Ahead of tomorrow’s payroll report the narrative is being set that it will be weak because of Harvey and Irma. Historically, major storms have had a negative effect on the labor market. Just as auto sales were up sharply in September very likely because of the hurricane(s) and could remain that way for several months, payrolls could be weak for the same reasons and the same timeframe. That said, we can’t pretend as if...

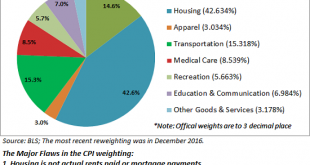

Read More »Be Careful What You Wish For: Inflation Is Much Higher Than Advertised

What the Federal Reserve is actually whining about is not low inflation–it’s that high inflation isn’t pushing wages higher like it’s supposed to. It’s not exactly a secret that real-world inflation is a lot higher than the official rates–the Consumer Price Index (CPI) and Personal Consumption Expenditures PCE). As many observers have pointed out, there are two primary flaws in the official measures of inflation: 1....

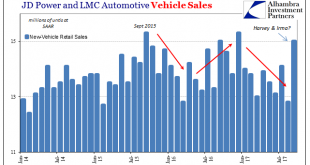

Read More »Auto Sales Up Last Month, But Why?

Auto sales rebounded sharply in September, with most major car manufacturers reporting better numbers. Sales at Ford were up 8.9% last month from September 2016; +11.9% at GM; Toyota +14.9%; Nissan +9.5%; Honda +6.8%. The only negatives were reported by FCA (-9.7%) and Mercedes (-1.7%). US Vehicle Sales, Jan 2014 - Jul 2017(see more posts on vehicle sales, ) - Click to enlarge The question is whether these...

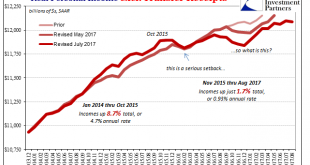

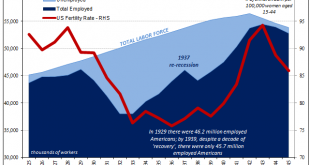

Read More »Incomes Are What Matters, So Bad Month, Bad Year, Bad Decade

Sometimes economics can be complicated, such as why the labor market has slowed in such lingering fashion since early 2015. Sometimes economics can be easy, such as why there is so much less to the economy this year than thought. The easy part relates to the hard part. The labor market slowed and so did national income. Though so much of official focus is on debt supplementation, it’s always, always about income. US...

Read More »What If the Tax Donkeys Rebel?

I would hazard a guess that an increasing number of tax donkeys are considering dropping out as a means of increasing their happiness and satisfaction with life. Since federal income taxes are in the spotlight, let’s ask a question that rarely (if ever) makes it into the public discussion: what if the tax donkeys who pay most of the tax rebel? There are several likely reasons why this question rarely arises. 1. Most...

Read More »Bi-Weekly Economic Review: Maximum Optimism?

The economic reports of the last two weeks were generally of a more positive tone. The majority of reports were better than expected although it must be noted that many of those reports were of the sentiment variety, reflecting optimism about the future that may or may not prove warranted. Markets have certainly responded to the dreams of tax reform dancing in investors’ heads with US stock markets providing a steady...

Read More »Surprise! The Rules Will Change (But Not to Your Benefit)

These expedient fixes end up crippling the mechanisms that are needed to actually solve the systemic sources of the crisis. We can add a third certainty to the two standard ones (death and taxes): The rules will suddenly change when a financial crisis strikes. Why is this a certainty? The answer is complex, as it draws on human nature, politics and the structure of societies/economies ruled by centralized states...

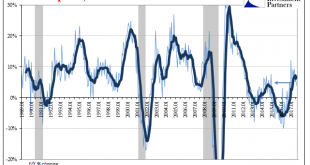

Read More »US: Reflation Check

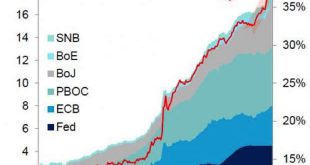

There is a difference between reflation and recovery. The terms are similar and relate to the same things, but in many ways the latter requires first the former. To get to recovery, the economy must reflate if in contraction it was beaten down in money as well as cyclical forces. In the Great Crash of 1929 and after, reflation was required because of the wholesale devastation of the money supply. By pumping up new...

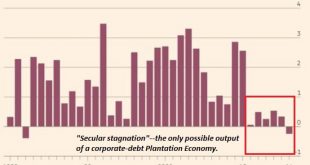

Read More »Stagnation Is Not Just the New Normal–It’s Official Policy

Japan is a global leader is how to gracefully manage stagnation. Although our leadership is too polite to say it out loud, they’ve embraced stagnation as the new quasi-official policy. The reason is tragi-comically obvious: any real reform would threaten the income streams gushing into untouchably powerful self-serving elites and fiefdoms. In our pay-to-play centralized form of governance, any reform that threatens the...

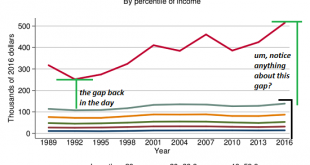

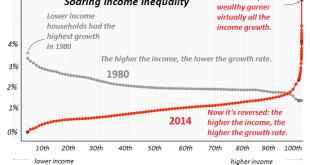

Read More »This Chart Defines the 21st Century Economy

There is nothing inevitable about such vast, fast-rising income-wealth inequality; it is the only possible output of our financial and pay-to-play political system. One chart defines the 21st century economy and thus its socio-political system: the chart of soaring wealth/income inequality. This chart doesn’t show a modest widening in the gap between the super-wealthy (top 1/10th of 1%) and everyone else: there is a...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org