We have recently written several essays about the fallacious concept of Gross Domestic Product. Among GDP’s several fatal flaws, it goes up when capital is converted to consumer goods, when seed corn is served at the feast. So we proposed—and originally dismissed—the idea of a national balance sheet. It’s easy (conceptually) to add up all the assets and the liabilities. But the problem is that the falling interest rate pushes up asset prices. Even if one booked assets at their original acquisition prices, that does not solve the problem as assets often change hands and then would be marked higher. Rising Net Present Value In a recent meeting with a reader, we’ll call him Ludwig, he suggested one possible way to

Topics:

Keith Weiner considers the following as important: 6a.) Keith Weiner on Monetary Metals, 6a) Gold & Bitcoin, Basic Reports, capital destruction, dollar price, Featured, gold basis, Gold co-basis, gold price, gold silver ratio, mark to market, net present value, newsletter, npv, rising liability, silver basis, Silver co-basis, silver prices, zero interest

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

We have recently written several essays about the fallacious concept of Gross Domestic Product. Among GDP’s several fatal flaws, it goes up when capital is converted to consumer goods, when seed corn is served at the feast. So we proposed—and originally dismissed—the idea of a national balance sheet.

It’s easy (conceptually) to add up all the assets and the liabilities. But the problem is that the falling interest rate pushes up asset prices. Even if one booked assets at their original acquisition prices, that does not solve the problem as assets often change hands and then would be marked higher.

Rising Net Present Value

In a recent meeting with a reader, we’ll call him Ludwig, he suggested one possible way to compensate for the problem of chronically-rising asset prices. It goes back to an idea first proposed by Professor Antal Fekete (under whom Keith studied). Keith began writing about it in 2010, and developing it further over many articles.

The net present value of a debt rises, when the interest rate falls.

You can observe the principle with any listed bond. Just look at the market price, which has gone up steadily since 1981. But this does not in itself help us solve the problem of how to calculate a national balance sheet. There is no continuity, as virtually all bonds that existed in 1981 were paid off and new ones have been issued since then (in much greater quantities).

Also, short-duration instruments do not go up much. They are less sensitive to interest rates. And therefore don’t really compensate for the incredible rise in assets.

Debt is Perpetual

This leads to another idea. In irredeemable currency, there is no extinguisher of debt. We therefore propose that all debt may be treated as perpetual debt. For a perpetuity, the Net Present Value (NPV) doubles, with each halving of the interest rate.

This is an elegant solution to the problem of rising assets. With this approach, the liability goes up along with the asset.

Here’s how to calculate it. Every month, first adjust all outstanding debt (total debt outstanding, not just government debt) by the change in interest rate. And then add the new debt incurred since then.

The so-called unfunded liabilities should be included also. This is because on the other side of each unfunded liability is a beneficiary who feels richer for having it. For example, a worker expects to receive his pension. The pension has a net present value, even if only implicit. This allows the worker to spend 100% of his salary, which he would never do if he knew he had to provide for his own retirement.

Our proposed national balance sheet may not be perfect, but it probably gets us into the right ballpark. It would take all the fun out of the game of borrowing to buy assets, which have made so many investors speculators into millionaires and billionaires. Currently, their net worth is calculated by the market value of their assets minus the nominal number of dollars of their liabilities.

Real vs. Nominal

Our proposed method shows that the real burden of debt is much higher than its nominal quantity (which is already alarming enough). And what would this show? It would shine a spotlight on the simple fact that Keynes’ drive to kill the investor by driving interest rates to zero / driving asset prices to infinity is not adding to the national balance sheet. It’s doing the opposite.

There are many fantasies about the good that government can do to us. One of the most tempting to smart and successful people is the central bank makes us richer with each tick down in the interest rate. Then-president of the Dallas Fed, Dick Fisher, certainly believed this when he spoke in 2014. And from the applause in the room full of one-percenters, the audience did too.

News Flash: the central bank cannot print wealth.

By marking up the liabilities, we can see this clearly. More clearly than Dick Fisher. More clearly than those who consume capital which comes to them as income via endless bull markets. More clearly than otherwise-free-marketers who think to manage GDP by monetary policy.

Our balance sheet approach shows rising liabilities, hence subtracts from equity, for two principal reasons. One, the endless rise of assets is a process of conversion of one party’s capital to another’s income, to be spent. To be consumed. This consumption is a significant reduction in equity by itself.

