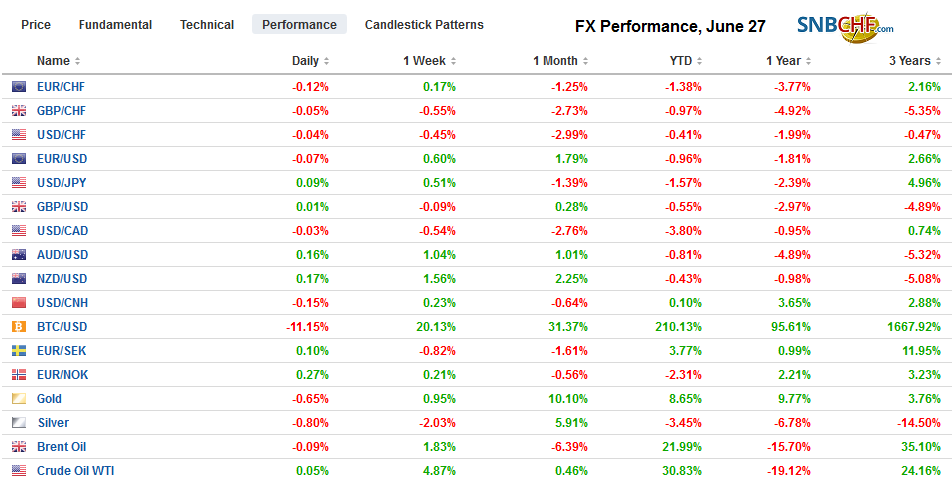

Swiss Franc The Euro has fallen by 0.07% at 1.111 EUR/CHF and USD/CHF, June 27(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The approaching month/quarter-end and the G20 meeting dominate considerations. Although the S&P 500 closed on its lows for the third consecutive session yesterday, Asia Pacific equities liked the apparent increase in the prospect of a tariff freeze between the US and China and the pullback in the Japanese yen. Equity benchmarks in Japan, China, Hong Kong, and Taiwan all gained over 1%. European shares are posting more minor gains but could end the four-day slide if they are maintained. US shares are also trading firmer. Australia and New

Topics:

Marc Chandler considers the following as important: 4) FX Trends, Eurozone Consumer Confidence, Eurozone Industrial Sentiment, Featured, Germany Consumer Price Index, Japan, Mexico, newsletter, U.S. Gross Domestic Product, USD

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Swiss FrancThe Euro has fallen by 0.07% at 1.111 |

EUR/CHF and USD/CHF, June 27(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

FX RatesOverview: The approaching month/quarter-end and the G20 meeting dominate considerations. Although the S&P 500 closed on its lows for the third consecutive session yesterday, Asia Pacific equities liked the apparent increase in the prospect of a tariff freeze between the US and China and the pullback in the Japanese yen. Equity benchmarks in Japan, China, Hong Kong, and Taiwan all gained over 1%. European shares are posting more minor gains but could end the four-day slide if they are maintained. US shares are also trading firmer. Australia and New Zealand bonds played catch-up after the backing up of US yields yesterday. Today European 10-year benchmarks and the similar US Treasury yields are 1-2 bp higher. The dollar is little changed against the majors and has a slightly softer bias against the emerging market currencies. Gold is sitting on the week’s low just above $1400, where it broke above at the end of last week. Oil is paring yesterday’s strong gains, helped by a significant drawdown of US inventories (~12.8 mln barrels according to the EIA). |

FX Performance, June 27 |

Asia Pacific

Japanese businesses, alongside economists, are looking for signs that consumers are stepping up their purchases ahead of the sales tax hike planned for October 1. It is not to be found in May retail sales, which rose 0.3% compared with a 0.6% median forecast in the Bloomberg survey, and the April series was revised to -0.1 from flat. Year-over-year retail sales have risen 1.2%, the highest of the year, but the June 2018 monthly increase of 0.9% makes for difficult comparison and warns the year-over-year pace will likely ease. Tomorrow Japan reports May employment and industrial production figures. Unemployment is expected to remain at 2.4%, while industrial output, which has been alternating monthly between increases and declines since last August, may have strong back-to-back advances. May’s industrial production is expected to match April’s 0.6% increase.

India was the subject of US criticism with Trump calling the recent increase in Indian tariffs “unacceptable.” After a few delays, India hiked tariffs many US goods in retaliation for US actions, including taking away India’s favorable access. The US has several non-trade asks of India-not purchasing a missile-defense system from Russia and not buying Iranian oil. The US also appears to be counting on India to help check the regional rise of China. Separately, Trump was critical of the US defense agreement with Japan, calling it “lopsided.” In some ways, this criticism may work in Abe’s favor. The Prime Minister has been a champion of strengthening Japan’s capabilities and nationalism.

