USD/CHF EUR/CHF EUR/CHF and USD/CHF, October 16(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge USD/JPY [embedded content] USD/JPY with Technical Indicators, October 16(see more posts on USD/JPY, ) - Click to enlarge EUR/USD [embedded content] EUR/USD with Technical Indicators, October 16(see more posts on EUR/USD, ) - Click to enlarge GBP/USD [embedded content]...

Read More »Weekly Technical Analysis: 09/10/2017 – EURJPY, EURAUD, USDCHF, GOLD

USD/CHF EUR/CHF EUR/CHF and USD/CHF, October 10(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge EUR/JPY [embedded content] EUR/JPY with Technical Indicators, October 10(see more posts on EUR/JPY, ) - Click to enlarge EUR/AUD [embedded content] EUR/AUD with Technical Indicators, October 10(see more posts on eur/aud, ) - Click to enlarge USD/CHF [embedded content]...

Read More »Federal Reserve President Kashkari’s Masterful Distractions

The True Believer How is it that seemingly intelligent people, of apparent sound mind and rational thought, can stray so far off the beam? How come there are certain professions that reward their practitioners for their failures? The central banking and monetary policy vocation rings the bell on both accounts. Today we offer a brief case study in this regard. Photo credit: Linda Davidson / The Washington Post -...

Read More »Bi-Weekly Economic Review: Maximum Optimism?

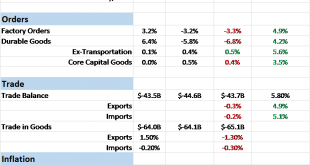

The economic reports of the last two weeks were generally of a more positive tone. The majority of reports were better than expected although it must be noted that many of those reports were of the sentiment variety, reflecting optimism about the future that may or may not prove warranted. Markets have certainly responded to the dreams of tax reform dancing in investors’ heads with US stock markets providing a steady...

Read More »Weekly Technical Analysis: 02/10/2017 – USDJPY, EURUSD, GBPUSD, USDCAD

USD/CHF EUR/CHF EUR/CHF and USD/CHF, October 05(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge USD/JPY [embedded content] USD/JPY with Technical Indicators, October 2 - Click to enlarge EUR/USD [embedded content] EUR/USD with Technical Indicators, October 2 - Click to enlarge GBP/USD [embedded content] GBP/USD with Technical Indicators, October 2 - Click to...

Read More »It Was Collateral, Not That We Needed Any More Proof

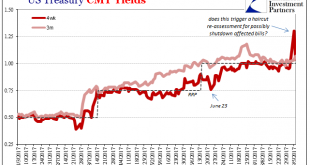

Eleven days ago, we asked a question about Treasury bills and haircuts. Specifically, we wanted to know if the spike in the 4-week bill’s equivalent yield was enough to trigger haircut adjustments, and therefore disrupt the collateral chain downstream. US Treasury, Jan - Sep 2017(see more posts on U.S. Treasuries, ) - Click to enlarge Within two days of that move in bills, the GC market for UST 10s had gone...

Read More »Weekly Technical Analysis: 25/09/2017 – USDJPY, EURUSD, GBPUSD, NZDUSD

USD/CHF EUR/CHF EUR/CHF and USD/CHF, September 23(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge EUR/USD [embedded content] USD/JPY [embedded content] GBP/USD [embedded content] NZD/USD [embedded content] Related posts: FX Weekly Review, August 28 – September 02: The end of big euro rise? FX Weekly Review, June 26 – July 01:...

Read More »Swimming The ‘Dollar’ Current (And Getting Nowhere)

The People’s Bank of China reported this week that its holdings of foreign assets fell slightly again in August 2017. Down about RMB 21 billion, almost identical to the RMB 22 billion decline in July, the pace of forex withdrawals is clearly much preferable to what China’s central bank experienced (intentionally or not) late last year at ten and even twenty times the rate of July and August. The US Treasury Department...

Read More »Bi-Weekly Economic Review: As Good As It Gets

The incoming economic data hasn’t changed its tone all that much in the last several years. The US economy is growing but more slowly than it once did and we hope it does again. It is frustrating for economic bulls and bears, never fully satisfying either. Probably more important is the frustration of the average American, a dissatisfaction with the status quo that permeates the national debate. The housing bubble...

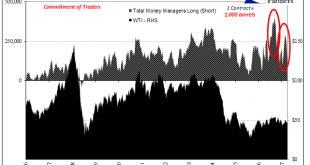

Read More »COT Report: Black (Crude) and Blue (UST’s)

Over the past month, crude prices have been pinned in a range $50 to the high side and ~$46 at the low. In the futures market, the price of crude is usually set by the money managers (how net long they shift). As discussed before, there have been notable exceptions to this paradigm including some big ones this year. It was earlier in February when money managers piled in to WTI longs, apparently expecting better things...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org