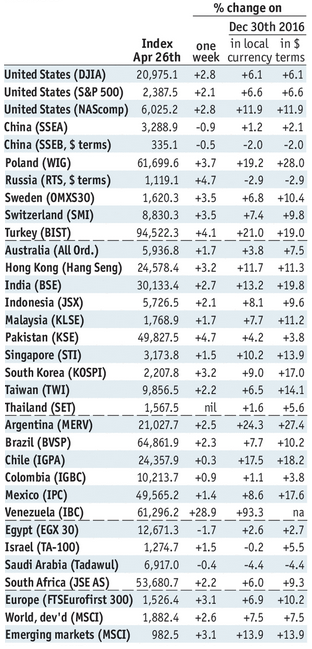

Stock Markets EM FX ended last week on a mixed note. Indeed, the week and the month were also very much mixed for EM, reflecting a variety of global and country-specific drivers impacting these countries. This week’s US jobs data could bring Fed tightening back as a major driver for EM. We will also get the first snapshots of trade in April from Korea and Brazil, as well as Caixin PMI readings for China. Official April manufacturing PMI was reported over the weekend at 51.2 vs. 51.7 expected and 51.8 in March, and so there are downside risks to this week’s Caixin PMI readings. Stock Markets Emerging Markets, April 26 Source: www.economist.com - Click to enlarge Korea Korea reports April trade data Monday. Exports are expected to rise 17% y/y and imports by 18.7% y/y. It then reports April CPI Tuesday, which is expected to rise 2.1% y/y vs. 2.2% in March. Given downside risks from political uncertainty (both domestic and regional), we think the BOK will remain on hold for now. Next policy meeting is May 25, no change expected then. Thailand Thailand reports April CPI Monday, which is expected to rise 0.72% y/y vs. 0.76% in March. This would be below the BOT’s target range of 1.0-4.0%.

Topics:

Win Thin considers the following as important: emerging markets, Featured, newslettersent

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Marc Chandler writes March 2025 Monthly

Mark Thornton writes Is Amazon a Union-Busting Leviathan?

Stock MarketsEM FX ended last week on a mixed note. Indeed, the week and the month were also very much mixed for EM, reflecting a variety of global and country-specific drivers impacting these countries. This week’s US jobs data could bring Fed tightening back as a major driver for EM. We will also get the first snapshots of trade in April from Korea and Brazil, as well as Caixin PMI readings for China. Official April manufacturing PMI was reported over the weekend at 51.2 vs. 51.7 expected and 51.8 in March, and so there are downside risks to this week’s Caixin PMI readings. |

Stock Markets Emerging Markets, April 26 Source: www.economist.com - Click to enlarge |

