The Economist reviews a new book—“Peak”—by Anders Ericsson and Robert Pool: Most notable is the “10,000 hour rule”: the idea that anyone can become an expert if they put in the time, a theme popularised by writers like Malcolm Gladwell. At the heart of Mr Ericsson’s thesis is that there is no such thing as natural ability. Not for Mozart, nor for Garry Kasparov. Traits favourable to a task, such as perfect musical pitch, help at the outset but confer no advantage at higher levels. Rather,...

Read More »Inequality and the Welfare State

A new book on inequality by Branko Milanovic adopts an international perspective. The Economist reviews the book: Like Mr Piketty, he begins with piles of data assembled over years of research. He sets the trends of different individual countries in a global context. Over the past 30 years the incomes of workers in the middle of the global income distribution—factory workers in China, say—have soared, as has pay for the richest 1% (see chart). At the same time, incomes of the working class...

Read More »Outcome Switching

The Economist reports about “outcome switching”—promoting empirical evidence collected in the context of a specific hypothesis test (that didn’t succeed) as support for a different hypothesis. Outcome switching is a good example of the ways in which science can go wrong. This is a hot topic at the moment, with fields from psychology to cancer research going through a “replication crisis”, in which published results evaporate when people try to duplicate them.

Read More »Regulation Catches Up with Fintech

The Economist reports that regulation catches up with peer-to-peer lending: Meanwhile, a case working its way through the courts may subject P2P loans to state usury laws, from which banks with a national charter are exempt. That would prevent the P2P firms from lending to the riskiest borrowers in much of America. In addition, the Consumer Financial Protection Bureau, a federal agency, announced this month that it would begin accepting complaints about P2P consumer lending. Rates of...

Read More »Blockchains in Banking (Commercial and Central)

The Economist reports about initiatives by commercial and central banks that aim at adopting the blockchain technology. For commercial banks, distributed ledgers promise various advantages—but they also cause problems: Instead of having to keep track of their assets in separate databases, as financial firms do now, they can share just one. Trades can be settled almost instantly, without the need for lots of intermediaries. As a result, less capital is tied up during a transaction, reducing...

Read More »Rent Seeking

In the Pro Market blog, (previous) industry insiders describe the extent of rent seeking activities in pharmaceutical companies (bribing doctors), finance (exploiting information asymmetries vis-à-vis clients).

Read More »Longer-Term Interest Rate Pegs

In his blog, Ben Bernanke discusses the merits of longer-term interest rate targeting as a monetary policy tool. A lot would depend on the credibility of the Fed’s announcement. If investors do not believe that the Fed will be successful at pushing down the two-year rate … they will immediately sell their securities of two years’ maturity or less to the Fed. … the Fed could end up owning most or all of the eligible securities, with uncertain consequences for interest rates overall. On the...

Read More »SNB Foreign Currency Reserves

Rising. Source: SNB. The series “in EUR” is based on the author’s calculations. Note: The exchange rate floor vis-a-vis the Euro was in place from 6 September 2011 until 15 January 2015.

Read More »Exchange Rate Predictability

In a Study Center Gerzensee working paper, Pinar Yesin argues that the IMF’s Equilibrium Real Exchange Rate model (ERER) helps predict medium term exchange rate changes. The reduced form equation relates the real effective exchange rate to macroeconomic fundamentals. … one of the models, namely the ERER model, outperforms not only the other two in predicting future exchange rate movements, but also the (average) IMF assessment. … the IMF assessments are better at predicting future exchange...

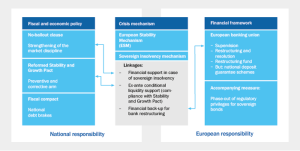

Read More »The German View of The Crisis

On VoxEU, representatives of the German Council of Economic Experts outline the German crisis narrative. In disagreement with the ‘consensus view’ outlined in Baldwin et al. (2015) the German economists including Lars Feld, Christoph Schmidt, Isabel Schnabel and Volker Wieland do not want to implicate the ‘intra-Eurozone capital flows that emerged in the decade before the crisis’ as the ‘real culprits’. … [Rather] it is the government failures and the failures in regulation and supervision...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org