Myths and Legends “Myths and legends die hard in America,” remarked Hunter S. Thompson in The Great Shark Hunt, nearly 40-years ago. Uncompromising independence, rugged individualism, and unbounded personal freedom were once ideals essential to the American character. According to popular American folklore, they still are. We have some reservations. In practice, the principles that gave rise to the great myths and...

Read More »Dumbest monetary experimental end game in history (including Havenstein and Gono’s)

We have seen several explanations for the financial crisis and its lingering effects depressing our global economy in its aftermath. Some are plain stupid, such as greed for some reason suddenly overwhelmed people working within finance, as if people in finance were not greedy before 2007. Others try to explain it through “liberalisation” which is almost just as nonsensical as government regulators never liberalised...

Read More »The Massachusetts Historical Commission And American Political Sclerosis

On his blog, John Cochrane happily reports about apparent agreement between Larry Summers and himself regarding the dangers of regulatory overkill and incompetence of government officials. John writes: This is a watershed. Here is the kind of reach out for middle ground that could unlock our political and economic sclerosis. Larry is likely to be in government again sooner or later, and I hope he will push hard for this — and with more effect than the last hundred or so anti-red-tape and...

Read More »Academic Skulduggery – How Ivory Tower Hubris Wrecks your Life

In the 1970s economists started to incorporate rational expectations into their models and not long after the seminal Kydand & Prescott (1977) article named Rules Rather than Discretion: The Inconsistency of Optimal Plan was published. Their work has been driving the mainstream macroeconomic debate ever since. The question raised in this debate is how policy-makers can credible commit to promises made today when future events may cause short-term pain if restricted by stringent rules...

Read More »Regulation Catches Up with Fintech

The Economist reports that regulation catches up with peer-to-peer lending: Meanwhile, a case working its way through the courts may subject P2P loans to state usury laws, from which banks with a national charter are exempt. That would prevent the P2P firms from lending to the riskiest borrowers in much of America. In addition, the Consumer Financial Protection Bureau, a federal agency, announced this month that it would begin accepting complaints about P2P consumer lending. Rates of...

Read More »An Age of Disruption

Disruption is either the gospel or the monster of the new millennium, depending which side of the trade you’re on. Every technology company worth its salt is aiming to disrupt something, and enough of them are succeeding that many conventional businesses face an existential threat. Why get a hotel room when you can rent a house or apartment on Airbnb? Why wait for a taxi when an Uber will come at the touch of a button? Why employ humans when there are faster, more precise robots? But...

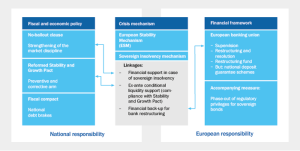

Read More »The German View of The Crisis

On VoxEU, representatives of the German Council of Economic Experts outline the German crisis narrative. In disagreement with the ‘consensus view’ outlined in Baldwin et al. (2015) the German economists including Lars Feld, Christoph Schmidt, Isabel Schnabel and Volker Wieland do not want to implicate the ‘intra-Eurozone capital flows that emerged in the decade before the crisis’ as the ‘real culprits’. … [Rather] it is the government failures and the failures in regulation and supervision...

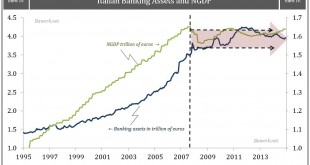

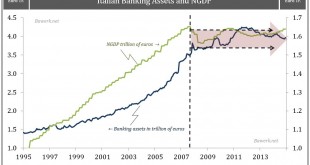

Read More »How Italy will fail and drag down the European Project

Italy is big enough to matter (it is the eight largest economy on the planet), but so uneventful that most does not pay any attention to what is going on there. We contend that Italy will, during the next year or two, be on everyone’s radar screen as it has the potential to derail the European project for real. Greece, Portugal and Ireland were mere test subjects for what will come. Spain would have been a challenge, but were narrowly avoided. Italy will drag the whole structure down if...

Read More »How Italy will fail and drag down the European Project

Italy is big enough to matter (it is the eight largest economy on the planet), but so uneventful that most does not pay any attention to what is going on there. We contend that Italy will, during the next year or two, be on everyone’s radar screen as it has the potential to derail the European project for real. Greece, Portugal and Ireland were mere test subjects for what will come. Spain would have been a challenge, but were narrowly avoided. Italy will drag the whole structure down if...

Read More »Unintended consequences of lift-off in a world of excess reserves

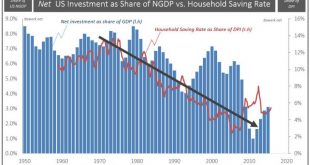

Bar a disastrous NFP print this coming Friday the US Federal Reserve will change the target range for the Federal Reserve (Fed) Bank’s Funds rate from the current level of zero – 25bp to 25 – 50bp on December 16th. The Fed will effectively raise the overnight interbank rate of interest to around 30bp from an average of only 12bp in 2015. Ironically, that will be seven years, to the day, when the Fed first lowered rates to the current band. During the period of ZIRP madness, the Fed’s...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org