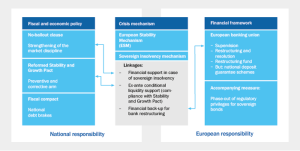

On VoxEU, representatives of the German Council of Economic Experts outline the German crisis narrative. In disagreement with the ‘consensus view’ outlined in Baldwin et al. (2015) the German economists including Lars Feld, Christoph Schmidt, Isabel Schnabel and Volker Wieland do not want to implicate the ‘intra-Eurozone capital flows that emerged in the decade before the crisis’ as the ‘real culprits’. … [Rather] it is the government failures and the failures in regulation and supervision leading to those excessive developments that should take centre-stage in the Crisis narrative. Consequently, their assessment of the policy response to the crisis is positive: While the alleged consensus summary concludes that ‘the whole situation was made much worse by poor crisis management’, our view is that the ‘loans for reforms’ rationale underlying the rescue approach was not only sensible, since it was the only way to successfully address the underlying causes of the Crisis. It also worked and substantially improved matters. Sensibly, the writers favor the objective of retaining the unity of liability and control in all relevant fields of economic policy. They promote the ‘Maastricht 2.0’ framework proposed earlier by the German Council.

Topics:

Dirk Niepelt considers the following as important: Capital flow, Credibility, Crisis, German Council of Economic Experts, Maastricht treaties, Notes, Regulation, Unity of liability and control

This could be interesting, too:

Dirk Niepelt writes Does the US Administration Prohibit the Use of Reserves?

Claudio Grass writes Year in review: A tectonic shift has only just begun

Dirk Niepelt writes “Report by the Parliamentary Investigation Committee on the Conduct of the Authorities in the Context of the Emergency Takeover of Credit Suisse”

Claudio Grass writes Gold climbing from record high to record high: why buy now?

On VoxEU, representatives of the German Council of Economic Experts outline the German crisis narrative. In disagreement with the ‘consensus view’ outlined in Baldwin et al. (2015) the German economists including Lars Feld, Christoph Schmidt, Isabel Schnabel and Volker Wieland do not want to

implicate the ‘intra-Eurozone capital flows that emerged in the decade before the crisis’ as the ‘real culprits’. … [Rather] it is the government failures and the failures in regulation and supervision leading to those excessive developments that should take centre-stage in the Crisis narrative.

Consequently, their assessment of the policy response to the crisis is positive:

While the alleged consensus summary concludes that ‘the whole situation was made much worse by poor crisis management’, our view is that the ‘loans for reforms’ rationale underlying the rescue approach was not only sensible, since it was the only way to successfully address the underlying causes of the Crisis. It also worked and substantially improved matters.

Sensibly, the writers favor the

objective of retaining the unity of liability and control in all relevant fields of economic policy.

They promote the ‘Maastricht 2.0’ framework proposed earlier by the German Council.