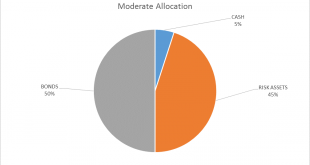

There is no change to the risk budget this month. For the moderate risk investor the allocation to bonds is 50%, risk assets 45% and cash 5%. The extreme overbought condition of the US stock market did not correct since the last update and so I will continue to hold a modest amount of cash. Prediction is very difficult, especially about the future… Niels Bohr Every time I see that quote I think to myself, “but that...

Read More »The Asymmetry of Bubbles: the Status Quo and Bitcoin

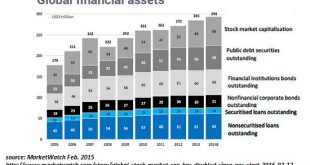

Shall we compare the damage that will be done when all these bubbles pop? Regardless of one’s own views about bitcoin/cryptocurrency, what is truly remarkable is the asymmetry that is applied to questioning the status quo and bitcoin. As I noted yesterday, everyone seems just fine with throwing away $20 billion in electricity annually in the U.S. alone to keep hundreds of millions of gadgets in stand-by mode, but the...

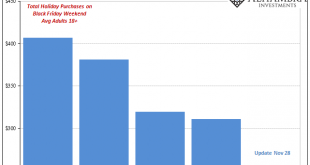

Read More »Fading Black Friday

Black Friday was once the king of all shopping. A retailer could make its year up on that one day, often by gimmicking its way to insane single-day volume. Those days, however, are certainly over. Though the day after Thanksgiving still means a great deal, as the annual flood of viral consumer brawl videos demonstrate, it’s just not what it once was. The change has meant something in terms of economic commentary, too....

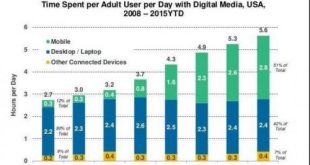

Read More »Addictions: Social Media & Mobile Phones Fall From Grace

Identifying social media and mobile phones as addictive is only the first step in a much more complex investigation. For everyone who remembers the Early Days of social media and mobile phones, it’s been quite a ride from My Space and awkward texting on tiny screens to the current alarm over the addictive nature of social media and mobile telephony. The emergence of withering criticism of Facebook and Google is a new...

Read More »Durable Goods Only About Halfway To Real Reflation

Durable goods were boosted for a second month by the after-effects of Harvey and Irma. New orders excluding those from transportation industries rose 8.5% year-over-year in October 2017, a slight acceleration from the 6.5% average of the four previous months. Shipments of durable goods (ex transportation) also rose by 8% last month. US Core Durable Goods Orders, Jan 1993 - Jan 2017(see more posts on U.S. Core Durable...

Read More »Beware the Marginal Buyer, Borrower and Renter

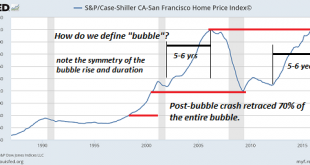

Bubbles always look unstoppable, yet they always burst.When times are good, the impact of the marginal buyer, borrower and renter on the market is often overlooked. By “marginal” I mean buyers, borrowers and renters who have to stretch their finances to the maximum to afford the purchase, loan or rent. In bubble manias, buyers of real estate reckon the potential appreciation gains are worth the risk of buying a house...

Read More »Bi-Weekly Economic Review: A Whirlwind of Data

The economic data of the last two weeks was generally better than expected, the Citigroup Economic Surprise index near the highs of the year. Still, as I’ve warned repeatedly over the last few years, better than expected should not be confused with good. We go through mini-cycles all the time, the economy ebbing and flowing through the course of a business cycle. This being a particularly long half cycle, it has had...

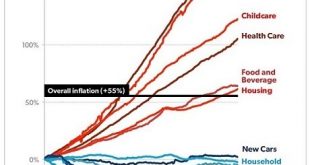

Read More »Want Widespread Prosperity? Radically Lower Costs

As long as this is business as usual, it’s impossible to slash costs and boost widespread prosperity. It’s easy to go down the wormhole of complexity when it comes to figuring out why our economy is stagnating for the bottom 80% of households. But it’s actually not that complicated: the primary driver of stagnation, decline of small business start-ups, etc. is costs are skyrocketing to the point of unaffordability. As I...

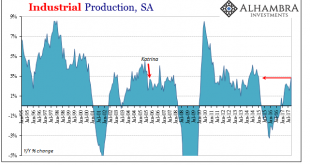

Read More »Industrial Production Still Reflating

Industrial Production benefited from a hurricane rebound in October 2017, rising 2.9% above October 2016. US Industrial Production, Jan 1995 - Nov 2017(see more posts on U.S. Industrial Production, ) - Click to enlarge That is the highest growth rate in nearly three years going back to January 2015. With IP lagging behind the rest of the manufacturing turnaround, this may be the best growth rate the sector will...

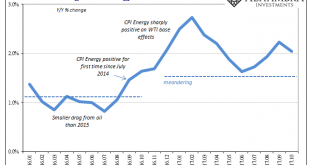

Read More »Can’t Hide From The CPI

On the vital matter of missing symmetry, consumer price indices across the world keep suggesting there remains none. Recoveries were called “V” shaped for a reason. Any economy knocked down would be as intense in getting back up, normal cyclical forces creating momentum for that to (only) happen. In the context of the past three years, symmetry is still nowhere to be found. It’s confounding even central bankers who up...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org