Summary:

The central banks claim omnipotent financial powers, and their comeuppance is overdue. I will be the first to admit that invoking the woo-woo of the Tao as the reason to expect a reversal of the stock market in 2018 smacks of Bearish desperation. With everything coming up roses in much of the global economy, there is precious little foundation for calling a tumultuous end to the global Bull Market other than variations of nothing lasts forever. Invoking the Tao specifically calls for extremes to return or reverse to the opposite polarity: this is expressed in the line from Lao Tzu, The way of the Tao is reversal or Reversal is the movement of Tao. In other words, extremes of bullishness lead to extremes of

Topics:

Charles Hugh Smith considers the following as important: Featured, newsletter, The United States

This could be interesting, too:

The central banks claim omnipotent financial powers, and their comeuppance is overdue. I will be the first to admit that invoking the woo-woo of the Tao as the reason to expect a reversal of the stock market in 2018 smacks of Bearish desperation. With everything coming up roses in much of the global economy, there is precious little foundation for calling a tumultuous end to the global Bull Market other than variations of nothing lasts forever. Invoking the Tao specifically calls for extremes to return or reverse to the opposite polarity: this is expressed in the line from Lao Tzu, The way of the Tao is reversal or Reversal is the movement of Tao. In other words, extremes of bullishness lead to extremes of

Topics:

Charles Hugh Smith considers the following as important: Featured, newsletter, The United States

This could be interesting, too:

RIA Team writes The Importance of Emergency Funds in Retirement Planning

Nachrichten Ticker - www.finanzen.ch writes Gesetzesvorschlag in Arizona: Wird Bitcoin bald zur Staatsreserve?

Nachrichten Ticker - www.finanzen.ch writes So bewegen sich Bitcoin & Co. heute

Nachrichten Ticker - www.finanzen.ch writes Aktueller Marktbericht zu Bitcoin & Co.

The central banks claim omnipotent financial powers, and their comeuppance is overdue.

I will be the first to admit that invoking the woo-woo of the Tao as the reason to expect a reversal of the stock market in 2018 smacks of Bearish desperation. With everything coming up roses in much of the global economy, there is precious little foundation for calling a tumultuous end to the global Bull Market other than variations of nothing lasts forever.

Invoking the Tao specifically calls for extremes to return or reverse to the opposite polarity: this is expressed in the line from Lao Tzu, The way of the Tao is reversal or Reversal is the movement of Tao.

In other words, extremes of bullishness lead to extremes of bearishness, just as the extremes of bearishness in March 2009 (S&P 500 at 667) led to the current extremes of bullishness (S&P 500 2,600).

Translations of this line add color to the concept:

To return is to complete the movement of the Tao.

Reversion is the action of Tao.

Turning back is Tao’s motion.

Tao moves by returning.

Cyclic reversion is Tao’s movement.

Reversal is the action of Tao.

Polar opposition helps the movement of the Way.

|

But there is another more subtle interpretation of The way of the Tao is reversal: in this view, only those who have rebelled against the Tao by distorting the natural order of things can push dynamics to extremes. Those who rebel against the Tao by pushing things to extremes will find the Tao will reverse their extreme to the opposite polarity.

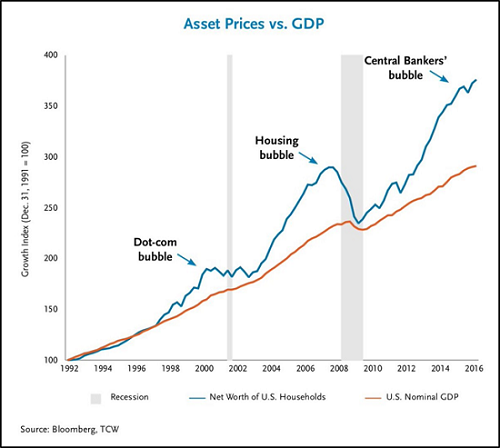

Central banks have pushed markets to extremes of liquidity, leverage, moral hazard, low volatility and “the central banks have our back” complacency. We all know they have distorted markets by backstopping losses, buying trillions of dollars in assets, lowering bond yields to negative territory (especially when adjusted for real-world inflation) and making the stock market the signaling device that is supposed to reflect the fundamental robustness of the global economy.

All of these actions pushed against the Tao, and the Tao is about to return to the Bearish polarity. Central banks are quietly trying to back away from their extremes, but it’s too little, too late: a full reversal is now baked in, and whatever central banks do from here on will only make matters worse.

Mess with the Tao, the Tao eventually pushes back, and reverses the entire move. My reading of the tea leaves is 2018 is the year the Tao crushes the central banks’ manipulated markets. The central banks claim omnipotent financial powers, and their comeuppance is overdue.

|

Asset Prices vs GDP, 1992 - 2016 |

Tags: Featured,newsletter