To my mind, “reflation” has always proceeded under false pretenses. This goes for more than just the latest version, as we witnessed the same incongruity in each of the prior three. The trend is grounded in mere hope more than rational analysis, largely because I think human nature demands it. We are conditioned to believe especially in the 21st century that the worst kinds of things are either unrealistic or apply to...

Read More »Same Country, Different Worlds

To my mind, “reflation” has always proceeded under false pretenses. This goes for more than just the latest version, as we witnessed the same incongruity in each of the prior three. The trend is grounded in mere hope more than rational analysis, largely because I think human nature demands it. We are conditioned to believe especially in the 21st century that the worst kinds of things are either unrealistic or apply to...

Read More »US Trade Skews

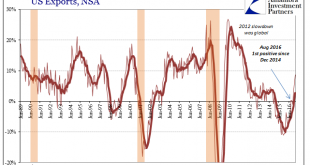

US trade statistics dramatically improved in January 2017, though questions remain as to interpreting by how much. On the export side, US exports of goods rose 8.7% year-over-year (NSA). While that was the highest growth rate since 2012, there is part symmetry to account for some of it. Exports in the latter half of 2015 and for that first month of 2016 were contracting at double digit rates, the base effects of the...

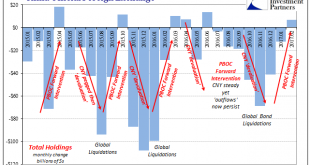

Read More »China And Reserves, A Straightforward Process Unnecessarily Made Into A Riddle

The fact that China reported a small increase in official “reserves” for February 2017 is one of the least surprising results in all of finance. The gamma of those reserves is as predictable as the ticking clock of CNY, in no small part because what is behind the changes in those balances are the gears that lie behind face of the forex timepiece. Yet, each and every time the delta pushes positive there is the same...

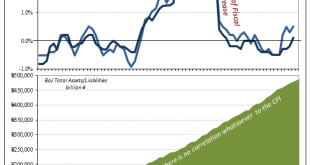

Read More »Do Record Eurodollar Balances Matter? Not Even Slightly

The BIS in its quarterly review published yesterday included a reference to the eurodollar market (thanks to M. Daya for pointing it out). The central bank to central banks, as the outfit is often called, is one of the few official institutions that have taken a more objective position with regard to the global money system. Of the very few who can identify eurodollars, or have even heard of them, the BIS while not...

Read More »Manufacturing Back To 2014

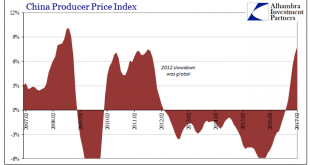

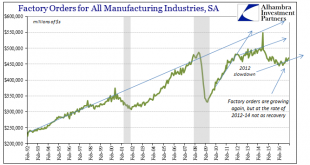

The ISM Manufacturing PMI registered 57.7 in February 2017, the highest value since August 2014 (revised). It was just slightly less than that peak in the 2014 “reflation” cycle. Given these comparisons, economic narratives have been spun further than even the past few years where “strong” was anything but. The ISM’s gauge of orders increased to the highest level in just over three years, while an index of production...

Read More »Bi-Weekly Economic Review

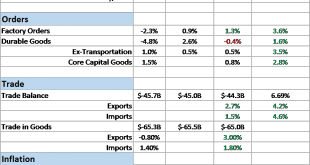

Economic Reports Scorecard The economic data released since my last update has been fairly positive but future growth and inflation expectations, as measured by our market indicators, have waned considerably. There is now a distinct divergence between the current data, stocks and bonds. Bond yields, both real and nominal, have fallen recently even as stocks continue their relentless march higher. The incoming, current...

Read More »True Cognitive Dissonance

There is gold in Asia, at least gold of the intellectual variety for anyone who wishes to see it. The Chinese offer us perhaps the purest view of monetary conditions globally, where RMB money markets are by design tied directly to “dollar” behavior. It is, in my view, enormously helpful to obsess over China’s monetary system so as to be able to infer a great deal about the global monetary system deep down beyond the...

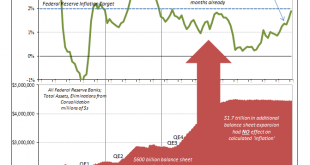

Read More »Real Disposable Income: Headwinds of the Negative

The PCE Deflator for January 2017 rose just 1.89% year-over-year. It was the 57th consecutive month less than the 2% mandate (given by the Fed itself when in early 2012 it made the 2% target for this metric its official definition of price stability). Though there is a chance that the streak will end with the update for February, it should not go unnoticed how weak that number is given that oil prices in January were...

Read More »Why Is the Cost of Living so Unaffordable?

Strip away the centralized power that protects and funds cartels, and prices would plummet. The mainstream narrative is “the problem is low wages.” Actually, the problem is the soaring cost of living. If essentials such as healthcare, housing, higher education and government services were as cheap as they once were, a wage of $10 or $12 an hour would be more than enough to maintain a decent everyday life. Here are some...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org