In Die Volkswirtschaft, Ernst Baltensperger and Peter Kugler summarize the history of the Swiss Franc since the mid 19th century: After 1973, the Swiss Franc has been strong. Swiss Franc yields have been lower than what uncovered interest parity would suggest. Before 1914, the Swiss Franc was weak in the sense that it enjoyed only limited credibility. In periods with fixed exchange rates, Swiss Franc yields typically exceeded yields in French Franc or Sterling. Throughout the 20th...

Read More »U.S. Imports Record Amount Of Gold From Switzerland In July

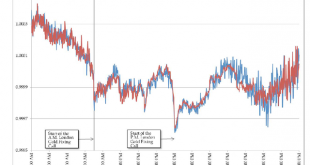

U.S. Gold Imports from Switzerland Monthly It seems as if the tide has changed as the U.S. imported a record amount of gold from Switzerland in July. Normally, the flow of gold from the United States has been heading toward Switzerland. For example, when the U.S. exported a record 691 metric tons (mt) of gold in 2013, Switzerland received 284 mt, which accounted for 41% of the total. Compare that to the paltry 3...

Read More »Un-Becoming American – One Man’s Painful Journey To Renouncing Citizenship

Submitted by ‘Kevnice’ via ForeignByNature.com, In April 2012, I returned to Switzerland – my country of birth – to commence a new phase of my adult life. Naturally, one of the first steps to undertake when establishing oneself in a new country is to open a bank account. I went down to the local Raiffeisen bank branch in the village of Aesch, Luzern, where my relatives and ancestors had lived and worked as farmers for...

Read More »Hanging by a Thread: “Very skeptical” judge – a former FBI/SEC official, eyes London Gold and Silver Fix lawsuits

By Allan Flynn, Guest Post at BullionStar.com Five months have lapsed without decision, since London gold and silver benchmark-rigging class action lawsuits received a cool response in a Manhattan court. Transcripts from April hearings show, in the absence of direct evidence, the claims dissected by a “very skeptical” judge, and criticized by defendants for lack of facts suggesting collusion, among other things. Judge Valerie E. Caproni, former white-collar...

Read More »Confiscation: Sorry, You Can’t Have Your Gold

Submitted by Jeff Thomas via InternationalMan.com, We warn regularly of the risk involved in storing wealth in banks. They’ve made the removal of your deposits increasingly difficult in addition to colluding with governments to allow them to legally freeze or confiscate your money. To add insult to injury, they’re creating reporting requirements with regard to the contents of safe deposit boxes and restricting what...

Read More »Best Countries To Store Gold: How Did America, A Serial Defaulter, Make The Cut?

[unable to retrieve full-text content]An era of slowing growth, falling corporate profits, record debt levels, and currency debauchment has many investors buying gold as a bet against global central banks. Holding that gold outside the banking system, and for some, outside one’s own country, are increasingly popular options. Canada, Switzerland, and four other countries have particularly attractive characteristics.

Read More »Rogoff Warns “Cash Is Not Forever, It’s A Curse”

Submitted by Christoph Gisiger via Finanz und Wirtschaft, Kenneth Rogoff, Professor of Public Policy at Harvard University, postulates to get rid of cash. In his opinion, killing big bills would hamper organized crime and make negative interest more effective. Kenneth Rogoff makes a provocative proposal. One of the most influential economists on the planet, he wants to phase out cash. «Paper currency lies at...

Read More »Strong Swiss growth lessens chance SNB will act

Macroview Stronger-than-forecast growth means the central bank is unlikely to alter monetary policy this month Switzerland: Real GDP Growth Swiss real GDP growth data surprised on the upside in Q2, expanding by 0.6% q-o-q (and 2.5% q-o-q annualised). In addition, growth in the three previous quarters was revised significantly higher. As a result, our GDP growth forecast for growth in Switzerland rises mechanically...

Read More »Strong Swiss growth lessens chance SNB will act

Macroview Stronger-than-forecast growth means the central bank is unlikely to alter monetary policy this month Swiss real GDP growth data surprised on the upside in Q2, expanding by 0.6% q-o-q (and 2.5% q-o-q annualised). In addition, growth in the three previous quarters was revised significantly higher. As a result, our GDP growth forecast for growth in Switzerland rises mechanically from 0.9% to 1.5% for 2016.GDP breakdown by expenditure component was less upbeat than the headline number...

Read More »Attack The Fed’s War On Savers, Workers And The Unborn (Taxpayers)

Submitted by David Stockman via Contra Corner blog, The central banks have gone so far off the deep-end with financial price manipulation that it is only a matter of time before some astute politician comes after them with all barrels blasting. As a matter of fact, that appears to be exactly what Donald Trump unloaded on bubble vision this morning: By keeping interest rates low, the Fed has created a “false stock...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org