Swiss Franc vs USD and EUR The Swiss Franc entered the second week of stronger losses. While the euro gained 4% last week, the dollar appreciated against the Swiss Franc by 2% during this week. The euro could add another percent in the last days. The EUR/CHF reached 1.1521 after the strong US job figures. Finally, however the euro fell to 1.1451 for two reasons: Profit taking at the end of the week and secondly that...

Read More »U.S. Treasuries: Not Really Wrong On Bonds

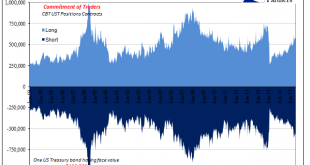

It is often said that the market for US Treasuries is the deepest and most liquid in the world. While that’s true, we have to be careful about what it is we are talking about. There is no single US Treasury market, and often differences can be striking. The most prominent example was, of course, October 15, 2014. In truth, the liquidity side of cash market UST’s has been diminished since around 2013. Largely as a...

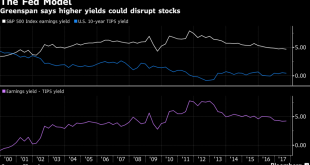

Read More »Greenspan Warns Stagflation Like 1970s “Not Good For Asset Prices”

Former Fed Chairman warns of bond bubble, stagflation “Moving into a … stagflation not seen since the 1970s” This will not be “good for asset prices” 10 Yr Gov bond yields fell from 15.8% in 1981 to 2.3% Interest rates will not stay low, will rise ‘reasonably fast’ “Normal” interest rates in 4%-5% range Inflation will not stay at historically low levels Gold “protects savings” and is “store of value” Gold is the...

Read More »Greenspan Warns Stagflation Like 1970s “Not Good For Asset Prices”

Former Fed Chairman warns of bond bubble, stagflation “Moving into a … stagflation not seen since the 1970s” This will not be “good for asset prices” 10 Yr Gov bond yields fell from 15.8% in 1981 to 2.3% Interest rates will not stay low, will rise ‘reasonably fast’ “Normal” interest rates in 4%-5% range Inflation will not stay at historically low levels Gold “protects savings” and is “store of value” Gold is the...

Read More »FX Weekly Review, July 24 – July 29: Swiss Franc getting crushed

Swiss Franc vs USD and EUR The Swiss franc was the only major foreign currency that fell against the dollar last week. The 2.6% decline was the largest in two years. Stops triggered in the euro-franc cross, reports of direct investment-related franc sales for yen, and conviction that the SNB will lag behind the other central banks is thought to be behind the move. The dollar high in June was near CHF0.9785, and the...

Read More »FX Weekly Review, July 17 – July 22: Euro and CHF move upwards against Dollar

Swiss Franc vs USD and EUR Both Swiss Franc and Euro were moving upwards against the dollar. So CHF gained 3% versus the dollar in the last month. The Euro is the strongest currency. CHF lost around 1.3% against the Euro. EUR/CHF and USD/CHF, July 22(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge Swiss Franc Currency Index (3 years) The Swiss Franc index is the trade-weighted...

Read More »FX Weekly Review, July 10 – July 15: CHF Winning against USD, but losing vs. Euro

Swiss Franc vs USD and EUR The Euro remained the strongest among EUR, CHF and USD during the last month. The Swiss lost against EUR 1.5%, while it gained versus the dollar 0.75%. EUR/CHF and USD/CHF, July 15(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge Swiss Franc Currency Index (3 years) The Swiss Franc index is the trade-weighted currency performance (see the currency...

Read More »FX Weekly Review, June 05 – June 10: Sterling Leads Dollar Recovery

Swiss Franc vs USD and EUR The US Dollar has lost 4% against the franc since the beginning of May, while the euro is down only 1%. Most important events in this week were the ECB meeting and the UK elections. The inability of the Tory Party to secure a parliamentary majority spurred a sharp decline in sterling. EUR/CHF and USD/CHF, June 10(see more posts on EUR/CHF, USD/CHF, )The picture shows that FX traders went...

Read More »FX Weekly Review, May 29 – June 03: Dollar Dogged by Disappointing Data

Swiss Franc vs USD and EUR While the Euro traded in the range between 1.08 and 1.09, the dollar declined by nearly 3%. Swiss Franc Currency Index (3 years) The Swiss Franc index is the trade-weighted currency performance (see the currency basket)On a three years interval, the Swiss Franc had a weak performance. The dollar index was far stronger. The dollar makes up 33% of the SNB portfolio and 25% of Swiss...

Read More »FX Weekly Review, May 22 – 27: Is the Dollar Going To Turn?

Swiss Franc vs USD and EUR The Federal Reserve is on track to hike rates in the middle of June. It will be the third hike since the November election. In addition to keeping the door open to another hike this year, the Federal Reserve has signaled its intention to begin, however slowly, the reduction of its balance sheet. In the meantime, regardless of potential changes in its risk assessment, the ECB is unlikely to...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org