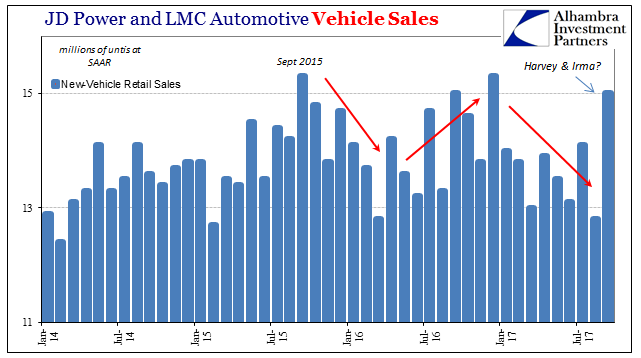

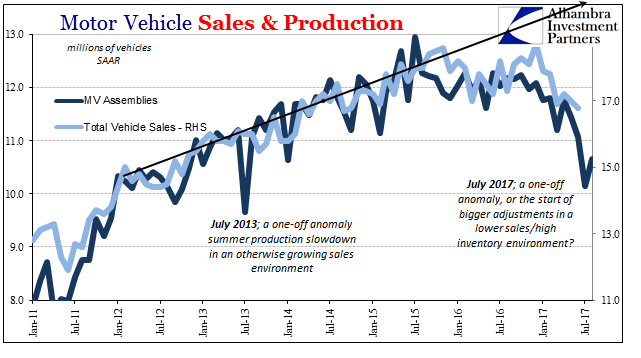

Auto sales rebounded sharply in September, with most major car manufacturers reporting better numbers. Sales at Ford were up 8.9% last month from September 2016; +11.9% at GM; Toyota +14.9%; Nissan +9.5%; Honda +6.8%. The only negatives were reported by FCA (-9.7%) and Mercedes (-1.7%). US Vehicle Sales, Jan 2014 - Jul 2017(see more posts on vehicle sales, ) - Click to enlarge The question is whether these numbers are sustainable beyond September and maybe the few months after. Auto sales in Texas were particularly robust as replacements are being sought for vehicles damaged during and after Hurricane Harvey. It is likely that will continue for some time and be extended to Florida in the wake of Hurricane

Topics:

Jeffrey P. Snider considers the following as important: Auto Production, Auto Sales, broken windows fallacy, currencies, economy, Featured, Federal Reserve/Monetary Policy, Ford, GM, Markets, motor vehicles, newslettersent, The United States, Toyota, U.S. Personal Income, vehicle sales

This could be interesting, too:

investrends.ch writes Ford und Renault bauen gemeinsam günstige E-Autos für Europa

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Marc Chandler writes March 2025 Monthly

| Auto sales rebounded sharply in September, with most major car manufacturers reporting better numbers. Sales at Ford were up 8.9% last month from September 2016; +11.9% at GM; Toyota +14.9%; Nissan +9.5%; Honda +6.8%. The only negatives were reported by FCA (-9.7%) and Mercedes (-1.7%). |

US Vehicle Sales, Jan 2014 - Jul 2017(see more posts on vehicle sales, ) |

| The question is whether these numbers are sustainable beyond September and maybe the few months after. Auto sales in Texas were particularly robust as replacements are being sought for vehicles damaged during and after Hurricane Harvey. It is likely that will continue for some time and be extended to Florida in the wake of Hurricane Irma. Estimates differ, but there is surely hundreds of thousands of cars and trucks in no working condition fit for further use. |

