“We’re moving into a global recession that has nothing to do with Brexit,” warns Marc Faber stressing that Britain leaving the EU would not be disastrous, saying that if Switzerland can operate in a “single” market and outside of the EU so can Britain. “Brexit is a victory of ordinary people, common sense and people who are prepared to take responsibility for the sake of freedom against a political and...

Read More »Gold Surges 15% To £968 Per Ounce – BREXIT Creates EU Contagion Risk

Gold Surges 15% To £968 Per Ounce – BREXIT Creates EU Contagion Risk – Sterling and euro have fallen sharply on fx markets– Gold bullion surged 20% in sterling to £1,015/oz– Gold now 15% in higher in GBP at £967 per ounce– Gold 8% higher in EUR and 5% higher in USD– Stocks globally are down sharply – FTSE down 9%– European stocks down sharply– Euro Stoxx 50 Futures collapsed over 11% at the open– Bank shares are down 20% to 25%– Cameron has resigned – adding to uncertainty in markets–...

Read More »Central Bankers Around The Globle Scramble To Defend Markets: BOE Pledges $345BN; ECB, Others Promise Liquidity

There was a reason why we warned readers two days ago that "The World's Central Bankers Are Gathering At The BIS' Basel Tower Ahead Of The Brexit Result": simply enough, it was to facilitate an immediate response when a worst-cased Brexit vote hit. And that is precisely what has happened today in the aftermath of the historic British decision to exit the EU. It started, as one would expect, with Mark Carney who said the Bank of England is ready to pump billions of pounds into the financial...

Read More »The British Referendum And The Long Arm Of The Lawless

Submitted by Danielle DiMartino Booth via DiMartinoBooth.com, “Kings have long arms, many ears, and many eyes.” So read an English proverb dated back to the year of our Lord 1539. And thus was born an idiom that today translates to the very familiar Long Arm of the Law. It stands to reason that such a warning was born of feudal times when omnipotent and seemingly omnipresent monarchs personified the law, possessed...

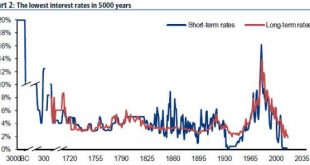

Read More »Visualizing “The 5000 Year Long Run” In 18 Stunning Charts

In the long run, as someone once said, we are all dead, but in the meantime, as BofAML’s Michael Hartnett provides a stunning tour de force of the last 5000 years illustrates long-run trends in the return, volatility, valuation & ownership of financial assets, interest rates & bond yields, economic growth, inflation & debt… The Longest Pictures reveals the astonishing history investors are living through...

Read More »Ten Most Expensive Countries for Healthcare in the World

What do financing your retirement as well as finding affordable healthcare and the possibility of losing your job all have in common with each other? Easy, at least for an American, these days. Those are the top three worries that we wake up to in this country and that 60% of people believe are very much more than just nightmares gone wrong. They could become reality and it would seem that women are more concerned in particular. It’s healthcare that is on everyone’s lips and it’s been like...

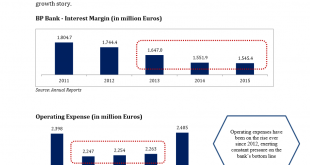

Read More »Veritaseum Blockchain-based Bank Research Hits Another Home Run – Banco Popular Shown to be Bear Stearns Redux!

During the months of March and April of 2016 we released a series of proprietary research reports indicating signficant weakneses that we found in the European banking system and released it for sale through the blockchain (reference The First Bank Likely to Fall in the Great European Banking Crisis). This was performed by the same macro forensic and fundamental analysis team that first warned about the pan-European sovereign debt crisis in 2009 and 2010 (reference Pan-European...

Read More »Negative Rates: Jim Bianco Warns “The Risk Of An ‘Accident’ Is Very High”

In an interesting interview with Finanz und Wirtschaft, Bianco Research president Jim Bianco discusses a variety of topics such as negative interest rates turning the entire credit process upside down, bank balance sheets being even more complex and concentrated than before the financial crisis, energy loans being an accident waiting to happen, the markets having veto power over the Fed, and gold having more room to run. * * * Mr. Bianco, negative interest are causing a lot of stir at the...

Read More »U.S. Futures Flat After Oil Erases Overnight Losses; Dollar In The Driver’s Seat

In another quiet overnight session, the biggest - and unexpected - macro news was the surprise monetary easing by Singapore which as previously reported moved to a 2008 crisis policy response when it adopted a "zero currency appreciation" stance as a result of its trade-based economy grinding to a halt. As Richard Breslow accurately put it, "If you need yet another stark example of the fantasy storytelling we amuse ourselves with, juxtapose today’s Monetary Authority of Singapore policy...

Read More »Another Fed “Policy Error”? Dollar And Yields Tumble, Stocks Slide, Gold Jumps

Yesterday when summarizing the Fed's action we said that in its latest dovish announcement which has sent the USD to a five month low, the Fed clearly sided with China which desperately wants a weaker dollar to which it is pegged (reflected promptly in the Yuan's stronger fixing overnight) at the expense of Europe and Japan, both of which want the USD much stronger. ECB, BOJ don't want a weak dollar; China does not want a strong dollarFed sides with China for now — zerohedge (@zerohedge)...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org