This update will be a bit shorter than usual. I’m in Miami awaiting Hurricane Irma. As of now, it looks like the eye of the storm will make landfall near Key West and continue west of us with the Naples/Ft. Myers area at risk. Or at least that’s the way it looks right now. I’ve done a lot of these storms though – I lost a house in Andrew in ’92 – and you never know what these things will do. We are secure in a house...

Read More »FX Weekly Review, September 04 – 09: Draghi Dovish? EUR and USD falling against CHF

EUR/CHF The euro rose close to CHF 1.15 with the ECB meeting this week. Finally traders realized that the ECB committed not to hike rates for a very long time. The ECB will review and take a first decision on the bond purchasing program this autumn. However, this program will come to an end only when the inflation target of 2% becomes in reach. Strangely the EUR/CHF reacted with losses only on Friday. Where will Euro...

Read More »FX Weekly Review, August 28 – September 02: The end of big euro rise?

EUR/CHF Let us remember why the euro has risen from 1.08 to 1.14 between June and August: Hopes that the French president Macron will help the French economy, similarly to the Trump reflation trade. Hopes that the ECB will finish their bond buying program earlier combined with quite good economic data. We are of the opinion that both points may be illusionary. The euro should not rise further. Politicians cannot...

Read More »Moscow Rules (for ‘dollars’)

In Ian Fleming’s 1959 spy novel Goldfinger, he makes mention of the Moscow Rules. These were rules-of-thumb for clandestine agents working during the Cold War in the Soviet capital, a notoriously difficult assignment. Among the quips included in the catalog were, “everyone is potentially under opposition control” and “do not harass the opposition.” Fleming’s book added another, “Once is an accident. Twice is...

Read More »FX Weekly Review, August 21 – August 26: Dollar Loses its Gains Against CHF

USD/CHF The dollar had some gains versus the franc during the last month, but it lost all during the last days. EUR/CHF The euro is still around 1.14, this is up 2.5% against one month ago. The rising momentum for EUR/CHF, however, seems to be fading. EUR/CHF and USD/CHF, August 26(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge Swiss Franc Currency Index (3...

Read More »United States: The Fed Tries To Tighten By Rates, But The System Instead Tightens By Repo

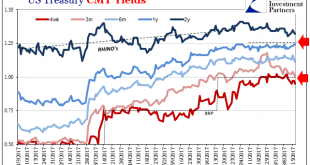

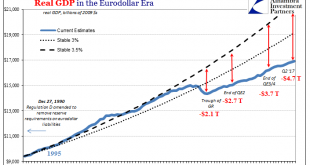

The Fed voted for the first federal funds increase in almost a decade on December 15, 2015. It was the official end of ZIRP, and though taking so many additional years to happen, to many it marked the start of recovery. The yield on the 2-year Treasury Note was 98 bps that day. A lot has happened between now and then, including three additional “rate hikes” dating back to December 2016, the last in June 2017. The yield...

Read More »FX Weekly Review, August 14 – August 19: CHF Recovers after Dovish Draghi Comments

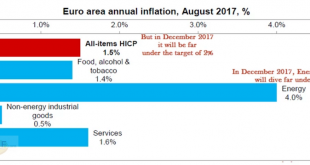

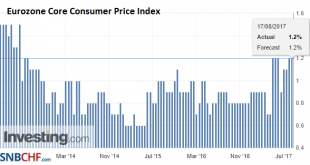

Overview The euro has lost some momentum versus the franc, the main reason is as usual monetary policy: Draghi does not want to talk about an early end of his bond buying programming at Jackson Hole. This had been confirmed by economic data: only 1.2% core inflation compared to a long-term inflation target of 2%. Consequently the Swissie appreciated during the week. Eurozone Core Consumer Price Index (CPI) YoY, Jul...

Read More »Global Asset Allocation Update: No Upside To Credit

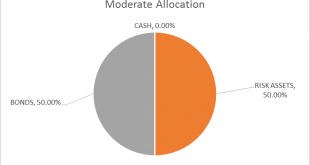

There is no change to the risk budget this month. For the moderate risk investor, the allocation between risk assets and bonds is unchanged at 50/50. There are other changes to the portfolio though so please read on. As I write this the stock market is in the process of taking a dive (well if 1.4% is a “dive”) and one can’t help but wonder if the long awaited and anticipated correction is finally at hand. Which means,...

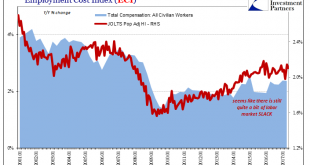

Read More »Data Dependent: Interest Rates Have Nowhere To Go

In October 2015, Federal Reserve Vice Chairman Bill Dudley admitted that the US economy might be slowing. In the typically understated fashion befitting the usual clownshow, he merely was acknowledging what was by then pretty obvious to anyone outside the economics profession. Dudley was at that moment, however, undaunted. His eye was cast toward the unemployment rate and that was nothing but encouraging no matter the...

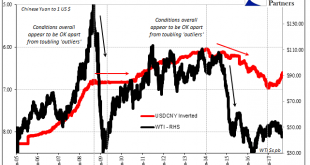

Read More »Oil Prices: The Center Of The Inflation Debate

The mainstream media is about to be presented with another (small) gift. In its quest to discredit populism, the condition of inflation has become paramount for largely the right reasons (accidents do happen). In the context of the macro economy of 2017, inflation isn’t really about consumer prices except as a broad gauge of hidden monetary conditions. Therefore, if inflation behaves as it is supposed to after so many...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org