Two, there are many mouths to feed just in the conversion process: bankers, lawyers, accountants, investment advisors, and research analysts, etc. Don’t forget the bonuses paid to CEOs based on the rising stock price, and indeed many corporate employees too.

And then there is the tax man. If you buy an asset for $1,000,000 and sell it for $2,000,000 the IRS will take hundreds of thousands of dollars to feed the hungry maw of government and its welfare dependents: individuals, corporations, and academia.

You didn’t think that all that consumption by government was free, did you? Vice President Dick Cheney once said that, “deficits don’t matter.” Many people would retort that it’s inflation, and we pay for it in a loss of purchasing power.

It’s worse than that.

Infinity

Note one important implication to this formula. When the interest rate on the 30-year Treasury, or arguably the 10-year, gets to zero then the NPV of the debt reaches infinity. Many might argue that this is not correct, even some who are otherwise on board our line of reasoning. Nevertheless, we will defend it.

It is not simply that it falls out of the math. Though if the math is valid, one ought to at least look at the conclusion seriously.

In this case, the math is simple. It’s saying as interest drops, NPV of debt rise. It works for other values of interest, e.g. as interest drops from 8 to 4%. Why should it not work at 0%? And if so, what is the NPV of the debt at zero interest, if not infinite?

We don’t like arguments that deduce from a definition, nor forming a profound conclusion from putting numbers into an equation. In these cases, you have to look directly to reality. Ask yourself what is really going on, at the mechanical level? What does this really mean? What does zero interest mean?

It means there is no demand for credit by businesses that justifies paying more than zero. When the interest rate falls, it tells us that the bid on credit has dropped. If businesses had opportunities to profit at higher rates, they’d take all the credit they could get at those rates. But with each drop in the rate, they added more debt. And by the time the rate gets to zero, most creditworthy enterprises have become heavily debt-laden. And debt capacity aside, what would they put the cash to?

No, buying their own shares, or speculating on other assets, does not count.

It means cash borrowed at zero is expected to generate a marginal return. And that means all the cash borrowed previously, at higher rates, is generating submarginal returns. Those capital assets are being churned. That is, competitors buy bigger machines, build bigger hotels, or more glorious restaurants simply by dint of borrowing cheaper. And the process has culminated in a market interest rate of zero. Zero means: “here, take this cash and use it for free. Yeah, no, we don’t expect a return.”

When there is no return on lending, that is a sign that there is little to no return on anything that can be financed by borrowing. One necessitates the other. We encourage you to stop here and think about this. It is a critical point.

Getting back to the problem of all the borrowing incurred at a higher rate, well much of it can be refinanced at lower rates or at the then-current zero rate. But that does not fix the problem of a restaurant that looks dated, with middling finishes and cheaper materials that now competes against an opulent Dining Palace. Customers prefer the latter, and no amount of refinancing can fix that problem.

Large corporations might borrow to refurbish and remodel their stores. This piles more debt on top of the old debt, which they cannot retire. They cannot operate the perfectly good old restaurant, so they go deeper into debt to rebuild it into something that can be operated. It may pay the debt service (hah!) payroll, food ingredients, etc. But it cannot amortize the debt.

The Singularity

And that brings us full circle. At zero interest, the debt has become so heavy it cannot be lifted. The force that would lift it is: return on capital. And it is precisely RoC that has been atrophied by decades of force-feeding capital to businesses. During this long process, the demand for capital picked up, only with each downtick in interest rates.

And finally the end is reached. Zero interest. In physics, there is a construct of infinite mass and zero volume. It is called the singularity. A black hole.

