI, Featured, France Manufacturing PMI, FX Trends, Germany Manufacturing PMI, Italy Manufacturing PMI, Japan Manufacturing PMI, JPY, newslettersent, Oil, Spain Manufacturing PMI, U.K. Manufacturing PMI, U.S. ISM Manufacturing Employment, U.S. ISM Manufacturing PMI, U.S. Manufacturing PMI, USD, USD/CHF

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Marc Chandler writes March 2025 Monthly

Mark Thornton writes Is Amazon a Union-Busting Leviathan?

Swiss FrancThe Euro has fallen by 0.41% to 1.14 CHF. |

EUR/CHF and USD/CHF, August 01(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

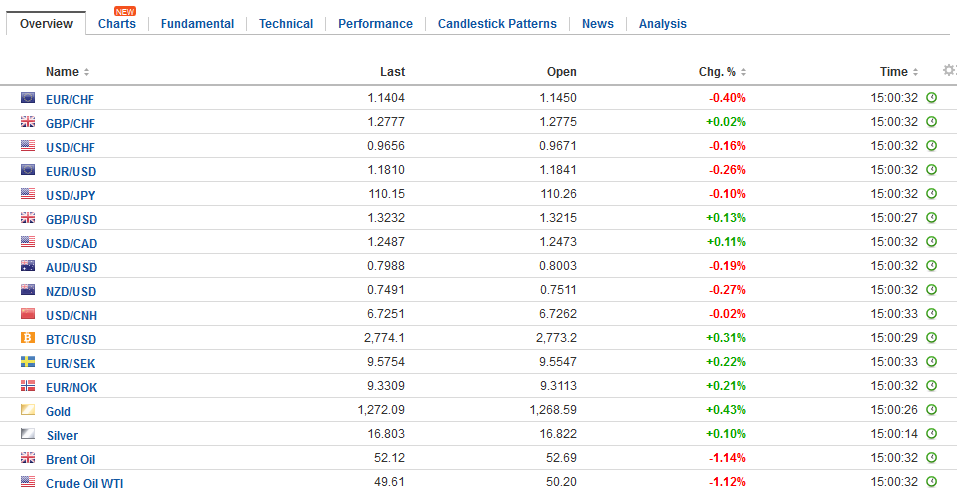

FX RatesAfter taking a step lower in the North American session yesterday, the dollar is consolidating today. The euro is holding above $1.18, and the dollar held JPY110.00. Global equities are mostly higher, while bonds are mixed. Asia-Pacific yields were mostly higher, while European rates are a little lower. The US 10-year yield is flat just below 2.30%. |

FX Daily Rates, August 01 |

| The RBA did meet earlier, and as widely anticipated, the cash rate was not touched (1.5%). New forecasts will be published at the end of the week. The focus was on Governor Lowe’s comments about the currency. He warned that a continued rise in the Australian dollar would depress prices and limit growth and employment. The Australian dollar has appreciated nearly 11% against the dollar this year, though, on a trade-weighted basis, it has appreciated less than half as much. The Aussie is consolidating its surge around the middle of July that carried it to about $0.8065 last week. It is struggling to hold above $0.8000.

Oil prices are slightly firmer. The API industry estimate of US inventories will be released later today. Kpler, the shipping tracker, was cited on Bloomberg, reporting that OPEC oil exports rose 388k barrels a day last month and are now 575k barrels a day above levels that prevailed last October. Most of the increase was accounted for by Libya and Nigeria. UAE oil exports also increased. According to the report, Saudi exports fell by 45k barrels a day to 7.15 mln. The September light sweet oil futures contract closed above $50 yesterday for the first time since the end of May. |

