In the NZZ, Heidi Gmür discusses some of the many forms of government support for agricultural producers in Switzerland. She lists: Direct payments: CHF 2.8 billion for 53’000 farms in 2016 (roughly CHF 50 thousand per farm). Tariffs and other protectionist measures: According to the OECD, the value for farmers of these measures amounts to CHF 2 billion annually, while the value for the country is negative (CHF -0.5 billion). Multiple tax breaks: Lower capital gains tax on land sales; no...

Read More »Commitment in Reach

In the FT, Richard Waters reports about the advent of the automated company. The DAO — an acronym of decentralised autonomous organisation, the name given to such entities — has been set up to invest in other businesses, making it a form of investor-directed venture capital fund. … The organisation is governed by a set of so-called smart contracts which run on the Ethereum blockchain, a public ledger designed to make its operations transparent and enforceable. In other words, the code...

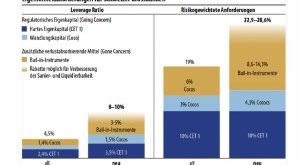

Read More »Capital Requirements for Large Swiss Banks

They have been increased. The illustration is taken from Finanz und Wirtschaft. Report by Hansueli Schöchli in the NZZ.

Read More »Crony Capitalism

From The Economist:

Read More »FATCA in Reverse?

The Greens/EFA group in the European Parliament wants the European Union to exert more pressure on the United States: the US should no longer serve as a “tax haven” for European tax dodgers. Proposed measures include blacklisting and a FATCA-type 30% withholding tax on EU-sourced payments. From the executive summary of the report commissioned by the group: Two global transparency initiatives are underway that could help tackle financial crimes including tax evasion, money laundering and...

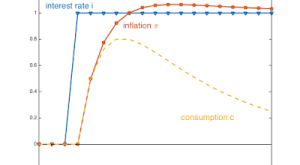

Read More »Neo-Fisherianism Turns Mainstream

On his blog, John Cochrane offers a stripped down model and some intuition for why inflation would rise after an increase in the interest rate. The model features the usual Euler (IS) equation and a Mickey Mouse Phillips curve—inflation is proportional to consumption (or output). The intuition: During the time of high real interest rates — when the nominal rate has risen, but inflation has not yet caught up — consumption must grow faster [the Euler equation, DN]. … Since more consumption...

Read More »Condorcet vs Trump

In the New York Times, Eric Maskin and Amartya Sen explain Condorcet’s system for electing candidates who truly command majority support. In this system, a voter has the opportunity to rank candidates. Maskin and Sen’s fictitious example of the American primaries illustrates the difference between a plurality system (as used in the primaries) and a majority system a la Condorcet (where the winner is the one who defeats any other candidate in pairwise comparison). They also point out that...

Read More »IMFx

Last year, the IMF has joined the MOOC movement. On edX, the online education platform founded by Harvard University and MIT, the IMF contributes a set of “IMFx” courses developed by its Institute for Capacity Development. Courses cover Debt sustainability analysis; Energy subsidy reform; and soon Financial programming and policies (analysis and program design) as well as Macroeconomic forecasting.

Read More »GDP: Imperfectly Measured, Often Abused

The Economist recounts the reasons why the quality of GDP measurement is lacking and why GDP measures cannot answer all the questions they are used to address.

Read More »Banks Without Debt

In his blog, John Cochrane points to SoFi, a FinTech company, as proof that banking services can be delivered by institutions without the traditional characteristics of a bank. SoFi finances loans by selling equity. The loans are securitized and the cash is reinvested in loans. As John points out: A “bank” (in the economic, not legal sense) can finance loans, raising money essentially all from equity and no conventional debt. And it can offer competitive borrowing rates — the supposedly...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org