Supply and Demand Fundamentals

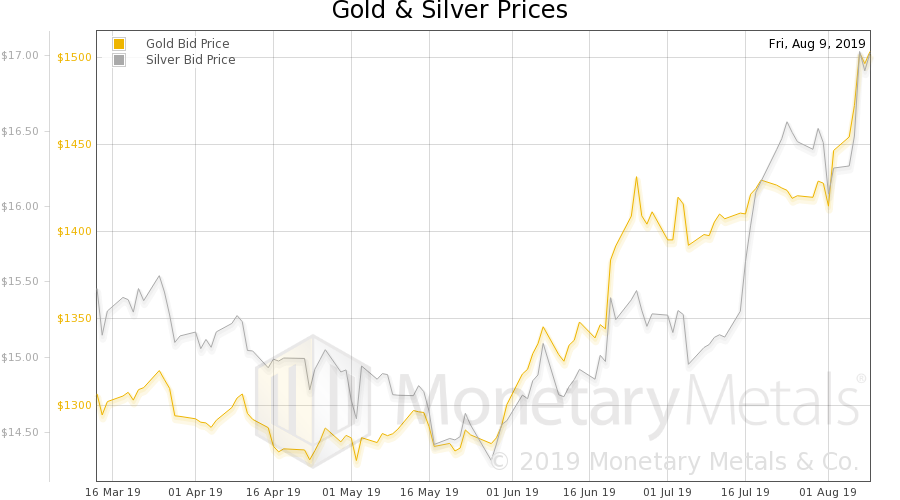

Big moves occurred in the prices of the metals, with that of gold up $57 and silver $0.77.

We have now reached a price of gold (if not silver) not seen since 2013, when it was on the way down. What’s causing this sudden spike in price and renewed interest in gold?

Well, first the bad news. According to every retail dealer with whom we have spoken, worldwide, the rising price has generated lots of customer selling. At retail, long-suffering gold holders are taking advantage of the price to unload. Perhaps they’re thinking, “whew! I can finally get out!” We don’t bring this up to blame them, but to point out that retail is a countervailing force. They are certainly not driving the price action.

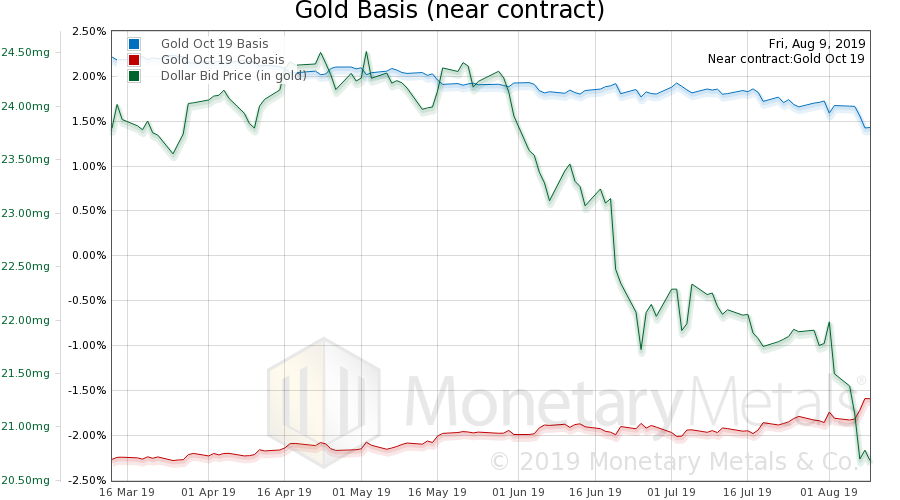

Those who follow the basis have been seeing that there is not a corresponding rise in basis, either. When leveraged speculators buy futures, they push up the price of a contract for future delivery relative to spot. This is what the basis spread measures. Or would be measuring, if this price move was the same as all other moves up in the last six years.

Keith had short debate on Twitter with a well-known goldbug of the subjectivist persuasion. He was conceding that gold has value only because of the same kind of faith as people have in fiat currencies or bitcoin. As regular readers know, we have argued that even fiat currencies are not held up by faith. They are supported by the struggles of the debtors. And definitely not gold.

Gold is not held up by faith, either of the subjectivist what-if-people-stopped-having-faith variety. Nor of the “God said” type, which was the only alternative of which he could conceive.

People value gold because there are times when they wish not to be a creditor. When there is no counterparty to whom they wish to lend (yes, to hold a dollar is to be a creditor to the Fed). With possible war with Iran, and trade war with China, now looks to be such a time.

Oh, and adding fuel to the fire, interest on a vast-and-growing pile of bonds is negative. You pay the borrower to use your cash. And at the end, they return less than you lent. Even in the dollar, the rate of interest is now much lower than it had been recently.

Rising credit risk and falling compensation to reward one for taking it? Perhaps these factors explain why there is renewed buying of gold. At least by the smart money.

Monetary Metals is excited to be bringing the first gold bond to market. Please contact us if you are interested in investing.