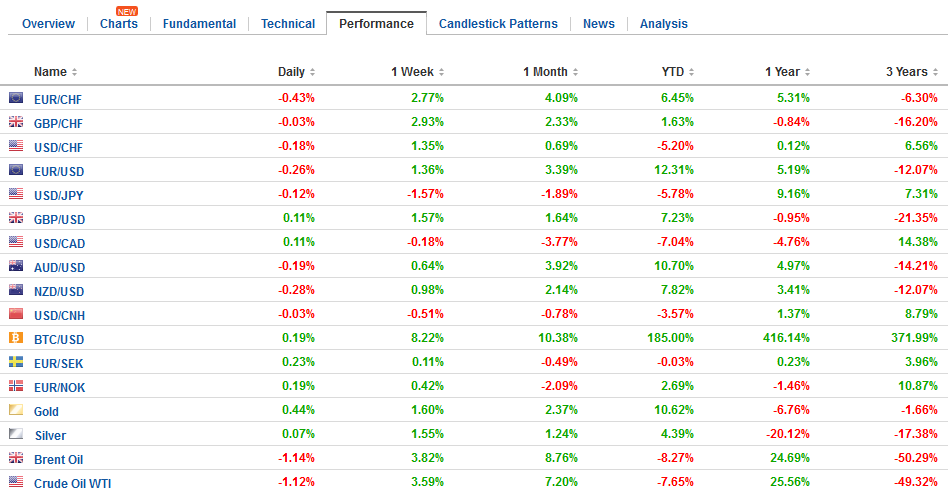

FX Performance, August 01 |

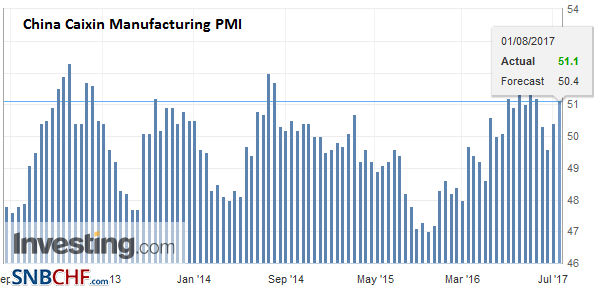

ChinaThe monthly cycle of high frequency data begins with the PMI data. The Caixin manufacturing PMI for China unexpectedly rebounded to 51.1 from 50.4 in June. Recall that on Monday, the official manufacturing PMI slipped to 51.4 from 51.7. There is no big takeaway. China’s economy was stronger than expected in H1 and many expect a modest slowing in H2. A combination of capital controls and a weaker US dollar has allowed China to rebuild reserves in recent months. Reserves are expected to have risen in July for the sixth consecutive month. The reserve data are expected next week. |

China Caixin Manufacturing PMI, July 2017(see more posts on China Caixin Manufacturing PMI, ) Source: Investing.com - Click to enlarge |

Japan |

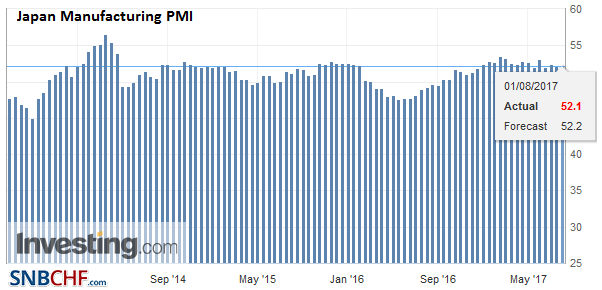

Japan Manufacturing PMI, July 2017(see more posts on Japan Manufacturing PMI, ) Source: Investing.com - Click to enlarge |

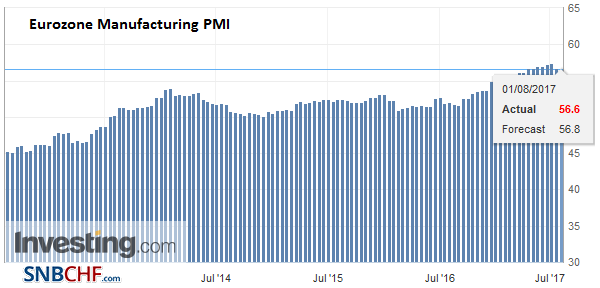

EurozoneThe EMU’s manufacturing PMI slipped to 56.6 from the flash reading of 56.8, showing a somewhat larger pullback from June’s 57.4. It is the first decline since last August. It puts it at its lowest level since March. |

Eurozone Manufacturing PMI, July 2017(see more posts on Eurozone Manufacturing PMI, ) Source: Investing.com - Click to enlarge |

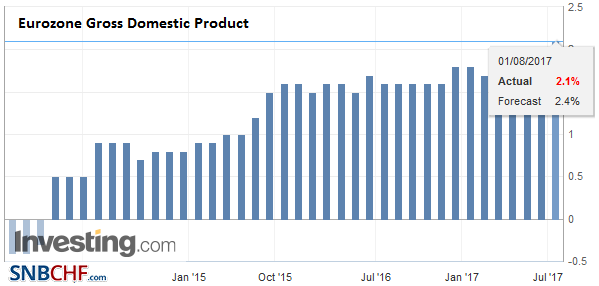

| It is warning that the economy may be stabilizing after it was reported earlier today that the region expanded by 0.6% in Q2, lifting the year-over-year rate to 2.1% from 1.9%. Growth in Q1 was revised lower to 0.5% from 0.6%. Of note, especially when thinking about the ECB’s deliberations, the manufacturing PMI found the lowest input prices in nine months, and the lowest prices paid since the start of the year. |