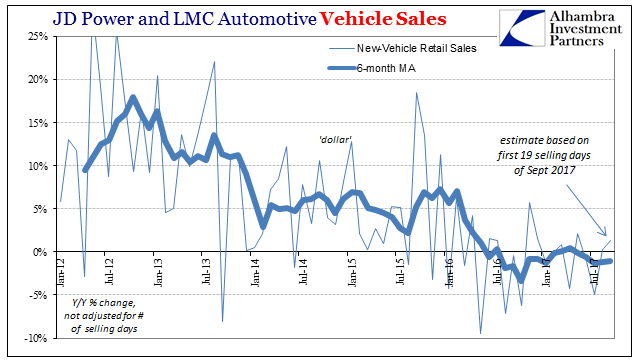

US Vehicle Sales, Jan 2012 - Jul 2017(see more posts on vehicle sales, ) |

| Ford’s head of sales Mark LaNeve was quick to note that sales were up in all regions, but that they had been “particularly strong” in and around Houston. GM’s chief economist Mustafa Mohatarem suggested that, “overall strength of the U.S. economy is the main force driving the market,” without clarifying that he has been saying almost exactly the same thing for over a year while auto sales slumped. |

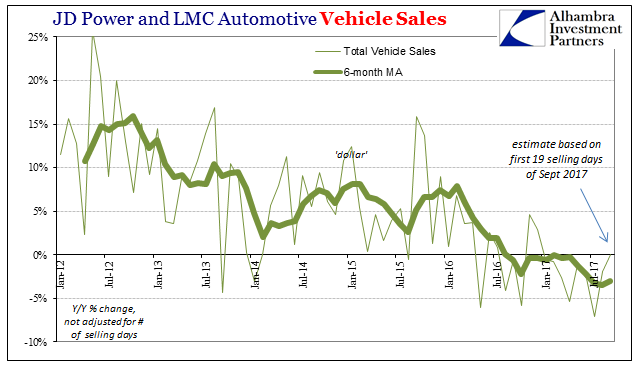

US Vehicle Sales, Jan 2012 - Jul 2017(see more posts on vehicle sales, ) |

| One executive for Autotrader predicted instead “this will be a short-lived party.” Another auto website, Edmunds, noted that vehicle sales were up 109% in the Houston area in the three weeks following Harvey as compared to the three weeks prior to its arrival.

I guess we will find out over the next few months. Sales had certainly been trending lower going back to December. Like everything else in the economy, there was the downturn in 2015-16 that gave way to some level of rebound in the second half of last year, an upturn that just didn’t continue into 2017. |

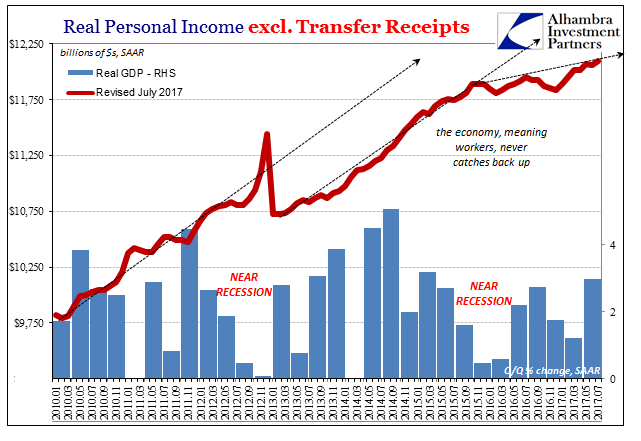

US Real Personal Income, Jan 2010 - Jul 2017(see more posts on U.S. Personal Income, ) |

| Fleet sales accounted for another big part of the sales gains, especially for Ford and GM. This part of the auto market had been a significant drag on sales going back to last year. It adds another level of uncertainty as to whether it represents a one-time pickup for rental companies in particular to renew their fleets, or if they are back in the business of steadily buying new vehicles.

Either way, there is no denying these were good numbers and desperately needed for an auto sector that had swung way out of balance this year. It doesn’t, of course, propose once-in-a-century type hurricanes as economic “stimulus”, for whatever might be briefly gained in the auto sector is more than lost elsewhere around Texas and Florida (especially the insurance carriers and the homeowners who next year will surely be shocked at their premium increases and a good many cancellations). |

US Motor Vehicle Sales and Production, Jan 2011 - Jul 2017(see more posts on motor vehicle sales, ) |

Tags: Auto Production,Auto Sales,broken windows fallacy,currencies,economy,Featured,Federal Reserve/Monetary Policy,Ford,gm,Markets,motor vehicles,newslettersent,Toyota,U.S. Personal Income,vehicle sales