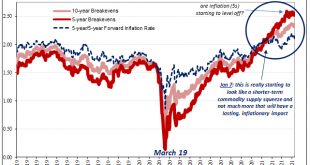

The benchmark 10-year US Treasury has obtained some bids. Not long ago the certain harbinger of bond rout doom, the long end maybe has joined the rest of the world in its global pause if somewhat later than it had begun elsewhere (including, importantly, its own TIPS real yield backyard). Even nearer-in inflation expectations have rounded off at their current top. Perhaps no more than a short-term rest before each rising again, then again with the rest of the...

Read More »Deja Vu: Treasury Shorts Meet Treasury Shortages

Investors like to short bonds, even Treasuries, as much as they might stocks and their ilk. It should be no surprise that profit-maximizing speculators will seek the best risk-adjusted returns wherever and whenever they might perceive them. If one, or a whole bunch, has to first “borrow” a security the one doesn’t own in order to sell something at a high price betting the price to go down, you can likewise bet there’s someone out there in the financial landscape more...

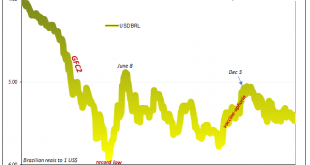

Read More »For The Dollar, Not How Much But How Long Therefore How Familiar

Brazil’s stock market was rocked yesterday by politics. The country’s “populist” President, Jair Bolsonaro, said he was going to name an army general who had served with Bolsomito (a nickname given to him by supporters) during that country’s prior military dictatorship as CEO of state-owned oil giant Petróleo Brasileiro SA. Gen. Joaquim Silva e Luna is being installed, allegedly, to facilitate more direct control of the company by the federal government. With the...

Read More »What Might Be In *Another* Market-based Yield Curve Twist?

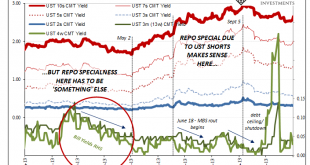

With the UST yield curve currently undergoing its own market-based twist, it’s worth investigating a couple potential reasons for it. On the one hand, the long end, clear cut reflation: markets are not, as is commonly told right now, pricing 1979 Great Inflation #2, rather how the next few years may not be as bad (deflationary) as once thought a few months ago. On the other hand, over at the short end, yields are dropping toward zero again. This steepening isn’t...

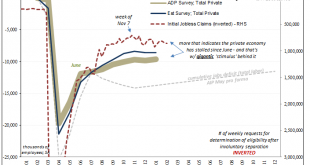

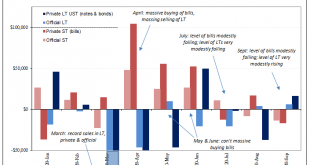

Read More »Just Who Is, And Who Is Not, Selling T-Bills

Are foreigners selling Treasury bills? If they are, this would seem to merit consideration for the reflation argument. After all, the paramount monetary deficiency exposed by March’s GFC2 (and the Fed’s blatant role in making it worse) was the dangerous degree of shortage over the best collateral. Best collateral means OTR, and for standard practice this had always meant Treasury bills (as well as, noted yesterday, bonds and notes just auctioned off). According to...

Read More »Treasury Auctions Are Anything But Sorry Because They’ve Never Been Sorry About Solly

Twenty years ago, in November 2000, the Treasury Department changed one aspect of the way the government would sell its own debt. Auctions of these and other kinds of securities had been ongoing for decades, back to the twenties, and they had been transformed many times along the way. In the middle of the 1970’s Great Inflation, for example, Treasury gradually phased out all other means for issuing securities, by 1977 relying exclusively on auctions as the sole...

Read More »What’s Zambia Got To With It (everything)

As one of Africa’s largest copper producers, it seemed like a no-brainer. Financial firms across the Western world, pension funds from the US or banks in Europe, they lined up for a bit of additional yield. This was 2012, still global recovery on the horizon – at least that’s what “they” all kept saying. Zambia did what everyone does, the country floated its first Eurobond ($750 million). At that point, copper was only down modestly from its 2011 peak. By 2014,...

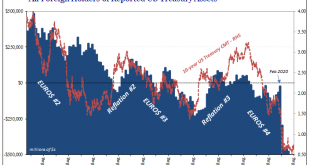

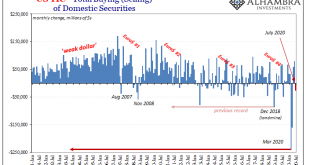

Read More »If Dollar Is Fixed By Jay’s Flood, Why So Many TIC-ked At Corporates in July?

When the eurodollar system worked, or at least appeared to, not only did the overflow of real effective (if virtual and confusing) currency “weaken” the US dollar’s exchange value, its enormous excess showed up as more and more foreign holdings of US$ assets. Mostly US Treasuries, especially in official hands, but not entirely those. That much is perfectly clear; you can actually see the difference on every chart despite all the QE’s and trillions in bank reserves...

Read More »The Global Engine Is Still Leaking

An internal combustion engine that is leaking oil presents a difficult dilemma. In most cases, the leak itself is obscured if not completely hidden. You can only tell that there’s a problem because of secondary signs and observations. If you find dark stains underneath your car, for example, or if your engine smells of thick, bitter unpleasantness, you’d be wise to consider the possibility. There’s also the potential for the engine to overheat and maybe even...

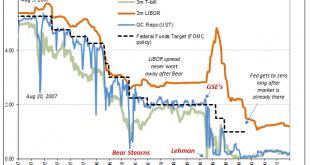

Read More »Banks Or (euro)Dollars? That Is The (only) Question

It used to be that at each quarter’s end the repo rate would rise often quite far. You may recall the end of 2018, following a wave of global liquidations and curve collapsing when the GC rate (UST) skyrocketed to 5.149%, nearly 300 bps above the RRP “floor.” Chalked up to nothing more than 2a7 or “too many” Treasuries, it was to be ignored as the Fed at that point was still forecasting inflation and rate hikes. Total financial resilience otherwise. Yesterday was,...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org