Eurozone Gross Domestic Product (GDP) YoY, Q2 2017(see more posts on Eurozone Gross Domestic Product, ) Source: Investing.com - Click to enlarge |

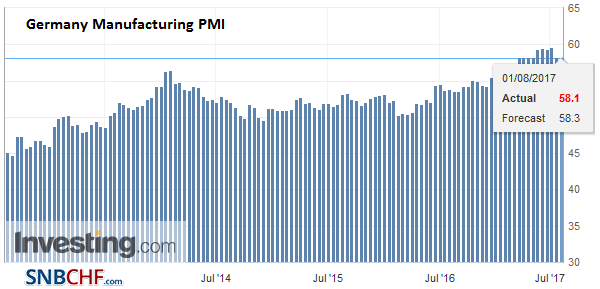

GermanyIn terms of national reports, the flash manufacturing PMI for Germany and France were revised lower. Germany’s manufacturing PMI slipped to 58.1 from 58.3 flash estimate and its possible cyclical peak last month at 59.6. |

Germany Manufacturing PMI, July 2017(see more posts on Germany Manufacturing PMI, ) Source: Investing.com - Click to enlarge |

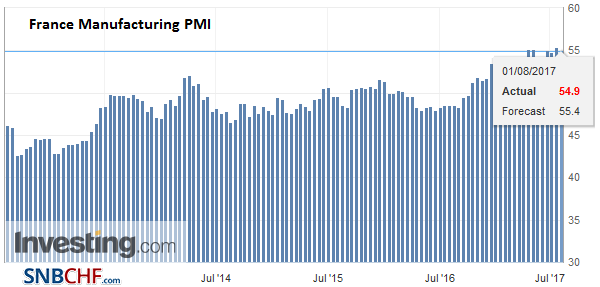

FranceFrance stands at 54.9 down from 55.4 flash, but slightly above June’s 54.8. The high so far was set in April at 55.1. |

France Manufacturing PMI, July 2017(see more posts on France Manufacturing PMI, ) Source: Investing.com - Click to enlarge |

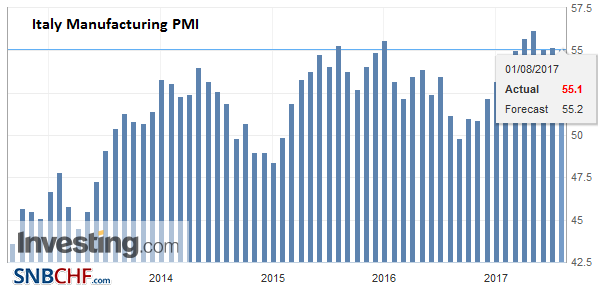

ItalyItaly’s manufacturing PMI slipped to 55.1 from 55.2, which is slightly better than the median forecast of the Bloomberg poll. |

Italy Manufacturing PMI, July 2017(see more posts on Italy Manufacturing PMI, ) Source: Investing.com - Click to enlarge |

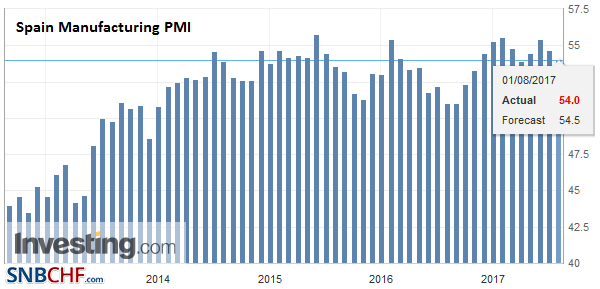

SpainSpain’s manufacturing PMI eased for the second consecutive month. The 54.0 reading is the lowest since March’s 53.9, which is also the lowest of the year. |

Spain Manufacturing PMI, July 2017(see more posts on Spain Manufacturing PMI, ) Source: Investing.com - Click to enlarge |

