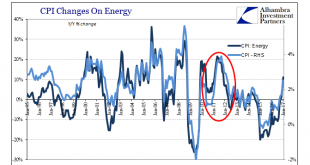

The Consumer Price Index for January 2017 rose 2.5%, pulled upward by its energy component which thanks to oil prices now being comparing to the absolutely lows last year saw that part of the index rise 11.1% year-over-year. Given that oil prices bottomed out on February 11, 2016, this is the last month where oil prices and thus energy inflation will be at its most extreme (except, of course, should WTI actually rise...

Read More »Real Wages Really Inconsistent

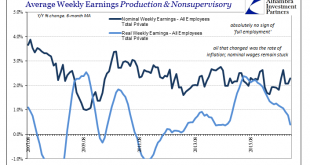

Real average weekly earnings for the private sector fell 0.6% year-over-year in January. It was the first contraction since December 2013 and the sharpest since October 2012. The reason for it is very simple; nominal wages remain stubbornly stagnant but now a rising CPI subtracts even more from them. Consumers receive no significant boost to their incomes, but are starting to pay more (in comparative terms) for things...

Read More »Jobless Claims Look Great, Until We Examine The Further Potential For What We Really, Really Don’t Want

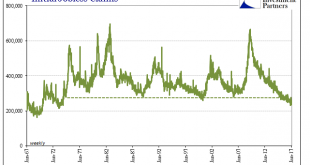

Initial jobless claims fell to just 234k for the week of February 4, nearly matching the 233k multi-decade low in mid-November. That brought the 4-week moving average down to just 244k, which was a new low going all the way back to the early 1970’s. Jobless claims seemingly stand in sharp contrast to other labor market figures which have been suggesting an economic slowdown for nearly two years. Unemployment insurance...

Read More »A Few Thoughts Ahead of the US Jobs Report

Summary ADP and Non-Manufacturing ISM lend credence to our fear of a disappointing national jobs report. Economists estimate only a small part of the manufacturing jobs loss can be traced to trade policy. 19 states increased min wage at the start of the year, but the impact on the nation’s average weekly earnings will likely be too small to detect. We have suggested the risk of disappointment with the US...

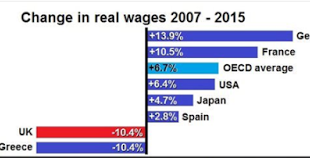

Read More »Great Graphic: Real Wages

This Great Graphic caught my eye. It was tweeted by Ninja Economics. Her point was about immigration. German had much higher immigration than the UK, but also saw real wage increase of nearly 14% in the 2007-2015 period, while real wages in the UK fell nearly 10.5%. She noted that Greece is the only developed country where real wages have collapsed as much as in the UK. This is amazing, and not because of...

Read More »The Need for Higher Wages: Lots of Thunder, No Rain

Summary: Major central banks and many economists are calling for higher wages. However, they are reluctant to offer proposals to strengthen those institutions who’s goal is to boost labor’s share of national income. The advocates are more interested in boosting prices than in lifting aggregate demand or addressing the disparity of income and wealth. Charlie Chaplin All that is solid is melting. After...

Read More »How you see the Stock Market determines your Profit or Loss!

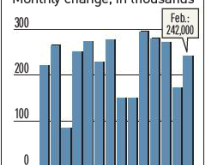

The key economic note this week was that non-farm payrolls for February was 242,000 versus Wall Street’s expectation of only 190,000; 27% above the consensus target. Wages however fell back by 0.1% from February’s gain of 0.5%. The workforce participation rate moved up to 62.9%. The excellent news on Friday was however received mutely by the market. Excellent news received muted by the market The reason was the likelihood that it will increase the probability of further interest rate rises...

Read More »US wages & monetary policy: not-so-dovish FOMC statement in January

Quarterly wage data (ECI) for Q4 pointed to modest increases with no apparent pick-up in wage inflation. Although the January FOMC statement was not so dovish, we continue to believe the Fed will remain on hold in March. Besides GDP data, today saw some other key data being published: the quarterly Employment Cost Index (ECI), admittedly the most reliable measure of wages and salaries. Following Wednesday’s less-dovish-than-hoped FOMC statement, prolonged uncertainty over inflation...

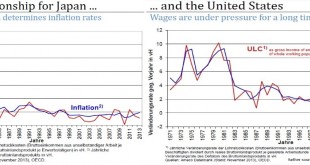

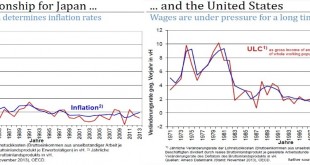

Read More »What Drives Government Bond Yields?

For us the five major drivers of government bond yields are: Inflation expectations and inflation: The by far most important criterion. High inflation expectations must be compensated via higher bond yields. The main driver behind inflation expectations is the wage development, this is the form of inflation that typically persists. Price inflation follows inflation expectations with a certain lag. Wealth: The higher the wealth of a country, the lower the bond yields. Wealth is typically...

Read More »What Drives Government Bond Yields?

For us the five major drivers of government bond yields are: Inflation expectations and inflation: The by far most important criterion. High inflation expectations must be compensated via higher bond yields. The main driver behind inflation expectations is the wage development, this is the form of inflation that typically persists. Price inflation follows inflation expectations with a certain lag. Wealth: The higher the wealth of a country, the lower the bond yields. Wealth is typically...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org