We’re the first to admit that investing in gold can be pretty boring. Don’t get us wrong, when you first decide to buy gold then the newness of it is exciting, as you choose which gold bullion dealer to use then it is interesting and when you actually see the gold bars or coins appear in your account then it’s really exciting. But then what? There aren’t any major price moves, it’s not like you see any huge crashes or major leaps to keep you on your toes, not like...

Read More »Will Silver Prices Go Up to $300?

This week’s guest is so bullish on silver that he’s even written a best-selling book ‘The Great Silver Bull’ where he takes an in-depth look at why silver will outperform gold once again and even go as high as $300 an ounce. Author and investments editor Peter Krauth joins Dave Russell on GoldCore TV to discuss the silver price, silver’s future and how industrial demand will continue to grow, outstripping supply. Silver’s a big theme for us at the moment, look out...

Read More »Long Term Gold Price Prediction

What do the weather and the markets have in common? Quite a bit says this week’s guest! Kevin Wadsworth is a meteorologist-turned-chart analyst who has a lot of interesting insight and predictions into market movements and the price of gold. Kevin joins GoldCore TV host Dave Russell to discuss how he applies his 35 years of experience and methodology to financial markets. He takes us through the range of outcomes he sees for the economy, the US Dollar and precious...

Read More »SWIFT Ban: A Game Changer for Russia?

As part of the sanctions against Russia, seven Russian banks have been cut off from SWIFT. We start by discussing what SWIFT is, and then the implications of completely cutting Russia out of SWIFT. What is SWIFT and Why Russia is Being Excluded SWIFT – The Society for Worldwide Interbank Financial Telecommunication is a messaging system that links more than 11,000 banks in 200 countries. The system doesn’t move actual money between the banks but...

Read More »Deflation Is Everywhere—If You Know Where to Look, Report 18 Aug

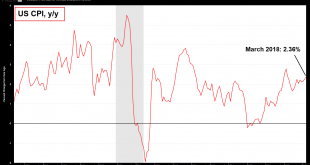

At a shopping mall recently, we observed an interesting deal at Sketchers. If you buy two pairs of shoes, the second is 30% off. Sketchers has long offered deals like this (sometimes 50% off). This is a sign of deflation. Regular readers know to wait for the punchline. Manufacturer Gives Away Its Margins We do not refer merely to the fact that there is a discount. We are not simply arguing that Sketchers are sold cheaper—hence deflation. That is not our approach....

Read More »The Economic Singularity, Report 11 Aug

We have recently written several essays about the fallacious concept of Gross Domestic Product. Among GDP’s several fatal flaws, it goes up when capital is converted to consumer goods, when seed corn is served at the feast. So we proposed—and originally dismissed—the idea of a national balance sheet. It’s easy (conceptually) to add up all the assets and the liabilities. But the problem is that the falling interest rate...

Read More »How to Fix GDP, Report 14 Jul

Last week, we looked at the idea of a national balance sheet, as a better way to measure the economy than GDP (which is production + destruction). The national balance sheet would take into account both assets and liabilities. If we take on another $1,000,000 debt to buy a $1,000,000 asset, then we have not added any equity. This is so, even though assets have gone up. But unfortunately, as a consequence of assets going...

Read More »Gold price to remain trendless

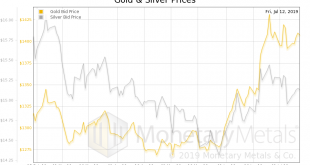

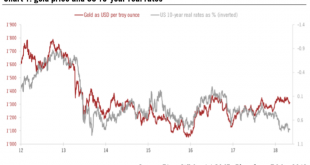

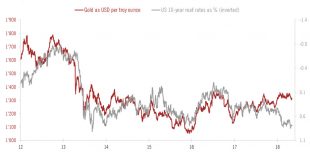

The recent strength of the US dollar coupled with the rise of the US 10-year Treasury yield has weighed on the price of gold and silver. Since 19 April, gold has lost roughly 2.3%, while silver lost almost 4.5% in USD terms. At the start of the year, these two drivers were sending conflicting signals: higher US real rates were weighing on non-yielding gold, but the decline in the greenback was acting as a tailwind for...

Read More »Gold price to remain trendless

Recent dollar strength coupled with rising US rates have weighed on gold and silver. The latter looks attractive but there are few obvious catalysts for gold.The recent strength of the US dollar coupled with the rise of the US 10-year Treasury yield has weighed on the price of gold and silver. Since 19 April, gold has lost roughly 2.3%, while silver lost almost 4.5% in USD terms.At the start of the year, these two drivers were sending conflicting signals: higher US real rates were weighing...

Read More »Flight of the Bricks – Precious Metals Supply and Demand

See the introduction and the video for the terms gold basis, co-basis, backwardation and contango. The Lighthouse Moves Picture, if you will, a brick slowly falling off a cliff. The brick is printed with green ink, and engraved on it are the words “Federal Reserve Note” (FRN). A camera is mounted to the brick. The camera shows lots of things moving up. The cliff face is whizzing upwards at a blur. A black painted brick...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org