In the FT, Richard Milne reports about the Riksbank pondering to issue a digital currency. There are considerable questions for Sweden’s central bank to answer about how a digital currency would work. Would individuals have an account at the Riksbank? Would transactions be traceable, unlike with cash? Would emoney earn interest? Ms Skingsley said: “Personally I would like to design it in a way that is most like notes and coins.” That would mean no interest would be paid on it. But she...

Read More »Rules Governing Payouts by Swiss National Bank

The Federal Council informs that the Federal Department of Finance and the Swiss National Bank have agreed on rules that govern how profits of the Swiss National Bank (SNB) will be paid out during the period 2016 to 2020: Subject to a positive distribution reserve, the SNB will in future pay CHF 1 billion p.a. to the Confederation and cantons, as was previously the case. In future, however, omitted distributions will be compensated for in subsequent years if the distribution reserve...

Read More »Swiss Government Recommends Rejection of “Vollgeldinitiative”

The Swiss Federal Council requests that Parliament recommend to the people and the cantons rejection of the popular initiative “For crisis-resistant money: end fractional-reserve banking (Vollgeld initiative)”, without a counterproposal. The Federal Council doubts that ending fractional-reserve banking would strengthen financial stability. It sees major risks for the Swiss National Bank’s credibility and for financial intermediation.

Read More »Polarized Labor Markets

In the NZZ, Thomas Fuster and Jürg Müller interview David Autor. Autor on polarization: Der Arbeitsmarkt wird immer polarisierter. Auf der einen Seite haben wir viele gutbezahlte, hochqualifizierte und interessante Stellen. Auf der anderen Seite stehen schlechter entlöhnte und niedrigqualifizierte Stellen, bei denen es quasi darum geht, dem Wohl und Komfort der Wohlhabenden zu dienen. Das ist keine gesunde Entwicklung. Sie schlägt Stufen aus der Leiter des wirtschaftlichen Aufstiegs. Das...

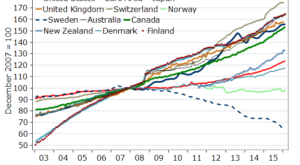

Read More »Secular Deflation Fears Are a Thing of the Past

Between November 8 and 9, medium and long-term US Treasury Yield Curve rates increased substantially: Date1 Mo3 Mo6 Mo1 Yr2 Yr3 Yr5 Yr7 Yr10 Yr20 Yr30 Yr 11/01/160.240.350.500.650.830.991.301.611.832.242.58 11/02/160.240.370.510.640.810.981.261.571.812.222.56 11/03/160.240.380.520.640.810.981.261.581.822.252.60 11/04/160.250.380.520.620.800.951.241.551.792.222.56 11/07/160.280.410.540.630.820.991.291.601.832.262.60 11/08/160.280.430.560.710.871.041.341.651.882.292.63...

Read More »2016 Vs. 2012

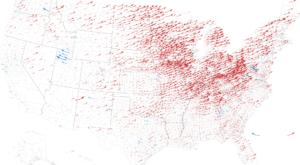

From the New York Times:

Read More »Julia

More and more researchers adopt the programming language Julia.

Read More »India’s Fight Against Shady Cash Holdings

India follows suggestions to fight tax evasion by taking high denomination notes out of circulation … and introducing new ones. Until the end of the year, Indians may exchange the old banknotes against new ones, at banks or post offices, by identifying themselves. On his blog, J P Koning discusses earlier demonetization episodes in Iraq and Sweden. India’s move does not exactly follow the well publicized suggestions currently debated. But it might work.

Read More »Leftovers for Grab

Food for All matches restaurants that miscalculated demand with hungry consumers.

Read More »The Demand for Cash

On his blog, J P Koning discusses Kenneth Rogoff’s proposal to abolish high denomination notes (discussed earlier). Koning concludes: I agree with Rogoff’s general point that it makes sense to burden cash users with ever more work since this burden disproportionately falls on heavy users like criminals. But Rogoff hasn’t yet convinced me that the status quo policy of gradually increasing the workload involved in cash usage (via inflation) needs to be sped up by a sudden removal of every...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org