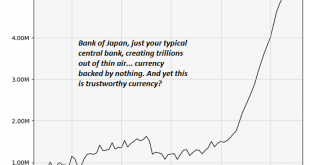

All of which brings us to the “crazy” idea of backing fiat currencies with cryptocurrencies, an idea I first floated back in 2013, long before the current crypto-craze emerged. Exhibit One: here’s your typical central bank, creating trillions of units of currency every year, backed by nothing but trust in the authority of the government, created at the whim of a handful of people in a room and distributed to their...

Read More »Chart of the Week: Collateral

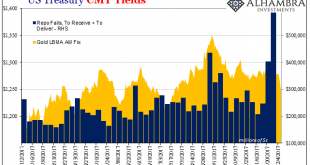

It’s been a week of quite righteous focus on collateral. The 4-week bill equivalent yield closes it at just 114 bps, with only three days left before the RRP “floor” is moved up by the FOMC to 125 bps. That’s too much premium in price, though we know why given what FRBNY reported for repo fails last week. With all that, there’s really nothing much to say about what’s below. OK, there is, but I’ll save that for next...

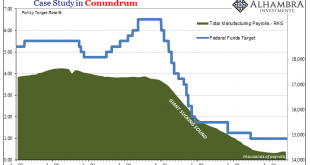

Read More »Defining The Economy Through Payrolls

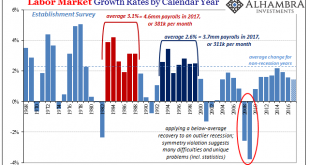

The year 2000 was a transition year in a lot of ways. Though Y2K amounted to mild mass hysteria, people did have to get used to writing the date with 20 in front of the year rather than 19. It was a new millennium (depending on your view of Year 0) that seemed to have started off under the best possible terms. Not only were stocks on fire at the outset, the economy was, too. The idea of this “new economy” leading...

Read More »A Radical Critique of Universal Basic Income

This critique reveals the unintended consequences of UBI. Readers have been asking me what I thought of Universal Basic Income (UBI) as the solution to the systemic problem of jobs being replaced by automation.To answer this question, I realized I had to start by taking a fresh look at work and its role in human life and society. And since UBI is fundamentally a distribution of money, I also needed to take a fresh...

Read More »Giant Sucking Sound Sucks (Far) More Than US Industry Now

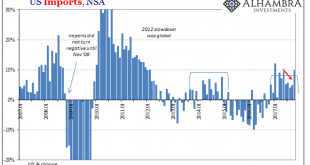

There are two possibilities with regard to stubbornly weak US imports in 2017. The first is the more obvious, meaning that the domestic goods economy despite its upturn last year isn’t actually doing anything positive other than no longer being in contraction. The second would be tremendously helpful given the circumstances of American labor in the whole 21st century so far. In other words, perhaps US consumers really...

Read More »Reduced Trade Terms Salute The Flattened Curve

The Census Bureau reported earlier today that US imports of foreign goods jumped 9.9% year-over-year in October. That is the second largest increase since February 2012, just less than the 12% import growth recorded for January earlier this year. US Imports, Jan 2007 - 2017 - Click to enlarge In both monthly cases, however, the almost normal rates of increase which would have at least suggested moving closer to a...

Read More »Bi-Weekly Economic Review: Who You Gonna Believe?

We’ve had a pretty good run of data recently and with the tax bill passing the Senate one would expect to see markets react positively, to reflect renewed optimism about economic growth. We have improving economic data on pretty much a global basis. It isn’t a boom by any stretch of the imagination but there is no doubt that the rate of change has recently been more positive. We also have a change in tax policy that...

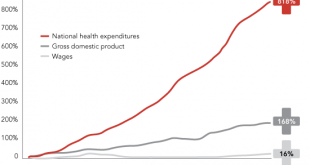

Read More »The Cost Basis of our Economy is Spiraling Out of Control

What will it take to radically reduce the cost basis of our economy? If we had to choose one “big picture” reason why the vast majority of households are losing ground, it would either be the stagnation of income or the spiraling out of control cost basis of our economy, that is, the essential foundational expenses of households, government and enterprise. Clearly, both rising costs and stagnating income cause...

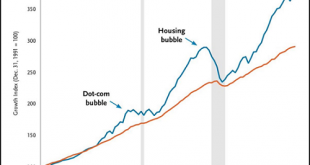

Read More »Stock Market 2018: The Tao vs. Central Banks

The central banks claim omnipotent financial powers, and their comeuppance is overdue. I will be the first to admit that invoking the woo-woo of the Tao as the reason to expect a reversal of the stock market in 2018 smacks of Bearish desperation. With everything coming up roses in much of the global economy, there is precious little foundation for calling a tumultuous end to the global Bull Market other than variations...

Read More »Did Anyone Do Even a Minimal Check on the Sensationalist Bitcoin Electrical Consumption Story?

Check the context before uncritically accepting sensationalist conclusions. Let’s start with a primer on how to write a sensationalist story that can be passed off as “journalism:” 1. Locate credible-sounding data that can be de-contextualized, i.e. sensationalized. 2. Present the data as “fact” rather than data that requires verification by disinterested researchers. 3. Exaggerate the data as much as possible and set...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org