We suspect that the pressure that drove the dollar to around JPY106.80 earlier this week was fueled by Japanese investors raising hedge ratios on US-exposure ahead of the end of the month and quarter. The completion of this, coupled with the rise in US yields have helped the greenback poke through JPY108 for the first time in a week. Caution is in order now. There is a $1.1 bln option struck at JPY108 that expires later today, and the dollar has not been able to close above the 20-day moving average (~JPY108.10) since it peaked this year on April 24. Support is seen near JPY107.60. The Australian dollar is rising for the seventh time in the past eight sessions to test the $0.7000 level. The risk extends to around $0.7025, the highs from earlier this month. We expect sellers to emerge that will cap the Aussie ahead of the widely expected rate cut early next week. The dollar slipped slightly against the Chinese yuan, the first decline since last Thursday.

EuropeBoth candidates for Tory leader scoffed at the idea of an election before October 31. It might not be entirely up to the next Prime Minister. The problem is that the Tories are a minority government depending on the support of the DUP. That agreement terminates before the end of October, and it is not clear that it will support a PM that considers leaving the EU without a deal. |

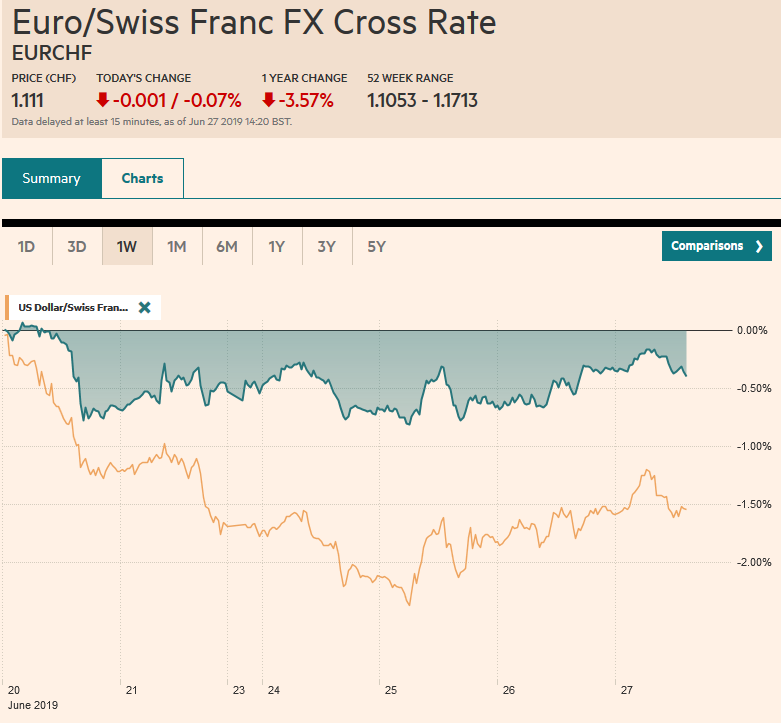

Eurozone Consumer Confidence, June 2019(see more posts on Eurozone Consumer Confidence, ) Source: investing.com - Click to enlarge |

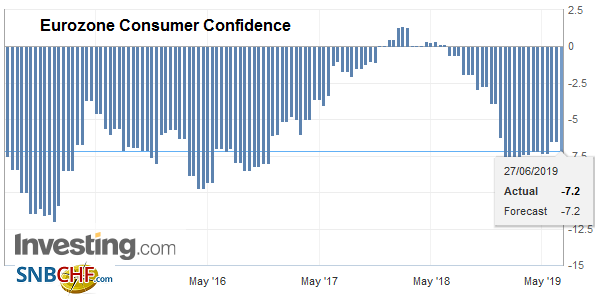

| German states reported firm CPI readings and the national report will be out shortly and the risk is to the upside of the median Bloomberg survey forecast of a 0.1% and an unchanged 1.3% year-over-year pace. On the other hand, Spain reported softer than expected June CPI. Prices fell 0.1% on the month, and the year-over-year rate unexpectedly fell to 0.6% form 0.9%. Spain’s low inflation reading allows it to gains a little competitiveness over Germany. |

Germany Consumer Price Index (CPI) YoY, June 2019(see more posts on Germany Consumer Price Index, ) Source: investing.com - Click to enlarge |

| The preliminary June eurozone CPI estimate is due tomorrow. It is expected to show the core rate recovery to 1.0% from 0.8%, but the headline is expected to be steady at 1.2%. Oil is around 2.5% higher on the month, and the euro has strengthened against the dollar this month (~1.8%) but is weaker against many other European currencies except sterling this month.

