Submitted by Jeff Thomas via InternationalMan.com, We warn regularly of the risk involved in storing wealth in banks. They’ve made the removal of your deposits increasingly difficult in addition to colluding with governments to allow them to legally freeze or confiscate your money. To add insult to injury, they’re creating reporting requirements with regard to the contents of safe deposit boxes and restricting what can be stored in them – again, at risk of confiscation. More and more, banks are becoming one of the more risky places to store wealth in any form. Not surprising, then, that many people are returning to those facilities that treat wealth storage the way the first banks did millennia ago – vault facilities that store your wealth for a fee but engage in no other banking activities. But, in suggesting to our readers that such facilities are a better bet, I’ve also repeatedly warned readers that many such facilities don’t store actual, physical gold. They instead provide a contract to you that states that they will deliver an agreed-upon amount of gold upon demand. The trouble with this idea is that it becomes tempting for such facilities to sign such a contract with you and collect the purchase price but never actually purchase and store any gold.

Topics:

Jeff Thomas considers the following as important: ETC, Featured, Gold&Swiss, Hong Kong, newsletter, Precious Metals, Switzerland

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Submitted by Jeff Thomas via InternationalMan.com,

More and more, banks are becoming one of the more risky places to store wealth in any form. Not surprising, then, that many people are returning to those facilities that treat wealth storage the way the first banks did millennia ago – vault facilities that store your wealth for a fee but engage in no other banking activities.

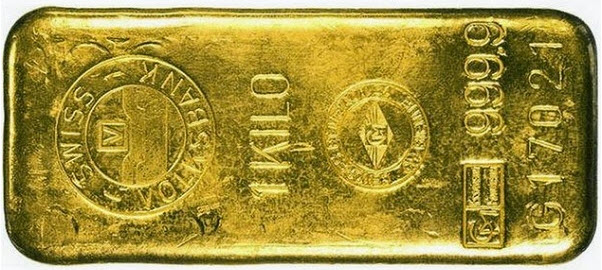

But, in suggesting to our readers that such facilities are a better bet, I’ve also repeatedly warned readers that many such facilities don’t store actual, physical gold. They instead provide a contract to you that states that they will deliver an agreed-upon amount of gold upon demand. The trouble with this idea is that it becomes tempting for such facilities to sign such a contract with you and collect the purchase price but never actually purchase and store any gold. It’s been estimated that the total worldwide value of such contracts equals 150 times the amount of gold in existence in the world.

Uh-oh.

This is why it’s imperative that you purchase only physical, allocated gold.

And another caution: I’ve repeatedly stated that, although many of the most secure facilities in the world are located in North America and Europe, these jurisdictions are on the cusp of economic crisis, a fact that suggests that, if and when the crisis arrives, the rule book will be thrown out the window. Governments and facilities alike may prove untrustworthy and, at some point, you may drop by the facility to withdraw your gold and be told, “Sorry, we’re unable to provide delivery.” There could be a multitude of reasons given, hoops to jump through, and endless red tape to deal with. And still, in the end, you may never be able to take delivery.

It’s for these reasons that we advise that, although nothing in life is guaranteed, you should always protect your wealth by choosing the least risky option.

This means that you should follow two simple rules – Rule #1: Select the jurisdiction with the best laws and reputation. Rule #2: Make sure there’s a reputable storage facility in that jurisdiction that has a Class III vault and a contract that meets your needs.

But am I being overly cautious when I so frequently offer this advice? Unfortunately, no. I’ve predicted that, in the future, as we get closer to a monetary crisis, banks and storage facilities that are located in countries that are likely to be heavily affected will work ever harder to avoid releasing either money on deposit (in the case of banks) and precious metals (in the case of storage facilities).

Recently, the reports that I’ve been receiving from wealth storage facilities in advantageous jurisdictions are indicating that that prediction is beginning to come to fruition. In case after case, clients are having a harder time getting their money and their metals out. In most cases, those institutions that don’t wish to deliver are creating red tape, stalling techniques (which are costly in both time and money), and, in some cases, outright refusals to deliver.

Let’s look at two actual examples – one of a bank, one of a wealth-storage facility.

USA: A client asks his bank to wire transfer US$178,000 in funds to an overseas facility to purchase precious metals for storage. The bank then created a series of roadblocks:

- Required a written request with an original, signed copy to be hand-delivered.

- Once that was done, a voice authorization of the letter by phone was required.

- Once that was done, it required the client to receive a PIN number, which would take several days to create and would need to be sent by courier.

- After the client jumped through all those hoops, the bank changed its requirements completely, requiring that a cashier’s cheque be sent instead, which required ten days clearance.

Lost time – four weeks from date of first request.

Austria: A client tries to transfer his allocated 138 gold Philharmonics from his bank to a facility in another jurisdiction. The bank repeatedly produced roadblocks, as follows:

- Refused to ship the products themselves and refused to arrange shipment.

- Refused to release the goods to FedEx when they arrived, even though proof of insurance was provided. The bank then insisted on the hiring of a Brinks truck.

- They then refused to release the coins at all, except to another bank.

- They then claimed that they were “not ready” to release the coins. The client was invited to “try again” if he wished. (Eight attempts were required.)

- Finally, they agreed to release the coins, but only if a 1% withdrawal fee were applied (not part of the original agreement – essentially a ransom).

There are many, many more examples already, but these should suffice to illustrate the growing trend: If you wish to get your money or metals out of an endangered jurisdiction, such as an EU country or North America, the window of opportunity is closing. Expect them to make it difficult, costly, and even impossible for you to get out.

But why should this be? What are these institutions up to? Don’t they realise that they’re sending a message to clients that they’re not helpful partners?

Well, yes they do, but they’re also aware of another factor that’s more important to them. As the economic crisis gets ever closer, they understand that the day will soon come when a banking emergency is declared and the banks will shut their doors for an as-yet-unknown period of time (presumably until a solution is found). What will the new rules be? No one knows. Will the banks and storage facilities be obligated to deliver in full if the doors open once again? No one knows.

Therefore, in the final stretch of this race to the bottom, they want to be holding as much of your money and metals as they can.

The above examples are just the thin end of the wedge and we can expect the future to reveal greater restrictions. Whilst, in an economic crisis, there are no guarantees, what we can do is opt for the situation that’s least likely to cost us our wealth. Again,

Choose a jurisdiction that has the best track record – a long history of a low-tax, or no-tax, regime; a stable government and legislation that protects rather than victimises the foreign investor.

Choose the jurisdiction that’s easiest for you to access – In Europe, this might be Switzerland or Austria. In Asia, this might be Singapore or Hong Kong. In the Western Hemisphere, this might be the Cayman Islands.

Choose the best facility within that jurisdiction – the one that has the best reputation and offers the best contract (competitive rates, Class III vault facility, 24-hour viewing access, etc.).

At this juncture, we can’t say how long the need to safeguard wealth will be as essential as it will be in the near future. It may be brief (a few years), or it may be many years before the dust has settled. Whatever the outcome of the coming economic crisis, those who have chosen the safest havens for their wealth will be those who will fare best.