Swiss Franc Currency Index Trade-weighted index Swiss Franc, April 29(see more posts on Swiss Franc Index, ) Source: markets.fx.xom - Click to enlarge Swiss Franc Currency Index (3 years) The Swiss Franc index is the trade-weighted currency performance (see the currency basket)On a three years interval, the Swiss Franc had a weak performance. The dollar index was far stronger. The dollar makes up 33% of the...

Read More »Emerging Markets: Week Ahead Preview

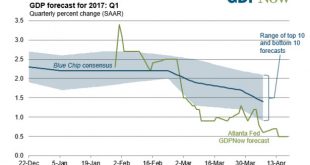

Stock Markets EM FX ended last week on a mixed note. Indeed, the week and the month were also very much mixed for EM, reflecting a variety of global and country-specific drivers impacting these countries. This week’s US jobs data could bring Fed tightening back as a major driver for EM. We will also get the first snapshots of trade in April from Korea and Brazil, as well as Caixin PMI readings for China. Official...

Read More »KOF Economic Barometer April: Is Easing

In April, the KOF Economic Barometer does not continue its upward tendency, which started at the beginning of 2017, but has declined slightly. However, despite the decline, the indicator is still well above its long-term average. It still indicates a more dynamic economic development than at the beginning of 2017. The recovery of the Swiss economy is likely to continue, albeit with a little less momentum than indicated...

Read More »FX Daily, April 28: Markets Limp into Month End

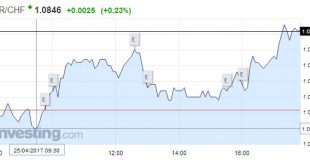

Swiss Franc EUR/CHF - Euro Swiss Franc, April 28(see more posts on EUR/CHF, ) - Click to enlarge GBP/CHF The pound to Swiss Franc rate could hit 1.30 very soon as the market gets closer to this important level of resistance that could easily break through in the coming weeks. The overall expectations for the pound to strengthen on the back of a strong UK election for the Conservatives remain, the Franc should...

Read More »PBoC: Mechanical Tightening PBoC is China Central Bank

The mainstream narrative as it relates to Chinese money is “tightening.” Having survived the economic downturn last year, we are to believe that the PBOC is once again on bubble duty. They raised their reverse repo rates, considered to be their policy benchmarks, three times up to mid-March. The central bank also increased the rate on its Medium Term Lending Facility (MLF) which has been a main source of RMB liquidity...

Read More »SNB posts 7.9 billion CHF Profit in Q1

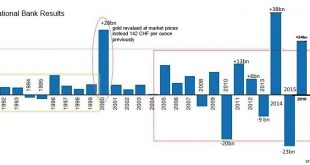

From the official news release Interim results of the Swiss National Bank as at 31 March 2017 The Swiss National Bank (SNB) reports a profit of CHF 7.9 billion for the first quarter of 2017. A valuation gain of CHF 2.2 billion was recorded on gold holdings. The profit on foreign currency positions amounted to CHF 5.3 billion. The SNB’s financial result depends largely on developments in the gold, foreign exchange...

Read More »To The Asian ‘Dollar’, And Then What?

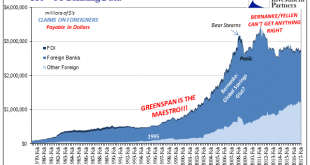

The Bretton Woods system was intentionally set up to funnel monetary convertibility through official channels. The primary characteristic of any true gold standard is that any person who wishes can change paper claims into hard money. It was as much true in any one country as between those bound by the same legal framework (property). What might differ were the standards for satisfying those claims (“good delivery”...

Read More »Weekly Speculative Positions: CHF Position Stands at same Position

Swiss Franc Speculators were net short CHF in January 2015, shortly before the end of the peg, with 26.4K contracts. Then again in December 2015, when they expected a Fed rate hike, with 25.5K contracts. The biggest short CHF, however, happened in June 2007, when speculators were net short 80K contracts. Shortly after, the U.S. subprime crisis started. The carry trade against CHF collapsed. The...

Read More »Where There’s Smoke…

Central banks around the world have colluded, if not conspired, to elevate and prop up financial asset prices. Here we’ll present the data and evidence that they’ve not only done so, but gone too far. When we discuss elevated financial asset prices we really are talking about everything; we’re talking not just about the sky-high prices of stocks and bonds, but also of the trillions of dollars’ worth of derivatives that...

Read More »FX Daily, April 25: Euro Consolidates Gains, Bond Market Sell-Off Continues

Swiss Franc EUR/CHF - Euro Swiss Franc, April 25(see more posts on EUR/CHF, ) - Click to enlarge GBP/CHF We have seen small gains made by the Euro against the Swiss Franc since the result of the first round of the Presidential elections in France, and indeed the Swiss Franc has generally weakened against most major currencies over the course of this week. The SNB (Swiss National Bank) have recently commented...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org