For a third session, the euro has found support near $1.1345 but has not been able to resurface above $1.14 since Tuesday. Options may be part of the story. There are 1.45 bln euros in expiring options struck between $1.1335 and $1.1350. Today, and for the next two sessions, there are 1.9 bln euros at $1.1400 strikes that will be cut. Sterling continues to trade in its trough after the reversal on Tuesday. Support has been built around $1.2660, a little below the 20-day moving average (~$1.2675) and just above the expiring $1.2650 option for GBP450 mln today. Sterling is flirting with $1.27, were GBP1 bln option is rolling off today. |

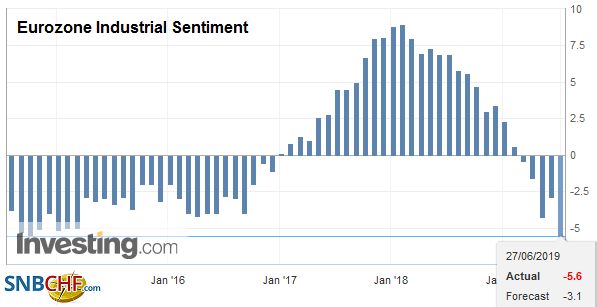

Eurozone Industrial Sentiment, June 2019(see more posts on Eurozone Industrial Sentiment, ) Source: investing.com - Click to enlarge |

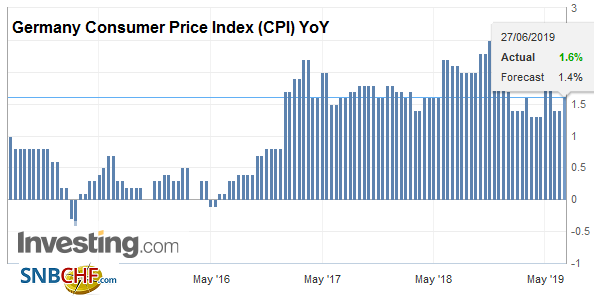

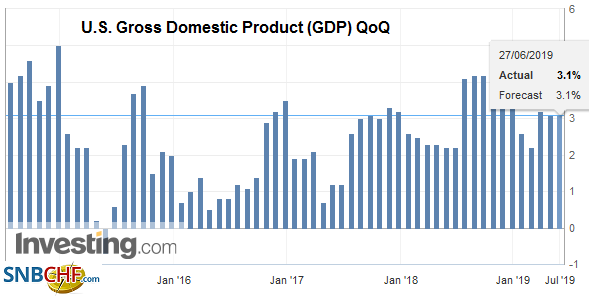

AmericaThe US takes another look at Q1 GDP, but it is too historical to matter much. Indeed the focus is on how Q2 finished, with the jobs report a week from Friday and Q3 data. Although the market pricing of odds of a 50 bp cut next month has slipped below 1-in-5, it is still discounting three cuts this year. Consider that the January 2020 fed funds futures imply an effective average rate of 1.67% at the end of 2019. It is currently near 2.38%. That pricing would also be consistent with the Fed lowering the rate of interest it pays on reserves. The US reports other data, including weekly initial jobless claims, pending home sales, and the KC Fed manufacturing survey, but they do not typically move the markets. |

U.S. Gross Domestic Product (GDP) QoQ, Q1 2019(see more posts on U.S. Gross Domestic Product, ) Source: investing.com - Click to enlarge |

Mexico reports its May trade balance before the central bank meets today. The trade balance may have swung back into deficit for the first time in four months. However, the May shortfall is expected to be a third smaller than last May’s deficit. In the first four months of this year, Mexico recorded an average deficit of $111.6 mln. In the same period in 2018, the average monthly shortfall was $509.4 mln. Mexico’s central bank is widely expected to leave the overnight rate at a punishingly high 8.25%. The market appears to be pricing in a greater chance that the next move is a hike rather than a cut. However, with the economy struggling and inflation gradually easing, we think a cut toward the end of the year is still the most likely scenario.

The US dollar fell to almost CAD1.31 yesterday and remains near there today. In Europe, it managed to approach CAD1.3140 before sellers pushed it back down. The year’s low, set in early February was by CAD1.3070. The Canadian dollar is the strongest of the majors here in H1, rising 3.9% against the US dollar. The yen is in second place with less than half the gain. The Mexican peso has risen about 2.9% against the greenback. It dollar turned back from testing the 20-day moving average in the past two sessions (~MXN19.29). Support is seen in the MXN19.04-MXN19.09 area today.

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #USD,Eurozone Consumer Confidence,Eurozone Industrial Sentiment,Featured,Germany Consumer Price Index,Japan,Mexico,newsletter,U.S. Gross Domestic Product