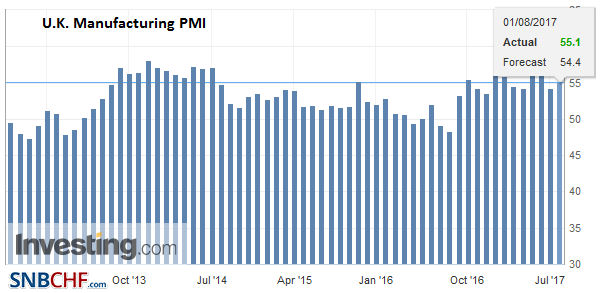

United KingdomThe UK offered a pleasant surprise, and it has helped underpin sterling and UK rates. The manufacturing PMI unexpectedly ticked up to 55.1 from a revised 54.2 (was 54.3) in June. It snaps a two-month decline. Exports were particularly strong and appeared to be the second highest reading since 1992 when the surveys began. On the other hand, sterling’s past decline appears to be dropping out some price measures, as input prices were at their lowest in over a year. The Bank of England meets on Thursday. While no one expects a hike, there is some debate over the guidance to be given in the Quarterly Inflation Report. We suggested that this provides room to negotiate. Haldane is seen as a swing vote whether it is a 6-2 or 5-3 vote. Keeping Haldane with the majority may require more hawkish rhetoric. |

U.K. Manufacturing PMI, July 2017(see more posts on U.K. Manufacturing PMI, ) Source: Investing.com - Click to enlarge |

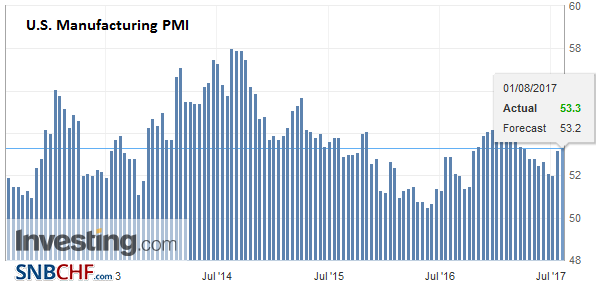

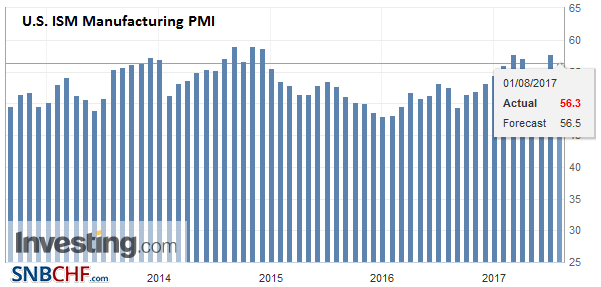

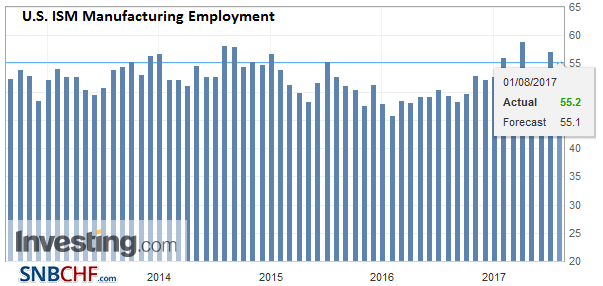

United StatesThe US has a busy calendar today. Since Q2 GDP was reported last week, the June personal income and expenditure data will be of passing interest. Of note, the core PCE deflator is expected to snap a four-month decline and be flat at 1.4% in June. The year-over-year comparisons will be somewhat easier in Q3, and the core PCE deflator may recover somewhat, though remaining below the 2% target. The July manufacturing PMI and ISM will draw attention, with the price and employment components of particular interesting. US auto sales will trickle out, and after a two-month decline, they are expected to recover (~16.8 mln seasonal adjusted annual rate), and this will be an encouraging start of Q3. |

U.S. Manufacturing PMI, July 2017(see more posts on U.S. Manufacturing PMI, ) Source: Investing.com - Click to enlarge |

U.S. ISM Manufacturing PMI, July 2017(see more posts on U.S. ISM Manufacturing PMI, ) Source: Investing.com - Click to enlarge |

|

U.S. ISM Manufacturing Employment, July 2017(see more posts on U.S. ISM Manufacturing Employment, ) Source: Investing.com - Click to enlarge |

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #USD,$AUD,$EUR,$JPY,China Caixin Manufacturing PMI,EUR/CHF,Eurozone Gross Domestic Product,Eurozone Manufacturing PMI,Featured,France Manufacturing PMI,Germany Manufacturing PMI,Italy Manufacturing PMI,Japan Manufacturing PMI,newslettersent,OIL,Spain Manufacturing PMI,U.K. Manufacturing PMI,U.S. IS,U.S. ISM Manufacturing Employment,U.S. ISM Manufacturing PMI,U.S. Manufacturing PMI,USD/CHF