KoreaKorea reports April trade data Monday. Exports are expected to rise 17% y/y and imports by 18.7% y/y. It then reports April CPI Tuesday, which is expected to rise 2.1% y/y vs. 2.2% in March. Given downside risks from political uncertainty (both domestic and regional), we think the BOK will remain on hold for now. Next policy meeting is May 25, no change expected then. ThailandThailand reports April CPI Monday, which is expected to rise 0.72% y/y vs. 0.76% in March. This would be below the BOT’s target range of 1.0-4.0%. For now, we think policymakers are focusing on boosting growth, and so rates are likely to remain steady for now. Next policy meeting is May 24, no change expected then. PeruPeru reports April CPI Monday, which is expected to rise 4.0% y/y vs. 3.97% in March. This would still be above the 1-3% target range. Until some significant disinflation is seen, we think that the central bank will remain on hold. Next policy meeting is May 11, no change expected then. BrazilBrazil reports April trade data Tuesday. It then reports March IP Wednesday, which is expected to rise 2.2% y/y vs. -0.8% in February. The economy remains weak, and so the central bank is likely to continue frontloading its rate cuts. Next COPOM meeting is May 31, and another 100 bp cut to 10.25% seems likely. TurkeyTurkey reports April CPI Wednesday, which is expected to rise 11.7% y/y vs. 11.3% in March. If so, this would move inflation further above the 3-7% target range. The central bank delivered a hawkish surprise in April with a 50 bp hike in the Late Liquidity Window rate. Next policy meeting is June 15, and further tightening is possible then. ChinaCaixin reports China April manufacturing PMI Tuesday, which is expected to rise a tick to 51.3. Official April manufacturing PMI was reported over the weekend at 51.2 vs. 51.7 expected and 51.8 in March, and so there are downside risks to this week’s Caixin PMI readings. Caixin reports April services and composite PMI Thursday. Up until now, markets were comfortable with the Chinese macro story but softer April data will surely test this thesis. HungaryHungary reports March retail sales Thursday, which are expected to rise 3.2% y/y vs. a revised 0.9% (was 1.2%) in February. March IP will be reported Friday, which is expected to rise 6.9% y/y vs. 7.0% in February. The economy remains robust, and yet the central bank eased at its April meeting. Next policy meeting is May 23, no change expected then. Czech RepublicCzech central bank meets Thursday and is expected to keep policy steady. After dropping the EUR/CZK floor last month, we see no changes to policy for the time being. If price pressures remain high, we think a tightening cycle could start in late 2017 or early 2018. TaiwanTaiwan reports April CPI Friday, which is expected to rise 0.45% y/y vs. 0.18% in March. The central bank does not have an explicit inflation target. However, low inflation should allow the bank to keep rates steady in 2017. Next quarterly policy meeting is in June, no change in rates is likely then. PhilippinesThe Philippines reports April CPI Friday, which is expected to rise 3.5% y/y vs. 3.4% in March. This would be in the upper half of the 2-4% target range. While the central bank has signaled the end of the easing cycle, tightening seems unlikely until late 2017 or early 2018. Next policy meeting is May 11, no change seen then. ColombiaColombia reports April CPI Friday, which is expected to rise 4.56% y/y vs. 4.69% in March. This would move inflation closer to the 2-4% target range. Continued disinflation should allow the central bank to keep cutting rates. On Friday, the central bank went big with a 50 bp cut to 6.5% when 25 bp was expected. Economic data have been very weak recently, and so like Brazil, Colombia is accelerating and frontloading the rate cuts. Next policy meeting is May 26, we think markets have to look for another 50 bp cut then too. |

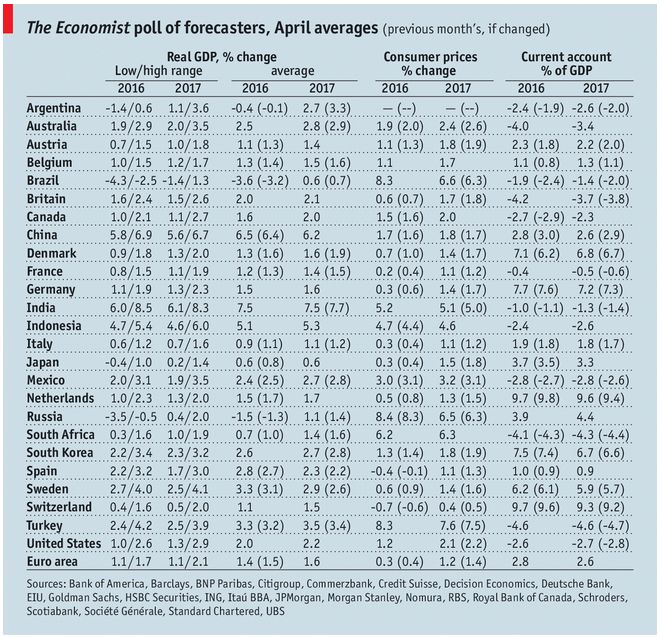

GDP, Consumer Inflation and Current Accounts The Economist poll of forecasters, April 2017 Source: Economist.com - Click to enlarge |

Tags: Emerging Markets,Featured,newslettersent