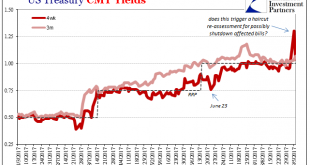

Eleven days ago, we asked a question about Treasury bills and haircuts. Specifically, we wanted to know if the spike in the 4-week bill’s equivalent yield was enough to trigger haircut adjustments, and therefore disrupt the collateral chain downstream. US Treasury, Jan - Sep 2017(see more posts on U.S. Treasuries, ) - Click to enlarge Within two days of that move in bills, the GC market for UST 10s had gone...

Read More »Moscow Rules (for ‘dollars’)

In Ian Fleming’s 1959 spy novel Goldfinger, he makes mention of the Moscow Rules. These were rules-of-thumb for clandestine agents working during the Cold War in the Soviet capital, a notoriously difficult assignment. Among the quips included in the catalog were, “everyone is potentially under opposition control” and “do not harass the opposition.” Fleming’s book added another, “Once is an accident. Twice is...

Read More »Not Do We Need One, But Do We Need A Different One

On March 24, 2009, then US President Barack Obama gave a prime time televised press conference whose subject was quite obviously the economy and markets. The US and global economy was at that moment trying to work through the worst conditions since the 1930’s and nobody really had any idea what that would mean. As President, Obama’s main task was not to deliver specifics about auto lending or the inner workings at...

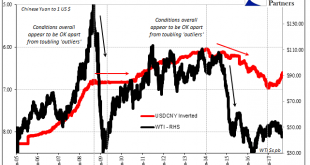

Read More »Non-Randomly Surveying RMB

China’s central bank, unlike other central banks, is constantly active almost never resting. Because it is always in motion, the PBOC can seem to be “adding” liquidity at the very same time it might be “draining” it. Its specific actions should never be interpreted as standalone procedures related solely to some unknown policy stance. That is particularly true given that we know what their stance is and has been –...

Read More »Collateral Values in ECB Operations

In the NZZ, Kjell Nyborg questions whether the collateral values of the securities the ECB accepts in monetary policy operations reflect market values. He argues that the valuation is discretionary and politicized. Meine Analyse macht deutlich, dass der Besicherungsrahmen in der Euro-Zone in unterschiedlicher Ausprägung unter all diesen Problemen leidet. Das öffentliche Verzeichnis der zulässigen notenbankfähigen Sicherheiten enthält 30 000 bis 40 000 verschiedene Wertpapiere, von...

Read More »Les liquidités de l’AVS/AI/APG nous intéresent, Liliane Held-Khawam

Compenswiss est la structure qui héberge la fortune des Fonds de compensations. Elle est responsable de la gestion centralisée des liquidités et de la fortune de l’assurance-vieillesse et survivants (AVS), de l’assurance-invalidité (AI) et du régime des allocations pour perte de gain (APG). Cette structure est détachée de l’Administration fédérale et est dotée d’un Conseil d’administration, organe suprême qui « décide du placement des capitaux du Fonds de compensation, surveille...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org