Finanz und Wirtschaft, April 30, 2016. PDF. Ökonomenstimme, May 6, 2016. HTML. The winners and losers of the current monetary environment are not that easy to identify. Investors holding long-term, non-indexed debt gain as unexpectedly low inflation shifts wealth from borrowers to lenders. Governments suffer from increased real debt burdens and reduced revenue due to effectively lower capital income tax rates. Policies that succeed in affecting the real exchange rate entail...

Read More »Neo-Fisherianism Turns Mainstream

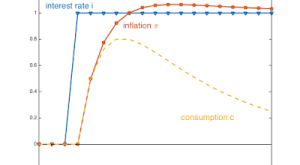

On his blog, John Cochrane offers a stripped down model and some intuition for why inflation would rise after an increase in the interest rate. The model features the usual Euler (IS) equation and a Mickey Mouse Phillips curve—inflation is proportional to consumption (or output). The intuition: During the time of high real interest rates — when the nominal rate has risen, but inflation has not yet caught up — consumption must grow faster [the Euler equation, DN]. … Since more consumption...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org