Gold and Silver PriceNow let’s look at the only true picture of supply and demand for gold and silver. But, first, here is the chart of the prices of gold and silver. |

Gold and Silver Price(see more posts on gold price, silver prices, ) |

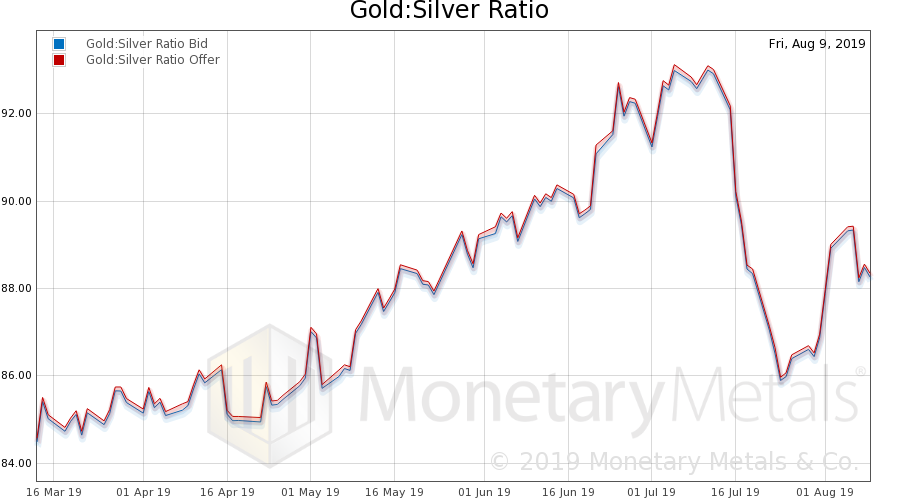

Gold: Silver RatioNext, this is a graph of the gold price measured in silver, otherwise known as the gold to silver ratio (see here for an explanation of bid and offer prices for the ratio). The ratio turned back down this week. |

Gold: Silver Ratio(see more posts on gold silver ratio, ) |

Gold Basis and Co-basis and the Dollar PriceHere is the gold graph showing gold basis, cobasis and the price of the dollar in terms of gold price. That scarcity (i.e. cobasis) does not seem to want to go down, even with rising price. For years, we have mentioned this possibility when it has briefly occurred. It has seemed almost more like a hypothetical than reality. And now here we see it: the gold price is being driven by buying of metal. So far. This week, the Monetary Metals Gold Fundamental Price is up $52 to $1,488. |

Gold Basis and Co-basis and the Dollar Price(see more posts on dollar price, gold basis, Gold co-basis, ) |

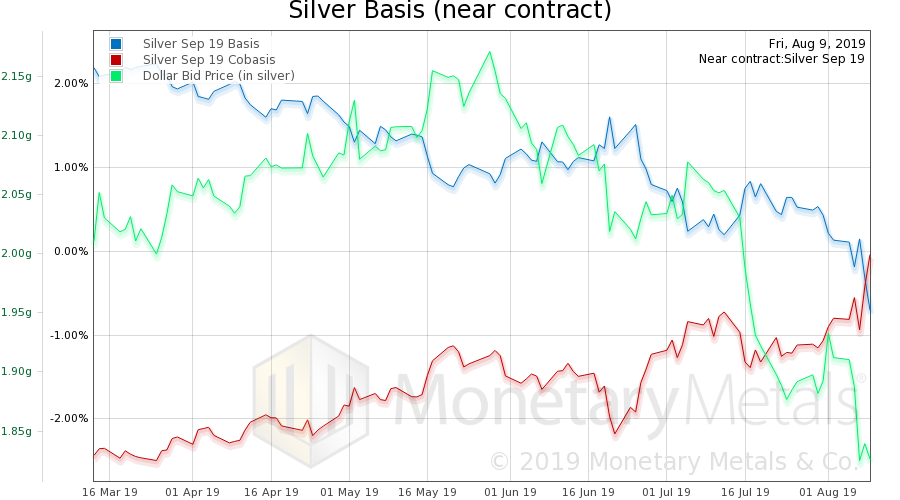

Silver Basis and Co-basis and the Dollar PriceNow let’s look at silver. Now we see silver following gold’s market action. The fundamental price spiked up over a dollar, to $16.76. |

Silver Basis and Co-basis and the Dollar Price(see more posts on dollar price, silver basis, Silver co-basis, ) |

© 2019 Monetary Metals

Tags: Basic Reports,capital destruction,dollar price,Featured,gold basis,Gold co-basis,gold price,gold silver ratio,mark to market,net present value,newsletter,npv,rising liability,silver basis,Silver co-basis,silver prices,zero interest